Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a major hurdle to market progress is the intense regulatory scrutiny concerning supply chain integrity and chemical residues, which frequently results in higher compliance costs and trade disruptions. According to the Agricultural and Processed Food Products Export Development Authority, in 2025, the export value of Indian certified organic products - a segment largely dominated by spices - was reported at USD 495 million for the 2023-24 fiscal year. This statistic underscores the significant trade volume subject to strict international quality standards, where even minor testing discrepancies or certification errors can lead to shipment rejections and subsequent market volatility.

Market Drivers

A primary catalyst for the Global Organic Spices Market is the growing consumer awareness concerning the benefits of chemical-free diets and health. Shoppers are aggressively scrutinizing product labels to avoid synthetic additives, creating a fundamental transition from conventional condiments to certified organic alternatives that promise purity. This trend is most visible in developed regions, where the willingness to invest in premium, health-centric ingredients is reshaping retail inventories. According to the Organic Trade Association, May 2024, in the '2024 Organic Industry Survey', U.S. organic food sales reached a record USD 63.8 billion in 2023, demonstrating the massive consumer pivot toward clean-label consumables that directly propels the organic seasoning sector.Furthermore, the escalating global appetite for authentic ethnic and exotic cuisines is accelerating market growth by necessitating high-quality, traceable ingredients. As culinary globalization expands, households and food service providers are seeking organic variants of spices like cinnamon, pepper, and turmeric to replicate traditional regional flavors without chemical residues, driving robust export activities from major spice-producing nations. According to the Vietnam Pepper and Spice Association, November 2024, in the 'October Export Report', the country’s pepper exports alone reached USD 1.1 billion in the first ten months of 2024. Such volumes underscore the intense international trade momentum, which is further contextualized by the broader industry's scale. According to the Spices Board India, in 2024, the total export of spices and spice products from India was valued at USD 4.46 billion for the 2023-24 fiscal year, highlighting the vast supply chain ecosystem from which the organic segment is capturing increasing market share.

Market Challenges

Strict regulatory scrutiny regarding chemical residues and supply chain integrity currently stands as a formidable barrier to the expansion of the Global Organic Spices Market. As international food safety bodies enforce increasingly rigorous standards for pesticide limits and sterilization agents, such as ethylene oxide, exporters face escalating compliance costs and severe procedural bottlenecks. The complexity of adhering to these disparate global regulations creates a volatile trading environment where even minor non-compliance results in mandatory testing, shipment rejections, and long-term reputational damage. This regulatory pressure forces suppliers to divert significant capital toward certification and testing, directly eroding profit margins and discouraging the entry of smaller organic producers into the global supply chain.The economic impact of these heightened control measures is substantial and directly hampers trade volumes. According to the Federation of Indian Spice Stakeholders, in 2024, industry projections indicated a potential 40% decline in spice export volumes for the fiscal year due to escalating regulatory concerns and market bans related to ethylene oxide contamination. Such a significant projected downturn highlights how rigorous quality control protocols can abruptly restrict market access, causing instability and reducing the overall growth momentum of the organic spice sector.

Market Trends

The surge in demand for functional and immunity-boosting spice blends is rapidly transforming the market, as consumers increasingly view seasonings as nutraceuticals rather than mere flavor enhancers. This trend is characterized by the targeted consumption of specific spices like turmeric, ginger, and garlic for their active compounds, such as curcumin, which are sought after for anti-inflammatory and therapeutic properties. Unlike the general preference for chemical-free diets, this movement drives the formulation of specialized wellness products, including golden milk powders and immunity shots, pushing raw material trade to record highs. According to the Ministry of Commerce & Industry, August 2025, in the 'India Turmeric Exports 2025' release, the country’s turmeric exports recorded a significant 50.7% jump to USD 341.54 million for the 2024-25 fiscal year, underscoring the global appetite for ingredients with proven medicinal benefits.Simultaneously, the proliferation of single-origin and ethically sourced spices is reshaping industry standards, moving beyond basic traceability to encompass holistic farmer welfare and environmental stewardship. Major corporations are aggressively implementing proprietary sustainability frameworks to ensure long-term supply security and meet the ethical expectations of modern buyers who demand proof of positive social impact. This shift forces brands to invest directly in grower communities to improve resilience against climate change and economic volatility, creating a distinct premium tier of verified sustainable products. According to McCormick & Company, June 2024, in the '2023 Purpose-led Performance Progress Report', the company successfully sustainably sourced 91% of its top five branded iconic ingredients, demonstrating the widespread industrial commitment to these rigorous ethical sourcing protocols.

Key Players Profiled in the Organic Spices Market

- Yogi Botanicals Pvt. Ltd.; Live Organics; Starwest Botanicals; Salzhausl Himalaya-Kristallsalz GmbH; Rocky Mountain Company; Rapid Organic Pvt. Ltd.; Organic Spices Inc; Earthen Delight; The Spice Hunter; Frontier Natural Products Corporation

Report Scope

In this report, the Global Organic Spices Market has been segmented into the following categories:Organic Spices Market, by Type:

- Ginger

- Turmeric

- Clove

- Pepper

- Cinnamon

- Nutmeg

- Mustard Seeds

- Others

Organic Spices Market, by Form:

- Whole

- Powder

- Chopped/Crushed

Organic Spices Market, by Distribution Channel:

- Convenience Stores

- Supermarkets/Hypermarkets

- Online

- Others

Organic Spices Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Organic Spices Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Organic Spices market report include:- Yogi Botanicals Pvt. Ltd.

- Live Organics

- Starwest Botanicals

- Salzhausl Himalaya-Kristallsalz GmbH

- Rocky Mountain Company

- Rapid Organic Pvt. Ltd.

- Organic Spices Inc.

- Earthen Delight

- The Spice Hunter

- Frontier Natural Products Corporation

Table Information

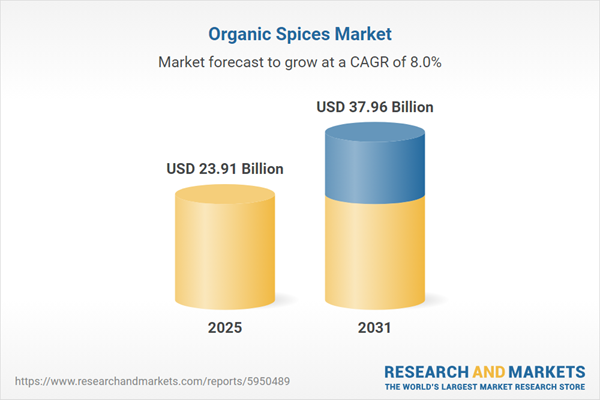

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 23.91 Billion |

| Forecasted Market Value ( USD | $ 37.96 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |