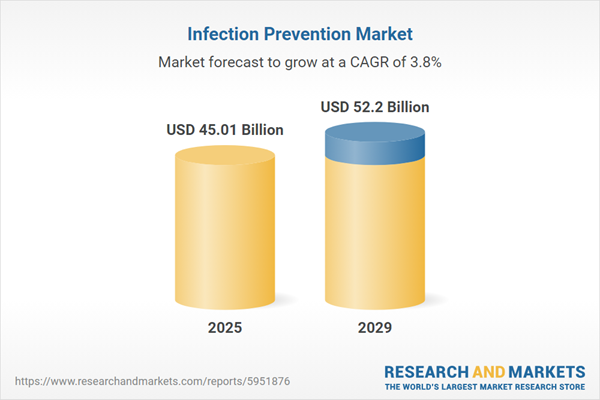

The infection prevention market size has grown steadily in recent years. It will grow from $43.4 billion in 2024 to $45.01 billion in 2025 at a compound annual growth rate (CAGR) of 3.7%. The growth in the historic period can be attributed to increasing awareness of healthcare-associated infections (HAIS), stringent regulatory guidelines, advancements in technology, globalization and international travel, and rising healthcare expenditure.

The infection prevention market size is expected to see steady growth in the next few years. It will grow to $52.2 billion in 2029 at a compound annual growth rate (CAGR) of 3.8%. The growth in the forecast period can be attributed to emerging infectious diseases, technological innovations, global population growth, and rise in ambulatory care services. Major trends in the forecast period include telemedicine and digital health solutions, personalized infection prevention, increased use of artificial intelligence (ai), rapid diagnostics, and focus on behavioral interventions.

The increase in the incidence of hospital-acquired infections (HAIs) is expected to fuel the growth of the infection prevention market going forward. HAIs refer to infections that patients acquire while receiving healthcare treatment in a hospital or other healthcare facility. Infection prevention strategies are crucial in addressing these infections by implementing measures designed to minimize the risk of infections and enhance patient safety. For instance, according to the European Centre for Disease Prevention and Control (ECDC), a Sweden-based government agency, data from the third Point Prevalence Survey (PPS) of HAIs in 2022-2023 revealed that an estimated 4.3 million patients in EU/EEA hospitals acquire at least one HAI each year. As the incidence of HAIs continues to rise, the demand for infection prevention solutions is driving market growth.

Key players in the infection prevention market are innovating by developing new products such as infection preventionist staffing calculators to enhance their service offerings. These calculators help estimate the required number of infection preventionists in a healthcare facility based on factors such as bed count, patient acuity, and facility type. For example, the Association for Professionals in Infection Control and Epidemiology (APIC) launched an infection preventionist staffing calculator in December 2023. This tool aids hospitals and clinics in determining the appropriate number of infection preventionists (IPs) needed, thereby improving patient safety through optimal staffing levels. Continuous refinement of the calculator using data from healthcare facilities ensures accurate staffing recommendations.

In January 2023, Applied UV, Inc., a US-based disinfection technology company, acquired Puro Lighting for an undisclosed amount. This acquisition allows Applied UV to leverage Puro Lighting's established commercial relationships, including partnerships with major companies such as Acuity Brands, Ushio, and Johnson Controls. Puro Lighting, a US-based medical equipment manufacturing company, specializes in UV light disinfection technologies. This strategic acquisition strengthens Applied UV’s position in the disinfection market, particularly in healthcare and commercial applications, enhancing its capabilities in advanced disinfection solutions.

Major companies operating in the infection prevention market report are Cardinal Health Inc., 3M Company, Stryker Corporation, Reckitt Benckiser Group plc, Ecolab Inc., B. Braun Melsungen AG, The Clorox Company, Olympus Corporation, Fortive Corporation, Steris PLC, Genitge AB, Sotera Health Inc., Belimed AG, Coltene Group, Steelco S.p.A., Skytron LLC, Melag Medizintechnik GmbH & Co. KG, Metrex Research, Pal International, Cisa Production S.r.l. Unipersonale, Covalon Technologies Ltd., Biosafe Systems LLC, Terragene SA, Micro-Scientific LLC, Matachana SA.

North America was the largest region in the infection prevention market in 2024. The regions covered in the infection prevention market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the infection prevention market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The infection prevention market consists of revenues earned by entities by providing services such as disinfection, sterilization, and isolation precautions. The market value includes the value of related goods sold by the service provider or included within the service offering. The infection prevention market consists of sales of hand hygiene products, personal protective equipment (PPE), antimicrobial wipes and sprays, sharps disposal containers, and biohazard bags. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Infection prevention encompasses a range of measures and practices aimed at reducing the risk and spread of infectious diseases. These practices include hygiene measures such as regular hand washing, vaccination, and the use of protective equipment. They play a critical role in healthcare settings, public spaces, and personal care to safeguard both individual and public health.

The key product categories within infection prevention include sterilization equipment, disinfectors, and consumables. Sterilization equipment is used to eliminate all forms of microbial life, including bacteria, viruses, and spores, from surfaces, fluids, medications, or biological culture media. Various types of infections, including microbial and healthcare-associated infections, are targeted by these products. They are utilized by a range of end-users such as hospitals and clinics, pharmaceutical companies, clinical laboratories, medical device companies, the life science industry, and academic and research centers.

The infection prevention market research report is one of a series of new reports that provides infection prevention market statistics, including infection prevention industry global market size, regional shares, competitors with an infection prevention market share, detailed infection prevention market segments, market trends, and opportunities, and any further data you may need to thrive in the infection prevention industry. This infection prevention market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Infection Prevention Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on infection prevention market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for infection prevention? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The infection prevention market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Sterilization Equipment; Disinfectors; Consumables2) By Infection Type: Microbial Infections; Healthcare Associated Infections

3) By End User: Hospitals And Clinics; Pharmaceutical Companies; Clinical Laboratories; Medical Device Companies; Life Science Industry; Academic And Research Center

Subsegments:

1) By Sterilization Equipment: Steam Sterilizers; Ethylene Oxide Sterilizers; Plasma Sterilizers; Dry Heat Sterilizers; Chemical Sterilizers2) By Disinfectors: Surface Disinfectors; Endoscope Disinfectors; Washer Disinfectors; Automated Disinfecting Systems

3) By Consumables: Sterilization Pouches And Wraps; Disinfectant Wipes; Chemical Indicators; Personal Protective Equipment (PPE); Cleaning Agents And Solutions

Key Companies Mentioned: Cardinal Health Inc.; 3M Company; Stryker Corporation; Reckitt Benckiser Group plc; Ecolab Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Infection Prevention market report include:- Cardinal Health Inc.

- 3M Company

- Stryker Corporation

- Reckitt Benckiser Group plc

- Ecolab Inc.

- B. Braun Melsungen AG

- The Clorox Company

- Olympus Corporation

- Fortive Corporation

- Steris PLC

- Genitge AB

- Sotera Health Inc.

- Belimed AG

- Coltene Group

- Steelco S.p.A.

- Skytron LLC

- Melag Medizintechnik GmbH & Co. KG

- Metrex Research

- Pal International

- Cisa Production S.r.l. Unipersonale

- Covalon Technologies Ltd.

- Biosafe Systems LLC

- Terragene SA

- Micro-Scientific LLC

- Matachana SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 45.01 Billion |

| Forecasted Market Value ( USD | $ 52.2 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |