Halal cosmetics are beauty and personal care products following Islamic law that ensures the formula does not contain any ingredients forbidden in Islam, such as alcohol or inevitable animal by-products. Moreover, the product should not be tested on animals; thus, cruelty-free. The popularity of halal cosmetics has grown significantly worldwide as the awareness of its principles expands beyond dietary restrictions.

The worldwide demand for halal cosmetics is the result of a growing population of Muslims who seek out products in conformance with their beliefs. But most importantly, non-Muslim consumers also have a special interest in the ethical and eco-friendly qualities often attached to halal brands. The appeal toward clean, natural ingredients and the focus on cruelty-free practices resonated well among an even larger group of people deeply concerned about their health and the environment.

Countries like Malaysia and Indonesia have pioneered the concept of halal cosmetics, but this market is now catching up in the West. Companies are following suit by introducing lines they term 'halal' as a way of tapping into this lucrative market. The rise of e-commerce further facilitates access to these products, enabling consumers worldwide to adopt halal beauty solutions.

Top Players in the Halal Cosmetics Market

Estee Lauder

Founded: 1946Headquarters: United States of America

Estée Lauder Companies Inc. (Estée Lauder) is a manufacturer, marketer, and distributor of beauty products. The company provides a wide variety of products, such as makeup, hair care, fragrances, and skincare. Estée Lauder markets these under various brand names such as Estée Lauder, Aramis, Origins, Bobbi Brown, Aveda, Clinique, Darphin, Dr. Jart+, Editions de Parfums Frédéric Malle, and GLAMGLOW. The products are sold through specialty multi-brand retailers, department stores, perfumeries, beauty salons, spas, authorized freestanding stores, online retail websites, duty-free shops, airport stores, and its own authorized freestanding locations. The company has operations across the Asia-Pacific, the Middle East, Europe, Africa, and the Americas.

L’Oréal

Founded: 1909Headquarters: France

L'Oreal SA (L'Oreal) is a provider of personal care products. The company manufactures and markets make-up products, perfumes, hair care, sun care, skincare, and coloring products. L’Oreal markets products under various brands such as L’Oreal Professionnel, Kerastase, Redken, Matrix, PureOlogy, L’Oréal Paris, Garnier, Maybelline New York, NYX Professional Makeup, Lancome, and Kiehl’s. The company merchandises products through a network of hair salons, mass-market retail, perfumeries, department stores, pharmacies, drugstores, medispas, branded retail, and travel retail. Apart from physical stores, the company sells its products online through e-commerce platforms. The company has business presence across the North America, Latin America, Europe, Asia-Pacific, Africa, and the Middle East.

S&J International Enterprises

Founded: 1980Headquarters: Thailand.

S&J International Enterprises is a dynamic organization dealing in global trade and commerce. Established with a zeal to bridge the gap between markets across the world, S&J is committed to offering high-quality products and services to fulfill diverse demands and needs of customers. The different fields of interest wherein S&J operates include manufacturing, logistics, and distribution to accomplish the task with efficient supply chain solutions. Built on the pillars of excellence, S&J International builds strong relationships with suppliers and clients, offering innovative solutions that improve the competitive edge. Also, their work team has the necessary international experience required for executing such tasks smoothly, thereby making them the best international partner for any business expansion. Their operations are guided by customer satisfaction, integrity, and sustainability. S&J, therefore, is considered a leading international trade company. Their mission demonstrates an aim to nurture long-term relations and mutual growth.

Kao Corporation

Founded: 1887Headquarters: Japan

Kao Corp (Kao) manufactures, markets and sells consumer and chemical products. The company's major products include cosmetics, facial and body cleansers, soaps, shampoos, conditioners, hair coloring and styling agents. It also offers sanitary napkins, baby diapers, health beverages, fragrances, laundry detergents, kitchen cleaners, surfactants, fatty alcohol, edible fats and oils, toners, and aroma chemicals. The company provides oleo chemicals, performance chemicals, and specialty chemicals. Kao markets these products under Attack, Essential, Biore, Ban, Blaune, Curel, Quickle, New Beads, Quickle Joan, Resesh, Goldwell, Guhl, Haiter and Jergens brands. The company has business operations in the Americas, Asia, the Middle East, Africa and Europe.

Clara International Beauty Group

Founded: 1977Headquarters: Malaysia

Clara International Beauty Group is one of the leading names in the beauty and cosmetic industry, having been born with the vision to empower individuals through innovative beauty solutions. From skincare and makeup to wellness, Clara International has a diverse portfolio combining quality and creativity. The company is committed to research and development to ensure that each product meets the highest standards of efficacy and safety. Their quest to ensure customer satisfaction is reflected in their wide range of offerings targeted at different skin types and beauty preferences. Furthermore, Clara International places a strong emphasis on sustainable and responsible practices that minimize environmental impact while enhancing the beauty experience for its customers. With a strong presence across many global regions, Clara International Beauty Group remains one of the leading companies in terms of beauty innovation and consumer trust.

Product Launches in the Halal Cosmetics Market

WARDAH COSMETICS

October 2025, Indonesian cosmetics giant ParagonCorp, the company behind the halal beauty brands Wardah, Emina, and Make Over, introduces Light+ by Wardah. This latest skincare and makeup line will be a new halal range intended for Indonesia's younger generation. The brand launched in Jakarta on Youth Pledge Day and reflects confidence, intelligence, and a sense of empowerment among Indonesian Gen Z consumers.SWOT Analysis of the Company

SAMPURE MINERALS

Strengths: Authentic brand positioning and high-quality natural formulations.Sampure Minerals' most significant strength in the halal cosmetics market is its genuine brand positioning with high-quality, natural formulation. Being one of the earliest halal-certified cosmetic brands in the UK, Sampure Minerals has engendered strong consumer trust in this market segment by combining ethics with high-performance beauty. All its formulations are 100% natural, vegan, cruelty-free, and free from harmful chemicals, thus responding to the increasing global demand for clean and ethical beauty. Its Halal certification guarantees transparency, making it inclusive for both Muslims and non-Muslims who seek safe, pure, and sustainable products. Sampure Minerals enjoys a diversified product portfolio comprising mineral foundations, lipsticks, and skincare products targeting various skin tones and types. Further, it pays due consideration to environmentally friendly packaging and sources raw materials in an ethical manner to enhance its sustainability credentials. With its strong brand reputation, product innovation, and adherence to the tenets of halal, Sampure Minerals is a trusted leader in the premium halal beauty segment.

AMARA COSMETICS

Strengths include ethical beauty, cultural authenticity, and product innovation catering specifically to the Muslim consumer.

The core strength of Amara Cosmetics in the halal cosmetics market rests on its commitment to ethical beauty, cultural authenticity, and product innovation aimed at Muslim consumers. The brand has carved a niche for itself as symbolic of modern halal elegance, providing a line of beauty and skincare products free of alcohol, animal-derived ingredients, and harsh chemicals. Such strict adherence to halal certification translates into strong consumer confidence and loyalty towards the brand. Powering this with deep understanding, Amara Cosmetics caters effectively to the needs of modest beauty consumers without losing its global relevance. The company invests in natural and safe formulations while assuring high product efficacy to distinguish itself in the growing clean beauty space. Further, Amara has invested in responsible sourcing, eco-conscious packaging, and cruelty-free testing to enhance its responsible brand image. Tamara Cosmetics successfully created a loyal base of consumers in the competitive halal cosmetics industry with a skilful combination of halal integrity and quality with style.Recent Developments in the Halal Cosmetics Market

IBA Halal Care

November 2022: India-based Iba Cosmetics entered into a strategic partnership with Believe, a Singaporean FMCG conglomerate in personal care essentials. In this process, the latter invested USD 10 million in Iba Cosmetics to expand its retail market space in Saudi Arabia, UAE, Bahrain, Bangladesh, and other countries.Sustainability Goal

Talent Cosmetics Co., Ltd.

Talent Cosmetics Co., Ltd. incorporates sustainability into its core business philosophy through its emphases on eco-innovation, ethics in production, and social responsibility. Its sustainability goals are pointed at lessening the environmental footprint along the entire life cycle of the product, from ingredient sourcing to packaging and distribution. Talent Cosmetics supports natural ingredients, biodegradable and sustainably sourced materials that guarantee the safety of the products and the environment. Moving forward, the company will focus on minimal and recyclable packaging so plastic waste and carbon emissions due to logistic transportation can be minimized. During manufacturing, energy efficiency at manufacturing sites, water conservation, and waste reduction programs are prioritized. Beyond environmental goals, fair labor practices and supporting the well-being of the communities through local partnerships and charitable initiatives stay indispensable. Aligning innovation with environmental and social sustainability, Talent Cosmetics aspires to become a beauty brand that empowers consumer confidence while contributing positively toward a healthier and more sustainable global cosmetics industry.Prolab Cosmetics

Prolab Cosmetics remains committed to sustainability through green innovation, responsible manufacturing, and ethical business practices. Sustainability objectives for this company focus on reducing environmental impact while ensuring a continual quality and safety of products. Prolab Cosmetics focuses on eco-friendly formulation with natural ingredients, vegan, cruelty-free, and from sustainable suppliers. Minimizing packaging waste through recyclable materials and refillable product systems is also another focal point. Energy efficiency with minimal water consumption is one of the key enterprises across its production facilities. Furthermore, it designs its products for longevity with low-impact formulation to reduce harm to the environment along the product's life cycle. The company also focuses strongly on social responsibility by cultivating an inclusive workplace and supporting women-led initiatives in the beauty industry. Combining technological development with ecological awareness, Prolab Cosmetics becomes an example of a holistic approach to sustainability with a commitment to ethical, safe beauty, and ecological responsibility for future generations.Market Segmentation

Halal Cosmetics Market

- Historical Trends

- Forecast Analysis

Market Share Analysis - Halal Cosmetics Market

Estee Lauder

Overview

- Company History and Mission

- Business Model and Operations

Workforce

Key Persons

- Executive Leadership

- Operational Management

- Division Leaders

- Board Composition

Recent Development & Strategies

- Mergers & Acquisitions

- Partnerships

- Investments

Sustainability Analysis

- Renewable Energy Adoption

- Energy-Efficient Infrastructure

- Use of Sustainable Packaging Materials

- Water Usage and Conservation Strategies

- Waste Management and Circular Economy Initiatives

Product Analysis

- Product Profile

- Quality Standards

- Product Pipeline

- Product Benchmarking

Strategic Assessment: SWOT Analysis

- Strengths

- Weaknesses

- Opportunities

- Threats

Revenue Analysis

The above information will be available for all the following companies:

- Estee Lauder

- L’Oréal

- S&J International Enterprises

- Kao Corporation

- Clara International Beauty Group

- INIKA

- AMARA COSMETICS

- WARDAH COSMETICS

- SAMPURE MINERALS

- HALAL COSMETICS COMPANY

- Ivy Beauty Corporation

- IBA Halal Care (Iba Cosmetics)

- Martha Tilaar Group

- Talent Cosmetics Co., Ltd.

- Prolab Cosmetics

- Saaf Pure Organic Skincare

- OnePure International Group

- PHB Ethical Beauty

- Wipro Unza Group

- Tanamera Tropical

Table of Contents

Companies Mentioned

- Estee Lauder

- L’Oréal

- S&J International Enterprises

- Kao Corporation

- Clara International Beauty Group

- INIKA

- AMARA COSMETICS

- WARDAH COSMETICS

- SAMPURE MINERALS

- HALAL COSMETICS COMPANY

- Ivy Beauty Corporation

- IBA Halal Care (Iba Cosmetics)

- Martha Tilaar Group

- Talent Cosmetics Co., Ltd.

- Prolab Cosmetics

- Saaf Pure Organic Skincare

- OnePure International Group

- PHB Ethical Beauty

- Wipro Unza Group

- Tanamera Tropical

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | December 2025 |

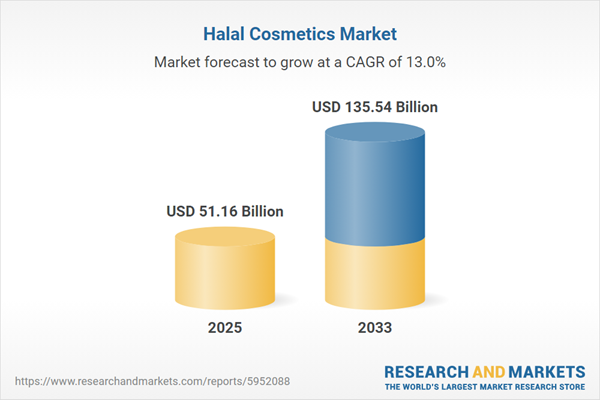

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 51.16 Billion |

| Forecasted Market Value ( USD | $ 135.54 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |