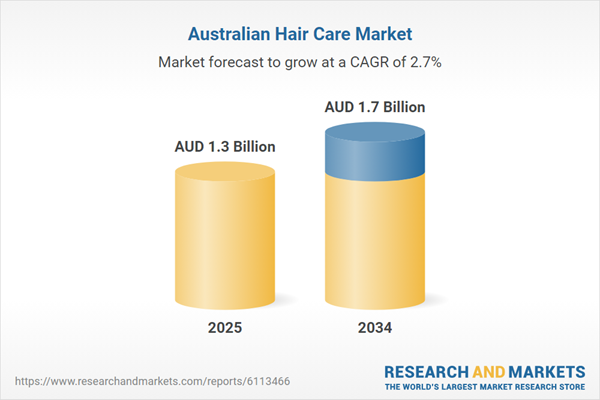

Australia Hair Care Market Trends

The Australia hair care market is experiencing significant growth in the demand for natural and organic products, fueled by heightened health and environmental consciousness. There is also a growing trend toward personalization, with brands providing customized solutions for specific hair needs. Sustainability remains a central focus, highlighting eco-friendly packaging and responsible sourcing, influencing the demand of the Australia hair care market. In July 2024, SustainHair introduced its innovative hair care line in Australia, emphasizing refillable packaging and zero-waste practices. The brand promotes reduced plastic usage through a convenient refill system, catering to the rising demand for sustainable beauty solutions.The Australia hair care market is increasingly adopting tech-driven solutions, with smart devices and apps offering personalized recommendations to enhance user engagement. A notable trend is the growth of e-commerce, as consumers opt for the convenience of online shopping for hair care products. Additionally, the expanding men's grooming segment is driving the growth of the Australia hair care market. This reflects evolving attitudes toward male personal care. In September 2024, Gentleman's Choice launched its premium men's hair care line in Australia, featuring pomades and hair serums. The brand emphasises high-quality formulations that promote healthy hair and scalp, catering to the rising demand for specialised grooming products for men.

Australia Hair Care Market Growth

The Australia hair care market is witnessing increased demand for salon-quality products designed for at-home use, allowing consumers to achieve professional results without salon visits. Moreover, the Australia hair care market dynamics and trends are greatly influenced by influencer marketing, which enhances brand awareness and shapes consumer preferences through social media. In August 2024, a popular UK haircare range debuted in Priceline stores across Australia, highlighting a strong commitment to diversity and inclusion. The products are specifically formulated to cater to different hair types and textures, reflecting the multicultural nature of Australian society.The Australia hair care market is experiencing growth as brands invest heavily in research and development to create innovative formulations. There is a notable shift toward clean beauty, with consumers favoring products free from harmful chemicals. Additionally, rising disposable incomes allow consumers to spend more on premium hair care, increasing Australia hair care market revenue. Launched in July 2024, Purely Organic Hair features organic products made from plant-based ingredients, appealing to those who prioritize natural formulations.

Australia Hair Care Market Insights

- The 2021 Census by the Australian Bureau of Statistics revealed that 50.7% of the population were women, with a median age of 39.

- In 2020, the Australian Institute of Health and Welfare noted 3.2 million individuals aged 15-24, accounting for 12%.

- The 2021 Census by the Australian Bureau of Statistics tallied 25,422,788 individuals in Australia, with males making up 49.3% and a median age of 37.

Industry News

October 2024: EcoHair launched its first line of sustainable hair care products in Australia, featuring biodegradable packaging and natural ingredients. The brand aims to reduce environmental impact while offering high-quality solutions for various hair types, appealing to eco-conscious consumers seeking effective and responsible hair care options.September 2024: GreenRoots Hair Care debuted its collection of eco-friendly hair products in Australia, emphasising cruelty-free and vegan formulations. The brand focuses on sustainability by using recyclable materials and ethically sourced ingredients, aiming to meet the growing demand for environmentally responsible beauty products among Australian consumers.

Australia Hair Care Market Drivers

Natural and Organic Products

The Australia hair care market is witnessing a growing consumer inclination toward natural and organic products. As health and environmental awareness increases, shoppers are increasingly looking for formulations that are free from harmful chemicals. In response, brands are introducing clean beauty options made from plant-based ingredients. This trend highlights a broader commitment to sustainability and wellness, appealing to eco-conscious consumers who prioritise both their hair health and the environment. As a result, there is an influx of products showcasing organic certifications and eco-friendly practices driving the demand of the Australia hair care market. In June 2024, the organic and vegan brand Vanessa Megan Naturaceuticals launched a 100% natural shampoo and conditioner line, featuring a Bamboo and Rosemary Shampoo and a Yuzu and Rice Protein Conditioner designed to smooth and strengthen hair. The shampoo contains bamboo extract, rich in silica and beneficial herbal extracts for hair and scalp health.Sustainable Practices

The Australia hair care market is experiencing significant growth driven by a strong focus onsustainability. Brands are increasingly adopting eco-friendly practices to attract environmentally conscious consumers, including using recyclable packaging, sustainably sourced ingredients, and refillable systems. As consumers prioritize brands committed to reducing their environmental impact, this shift is reshaping product development and marketing strategies boosting the Australia hair care industry revenue. Consequently, sustainable hair care options are gaining momentum, reflecting a broader societal movement towards responsible consumption. In September 2024, GreenRoots launched its eco-friendly hair care collection, highlighting cruelty-free and vegan formulations while utilizing recyclable materials and ethically sourced ingredients to address the growing demand for environmentally responsible beauty products.Opportunities in the Australia Hair Care Market

Men's Grooming Expansion

The Australia hair care market is experiencing significant growth, particularly in the men’s grooming segment. Changing societal norms and attitudes toward male personal care are fueling interest in specialized hair products designed for men. Brands are creating targeted solutions to address men's specific hair and scalp needs, including styling products, shampoos, and conditioners. This trend is reinforced by marketing campaigns that encourage self-care among men, motivating them to invest in grooming products. As the market evolves, there is increasing recognition of the importance of male-specific formulations, contributing to the Australia hair care industry growth. In July 2024, Brothers Grooming Co. launched a new range of hair care essentials for men, focusing on sustainable practices and eco-friendly packaging. The collection features shampoos, conditioners, and styling products tailored to the unique requirements of men's hair while promoting environmental responsibility.Market Restraints

The Australia hair care market faces several key restraints. Intense competition among established and emerging brands makes differentiation challenging, often leading to aggressive pricing and reduced profit margins. Regulatory compliance adds complexity, especially for smaller brands. Consumer scepticism regarding greenwashing necessitates transparency.Economic fluctuations can impact spending on premium products, while rapidly changing trends require brands to adapt quickly. Supply chain disruptions affect availability, and market saturation limits growth opportunities. Additionally, limited awareness of niche products and the need to cater to a diverse population complicate marketing strategy. Brands must align with sustainability to avoid losing Australia hair care market share.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Shampoo

- Conditioner

- Hair Colorant

- Hair Styling Products

- Others

Market Breakup by Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Speciality Stores

- Online

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Hair Care Market Share

By Type Analysis

In the Australia hair care market, shampoo is vital for removing dirt, oil, and product buildup, creating a healthier environment for hair growth, and supporting scalp health by addressing issues like dandruff and dryness. The availability of various formulations tailored for different hair types allows consumers to select products that meet their specific needs, enhancing manageability and providing a refreshing experience. This versatility drives the demand of the Australia hair care market. In October 2024, Oxfam collaborated with creative agency Bullfrog to launch ONLY SHAMPOO on National Hair Day. This campaign promotes sustainable hair care while raising awareness of global issues, effectively merging creativity with social responsibility for a significant impact.In the Australia hair care market, conditioner is vital for maintaining hair health, as it replenishes moisture, reduces dryness, and prevents breakage, particularly in challenging climates. It enhances hair texture by smoothing the cuticle, resulting in softer, more manageable hair. Additionally, conditioner minimizes tangling and frizz while protecting against environmental damage and heat styling. Tailored solutions for specific hair concerns effectively address diverse consumer needs, driving growth of the Australia hair care market. In September 2024, EcoLux Hair Care launched a new line of conditioners featuring organic ingredients and sustainable packaging, targeting environmentally conscious consumers looking for effective hair care solutions while promoting eco-friendly practices in the beauty industry.

By Distribution Channel Insights

The Australia hair care market is thriving as hypermarkets and supermarkets offer a wide array of products that cater to various consumer preferences and hair types. Competitive pricing and promotions enhance affordability, while the one-stop shopping experience boosts convenience and promotes impulse purchases. In August 2024, Purely Organic Hair launched its collection of natural shampoos and conditioners in hypermarkets, targeting consumers seeking chemical-free hair care options.The Australia hair care market benefits from convenience stores that provide swift access to hair care products, perfect for consumers on the move. Many stores are open late or operate 24/7, making it easy to purchase items at any time. Their localised selections cater to community preferences, while the strategic layout encourages impulse buying. Additionally, staff can offer personalized recommendations, enhancing the shopping experience for customers looking for specific solutions boosting the hair care demand. In August 2024, Eco-Friendly Care launched a new line of eco-conscious hair serums and treatments in recyclable packaging, aimed at environmentally conscious shoppers at convenience stores.

Australia Hair Care Market Regional Insights

New South Wales Hair Care Market Regional Insights

New South Wales is witnessing significant growth in the Australia hair care market, fueled by rising demand for natural and premium products. The diverse population influences brands to cater to various hair types, while urban centres like Sydney see increased interest in sustainable solutions. Salon Lane debuted their latest workspace salon brand for independent hair, beauty, and wellness entrepreneurs in Bondi Junction, Sydney, officially opening in August 2024.Queensland Hair Care Market Trends

The Queensland hair care market benefits from diverse demographics, catering to urban and regional clients. It thrives on a strong tourism industry and a growing demand for personal grooming and wellness treatments, creating a vibrant service environment. As reported by the Queensland government, from 2012 to 2022, the percentage of females in the region rose by 1.3%. Population growth forecasts are expected to drive increased demand for hair care and wellness services.Western Australia Hair Care Market Dynamics

Rising consumer interest in eco-friendly products, style innovation, and opportunities to use local ingredients drive growth in Western Australia's hair care market. WA Hair & Beauty, based in Perth, is a trusted wholesale supplier of premium hair, beauty, and nail products. They offer online ordering and have training rooms for various courses across the region.Competitive Landscape

Key market players in beauty, personal care, and household products prioritize sustainability and innovation, emphasizing eco-friendly practices and responsible sourcing. They focus on research and development to enhance product effectiveness while ensuring safety and consumer satisfaction. Committed to improving everyday lives, these companies integrate social responsibility and environmental stewardship into their core business strategies, striving to reduce their environmental impact.Key Industry Players

Unilever PLC: Headquartered in London, UK, Unilever PLC was established in 1929. This multinational consumer goods company specializes in food, beverages, cleaning agents, beauty, and personal care products. With a commitment to sustainability, Unilever aims to reduce its environmental impact while enhancing the quality of life for its consumers. Popular brands include Dove, Knorr, and Lipton.Procter & Gamble Co.: Headquartered in Cincinnati, Ohio, and was founded in 1837. This American multinational specializes in a wide range of consumer goods, including personal care, household cleaning, and health products. Known for its strong brand portfolio, which includes Tide, Gillette, and Pampers, P&G is dedicated to innovation and sustainability in its business practices.

Henkel AG & Co. KgaA: Founded in 1876 and based in Düsseldorf, Germany, operates in the consumer and industrial sectors. The company is renowned for its adhesives, beauty care, and home care products. With a focus on sustainability, Henkel aims to enhance lives through innovative solutions. Notable brands include Persil, Schwarzkopf, and Loctite.

L'Oréal SA: Established in 1909 and headquartered in Clichy, France, L'Oréal SA is a global leader in cosmetics and beauty products. The company emphasizes innovation and research in developing skincare, makeup, haircare, and fragrance products. L'Oréal is committed to sustainability and inclusivity, with well-known brands such as Lancôme, Garnier, and Maybelline under its umbrella.

Other key players in the Australia hair care market report include Kao Corporation, De Lorenzo, Natural Australian Kulture Pty Limited, Australian Pty Ltd, Natures Organics Pty Ltd., Evo Labs Pty Ltd. and My Skincare Manufacturer Pty Ltd among others.

Recent Developments

August 2024: Purely Organic Hair launched a new line of organic hair care products in Australia, utilising plant-based ingredients, and sustainable packaging. This introduction aligns with consumer preferences for natural products and seeks to encourage healthier hair care practices while reducing environmental impact.June 2024: Nurture Nature revealed a new collection of sustainable hair care products in Australia, focusing on recyclable packaging and responsibly sourced ingredients. The brand caters to eco-conscious consumers, offering effective solutions that prioritise both hair health and environmental responsibility, reflecting the increasing trend towards sustainability in the beauty industry.

Table of Contents

Companies Mentioned

- Unilever plc

- Procter & Gamble Co.

- Henkel AG & Co KGaA

- L'Oreal SA

- Kao Corporation

- De Lorenzo

- Natural Australian Kulture Pty Limited

- Costralia Pty Ltd

- Natures Organics Pty Ltd.

- Evo Labs Pty Ltd.

- My Skincare Manufacturer Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 107 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.3 Billion |

| Forecasted Market Value ( AUD | $ 1.7 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 11 |