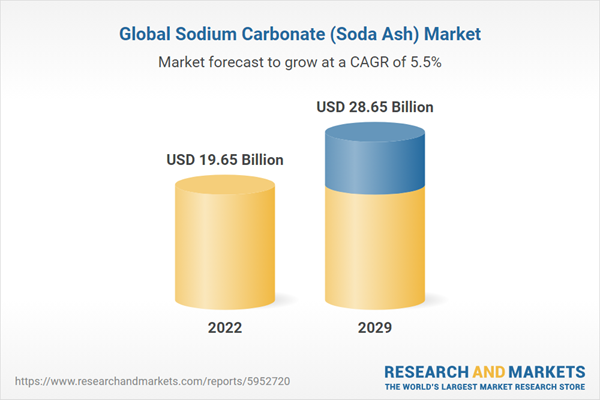

The global sodium carbonate market is anticipated to grow from US$19.654 billion in 2022, to US$28.647 billion by 2029, growing at a CAGR of 5.53%.

Soda Ash, also known as sodium carbonate, serves as a crucial raw material in the production of glass, soaps, detergents, and various other industrial applications. The market is expected to witness growth driven by the expanding construction industry, marked by diverse investments in global infrastructure projects. In the United States, chemicals rank among the most widely used and essential products, contributing significantly to the country's GDP. Consequently, the Federal Reserve Board incorporates monthly soda ash production data into its economic indicators to monitor the overall condition of the U.S. economy. The market is segmented into dense soda ash and light soda ash based on type.MARKET DRIVERS:

Expanding growth of end user industries to drive demand and market growth of sodium carbonate market

Soda ash finds application in formulations for laundry and cleaning compounds. It contributes to improved cleansing efficacy, such as serving as a builder in the emulsification of oil stains. Its usage extends to minimizing dirt deposition during washing and rinsing, providing alkalinity for cleaning purposes, and aiding in the softening of laundry water. Additionally, soda ash plays a crucial role as a constituent in the formulation of another significant builder in detergent compositions, namely sodium tripolyphosphate (STPP). Moreover, it is employed in the production of ultramarine, enhancing the brightness of white clothing. According to a 2022 report from the US Environmental Protection Agency, in 2019, nearly 47% of the total sodium carbonate consumed was attributed to glass manufacturing. The chemical industry accounted for approximately 30% of total sodium carbonate sales. The remaining portion of domestic consumption in 2019 comprised commercial market distributors at 6%, soaps and detergents at 6%, miscellaneous applications at 5%, flue gas desulfurization at 4%, pulp and paper at 1%, and water treatment at 1%.In 2019, the total estimated value of nonfuel mineral production in the United States reached $86.3 billion, marking a $2 billion increase from the previous year. The 2020 report indicates that the U.S. still depends on foreign sources for various raw and processed mineral materials. Imports accounted for over half of the apparent consumption of 46 nonfuel mineral commodities in 2019, and the U.S. was 100% net import reliant for 17 of them. The domestic production of critical rare-earth mineral concentrates saw a significant increase of 8,000 metric tons (over 44%) in 2019, reaching a total of 26,000 metric tons. This positioned the U.S. as the largest producer of rare-earth mineral concentrates outside of China. In 2019, the estimated value of metal mine production in the United States was 28.1 billion, representing an increase of nearly 500 million compared to 2018. The primary contributors to the overall value of metal mine production in 2018 were gold (32%), copper (28%), iron ore (19%), and zinc (7%).

Market developments to bolster the growth of the market.

- In May 2022, Solvay obtained full ownership of its natural soda ash facility in Green River, Wyoming. Solvay revealed the purchase of the remaining 20% minority stake held by AGC in the Soda Ash joint venture located in Green River, WY, USA, strengthening its dominant role in trona-based soda ash manufacturing.

- On September 23, 2023, the V.O. Chidambaranar Port Authority in Tamil Nadu successfully managed the handling of 3x20 ISO Green Ammonia Containers, with a total weight of 37.4 tons of Green Ammonia, arriving from Damietta Port, Egypt, for M/s. Tuticorin Alkali Chemical and Fertilizers Ltd (TFL). Traditionally, Grey Ammonia is used in soda ash production. In line with the Go Green initiative, TFL has imported green ammonia for the trial production of Green Soda Ash. Additionally, TFL has plans to import 2000 MT this year, contingent upon the availability of Green Ammonia.

North America is expected to witness subsequent growth in the sodium carbonate market.

The United States stands as the primary global hub for natural sodium carbonate deposits, controlling some of the largest reservoirs worldwide. Beyond its global manufacturing prominence, the U.S. maintains a substantial domestic supply and distribution network for sodium carbonate. For instance, domestic production yielded twelve million tons of natural soda ash (sodium carbonate), marking a 20% increase from the previous year. Despite this, the U.S. soda ash industry is characterized by a limited number of producers and dispersed production sites, primarily concentrated in two regions. Wyoming houses four companies operating five facilities, while California hosts one plant under the management of a single company.Natural soda ash producers enjoy distinct advantages over synthetic counterparts, marked by lower production costs and a reduced environmental footprint. The manufacturing process of synthetic soda ash typically entails higher energy consumption and greater carbon dioxide emissions compared to the production of natural soda ash. Recent years have witnessed the closure or inactivity of several synthetic soda ash plants globally. This creates opportunities for American manufacturers of natural soda ash to expand their market presence.

Market Segmentation

By Type

- Heavy soda ash

- Light soda ash

By Application

- Glass

- Soaps and Detergents

- Chemicals

- Mining

- Paper and Pulp

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Others

Table of Contents

Companies Mentioned

- CIECH S.A.

- Solvay

- Ciner Resources Corporation

- Tata Chemicals Ltd.

- Genesis Energy, LP

- Tangshan Sanyou Chemical Industries Co., Ltd.

- Shandong Haihua Group

- Nirma Limited

- Joint-stock company “Bashkir soda company” (JSC "BSC")

- GHCL Limited

- Tokuyama Corporation

- Seqens Group

- Natrium Products Inc.

- Hawkins, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | February 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 19.65 Billion |

| Forecasted Market Value ( USD | $ 28.65 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |