Penicillins is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The escalating global demand for animal-derived protein represents a primary driver for the animal antibiotics and antimicrobials market, as efficient livestock production relies heavily on disease prevention and control. With a growing world population and shifting dietary preferences, the need to maximize yields and ensure animal health in food-producing animals becomes increasingly critical. According to the Food and Agriculture Organization (FAO) of the United Nations, in December 2024, global meat production was forecast to increase by 1.4% to 373 million tons in 2024, demonstrating the continuous pressure on the animal agriculture sector to meet consumption needs. This sustained demand necessitates the judicious use of antimicrobials to prevent widespread disease, maintain animal welfare, and optimize productivity within intensive farming systems.Key Market Challenges

The growing concern over antimicrobial resistance (AMR) represents a significant impediment to the expansion of the Global Animal Antibiotics and Antimicrobials Market. This challenge directly necessitates the implementation of increasingly stringent regulatory frameworks and responsible usage guidelines across various regions. Governments and international bodies are imposing stricter controls on the prescription, sale, and administration of these vital drugs to mitigate the public health risks associated with AMR.These heightened regulations limit the availability of certain antimicrobial classes and restrict their application, particularly for non-therapeutic purposes such as growth promotion. The transition of many medically important antimicrobials from over-the-counter to prescription-only status, as seen with U. S. FDA guidance implemented in June 2023, directly curtails market access for producers and veterinarians.

Key Market Trends

The growing focus on antibiotic alternatives and prudent use represents a pivotal shift in global animal health management, moving from antibiotic reliance toward integrated disease prevention and responsible usage. Driven by antimicrobial resistance concerns and regulatory pressures, the market sees increased adoption of alternatives like vaccines, probiotics, and phytogenics. These bolster immunity and reduce therapeutic antibiotic needs. According to a European Surveillance of Veterinary Antimicrobial Consumption report published in November 2023, farm antibiotic sales in 31 European countries fell by 12.7% in 2022 compared to 2021. This strategic pivot towards prudent antimicrobial stewardship, alongside improved biosecurity, directly influences the market by promoting judicious consumption and preserving drug efficacy.Key Market Players Profiled:

- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Merck & co. Inc

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

- Vetoquinol S.A.

- Virbac S.A.

- HIPRA S.A.

- Ceva Sante Animale S.A.

- Kyoritsuseiyaku Corporation

Report Scope:

In this report, the Global Animal Antibiotics and Antimicrobials Market has been segmented into the following categories:By Product:

- Tetracycline

- Penicillin

- Sulfonamide

- Macrolide

- Cephalosporin

- Lincosamide

By Mode of Delivery:

- Premixes

- Oral Solutions

- Injection

By Animal Type:

- Food Producing

- Companion

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Animal Antibiotics and Antimicrobials Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Animal Antibiotics and Antimicrobials market report include:- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Merck & co. Inc

- Elanco Animal Health Incorporated

- Phibro Animal Health Corporation

- Vetoquinol S.A.

- Virbac S.A.

- HIPRA S.A.

- Ceva Sante Animale S.A.

- Kyoritsuseiyaku Corporation

Table Information

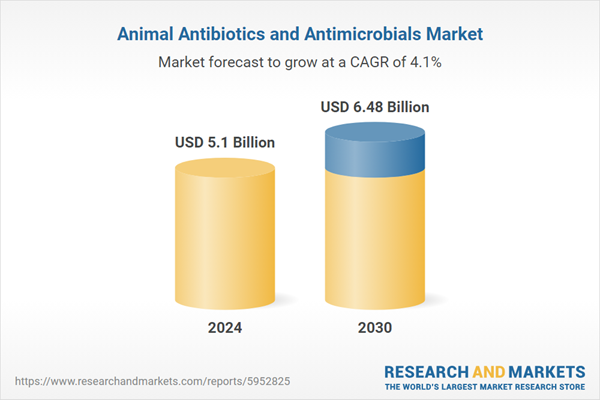

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 6.48 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |