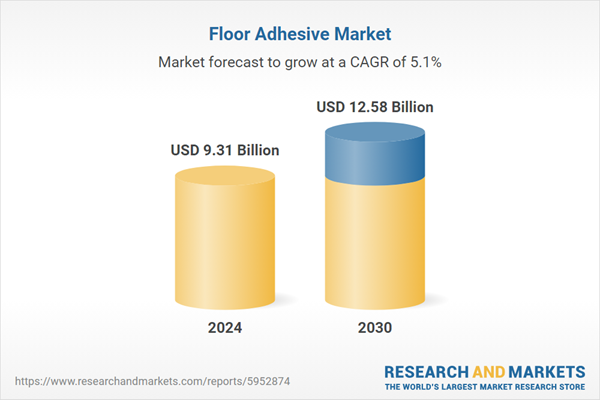

Acrylic Adhesive is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The expansion of the global construction industry significantly underpins the demand for floor adhesives by creating a continuous need for flooring installations across diverse building types. Robust activity in residential, commercial, and infrastructure sectors directly translates into increased consumption of specialized adhesive formulations required for the secure bonding of various flooring materials. This foundational driver is clearly reflected in regional growth trends; for instance, according to Eurostat data, as reported by Trading Economics in September 2025, Eurozone construction output grew 3.2% year-on-year in July 2025, highlighting sustained development across Europe. The ongoing global pipeline of new construction and large-scale renovation projects inherently expands the market for floor adhesives, ensuring a steady requirement for solutions that accommodate modern building practices and material specifications.Key Market Challenges

Volatility in raw material pricing represents a significant challenging factor directly impacting the growth of the Global Floor Adhesive Market. This inherent instability leads to unpredictable fluctuations in the cost of essential chemical components, such as petrochemicals and specialized polymers, which are fundamental to adhesive production. Manufacturers consequently face increased and volatile production costs throughout their supply chains.Such cost pressures often necessitate price adjustments for finished adhesive products, which can dampen demand in price-sensitive construction and renovation sectors. Alternatively, if manufacturers absorb these elevated costs to maintain market competitiveness, their profit margins are substantially compressed, limiting investment in innovation and market expansion. This constant uncertainty also complicates long-term business planning and inventory management for adhesive producers.

Key Market Trends

The floor adhesive market is significantly shaped by advancements in high-performance and rapid-curing formulations, meeting the construction industry's demand for efficiency and lasting durability. These innovations enable faster project completion by reducing setting times, thus minimizing labor costs and accelerating overall construction schedules.According to the Adhesive and Sealant Council (ASC), the global adhesives and sealants market was valued at USD 72.76 billion in 2024, reflecting the substantial market for these advanced products. For example, Sika introduced its SikaBond-6000, a firm-set acrylic resilient flooring adhesive, in July 2025, emphasizing its fast-setting properties and high moisture resistance up to 99% RH for demanding installations. This evolution supports resilient flooring applications requiring superior bonding strength and expedited operational speed.

Key Market Players Profiled:

- Mapei S.p.A.

- Sika AG

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- Wacker Chemie AG

- Bostik SA

- Forbo Holdings AG

- Pidilite Industries Limited

- LATICRETE International Inc.

- Dupont De Nemours Inc.

Report Scope:

In this report, the Global Floor Adhesive Market has been segmented into the following categories:By Resin Type:

- Polyurethane Adhesive

- Epoxy Adhesive

- Vinyl Adhesive

- Acrylic Adhesive

- Others

By Technology:

- Water-Based Adhesive

- Hot-Melt Adhesive

- Solvent-Based Adhesive

By Application:

- Wood

- Carpet

- Laminate

- Tile & Stone

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Floor Adhesive Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Floor Adhesive market report include:- Mapei S.p.A.

- Sika AG

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- Wacker Chemie AG

- Bostik SA

- Forbo Holdings AG

- Pidilite Industries Limited

- LATICRETE International Inc.

- Dupont De Nemours Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.31 Billion |

| Forecasted Market Value ( USD | $ 12.58 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |