Pyrethroids is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The escalating prevalence of mite and tick infestations across agricultural crops and livestock populations significantly drives the global acaricides market. These pervasive pests inflict substantial damage, leading to diminished crop yields and considerable economic losses in animal husbandry by consuming plant tissues or transmitting debilitating diseases. The persistent threat from these infestations necessitates continuous and effective control measures, thereby sustaining the demand for acaricidal solutions. According to Acta Scientific, November 2024, "Status of Economic Losses and Health Impact of the Tick Bites on Farm, Field and Dairy Animals", the cattle tick *Rhipicephalus microplus* alone caused an estimated $3.24 billion in annual economic losses to the Brazilian cattle industry, underscoring the critical financial impact that propels acaricide adoption.Key Market Challenges

A significant challenge impeding the expansion of the global acaricides market stems from the evolving landscape of stringent regulatory restrictions on certain chemical pesticides. These regulations directly hamper market growth by increasing the complexity and cost associated with product development, registration, and ongoing compliance. Such an environment limits the introduction of innovative acaricide formulations and can lead to the withdrawal of existing products, thereby reducing the available tools for effective pest management across agricultural crops and livestock.The increasing regulatory burden translates to substantial operational expenses for manufacturers, which can divert investment from research and development into compliance activities. According to the American Chemistry Council, in Q2 2024, 38% of chemical manufacturers reported concerns about the increasing level of regulatory burden. This directly impacts the global acaricides market by stifling innovation and product diversity, as fewer resources are allocated to developing new solutions or maintaining the registration of less profitable older ones. Consequently, the market's capacity to address emerging pest resistance and diverse regional pest challenges is constrained, impeding its overall growth potential.

Key Market Trends

The growing adoption of bio-based and organic acaricides represents a significant market trend, driven by increasing consumer demand for sustainable agricultural practices and stricter regulatory landscapes concerning synthetic chemical use. This shift necessitates the development and commercialization of naturally derived pest control solutions, including those effective against mites and ticks. According to the CropLife Biologicals Survey published in March 2024, biopesticide applications showed a notable increase, rising from 19% in 2023 to 22% in 2024, highlighting a steady market penetration for these alternatives.Key Market Players Profiled:

- Albaugh, LLC.

- Nissan Chemical Industries Ltd

- BASF SE

- Bayer CropScience AG

- FMC Corporation

- Syngenta International AG

- UPL Limited

Report Scope:

In this report, the Global Acaricides Market has been segmented into the following categories:By Chemical Type:

- Organophosphates

- Carbamates

- Organochlorines

- Pyrethrins

- Pyrethroids

- Other

By Application:

- Spray

- Dipping

- Hand Dressing

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Acaricides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Acaricides market report include:- Albaugh, LLC.

- Nissan Chemical Industries Ltd

- BASF SE

- Bayer CropScience AG

- FMC Corporation

- Syngenta International AG

- UPL Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

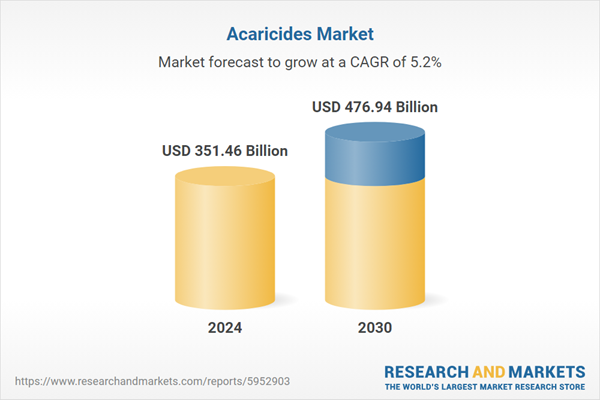

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 351.46 Billion |

| Forecasted Market Value ( USD | $ 476.94 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |