Ethylene Vinyl Acetate is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global hot melt adhesives market is significantly influenced by the robust expansion of the packaging industry and the rapid growth of e-commerce. These sectors necessitate high-speed, efficient bonding solutions for diverse materials, driving the demand for hot melt formulations that offer rapid setting times and strong adhesion critical for automated production lines. The surge in online retail, in particular, requires durable packaging to withstand complex logistics, directly benefiting hot melt adhesive applications in carton sealing, labeling, and protective packaging. According to PMMI's 2024 State of the Industry report, published in November 2024, U. S. packaging machinery shipments grew 5.8% in 2023 to $10.9 billion, underscoring the ongoing investment in packaging infrastructure that relies heavily on hot melt technology.Key Market Challenges

Consistent volatility in raw material prices poses a significant challenge to the growth of the Global Hot Melt Adhesives Market. This instability directly impacts manufacturers by introducing unpredictability into their operational expenses, as key chemical feedstocks, often petroleum-derived, experience frequent price shifts. Such fluctuations necessitate constant adjustments to production budgets and procurement strategies, hindering efficient long-term planning.Key Market Trends

The Global Hot Melt Adhesives Market is significantly influenced by the increasing adoption of sustainable and bio-based adhesive formulations. This trend is driven by escalating environmental regulations and a growing consumer preference for products with reduced ecological footprints, necessitating the development of adhesives derived from renewable resources.According to FEICA, adhesives based on natural polymers are forecasted to experience strong growth through 2028 due to heightened demand for sustainable materials. Companies are actively innovating in this area; for example, H. B. Fuller’s 2024 Sustainability Report, published in June 2025, highlighted its Swift®melt 1850, a bio-based pressure-sensitive hot melt adhesive designed to minimize fossil fuel reliance and enhance packaging recyclability. This shift addresses the industry's commitment to a circular economy and reduces overall carbon emissions.

Key Market Players Profiled:

- 3M Co.

- Alfa International Corporation

- Arkema SA

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Beardow & Adams (adhesives) Limited

- Dow Inc.

- H.B. Fuller Company

- Huntsman International LLC

- Master Bond Inc.

Report Scope:

In this report, the Global Hot Melt Adhesives Market has been segmented into the following categories:By Resin Type:

- Ethylene Vinyl Acetate

- Styrene Block Copolymers

- Metallocene Polyolefin

- Others

By End User:

- Packaging Solutions

- Nonwoven Hygiene Products

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hot Melt Adhesives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Hot Melt Adhesives market report include:- 3M Co.

- Alfa International Corporation

- Arkema SA

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- Beardow & Adams (adhesives) Limited

- Dow Inc.

- H.B. Fuller Company

- Huntsman International LLC

- Master Bond Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

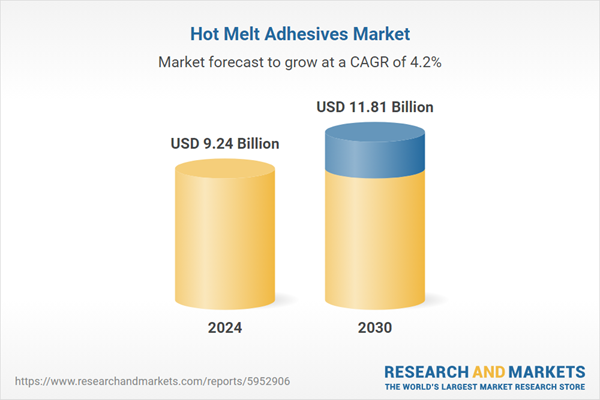

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.24 Billion |

| Forecasted Market Value ( USD | $ 11.81 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |