Agricultural is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

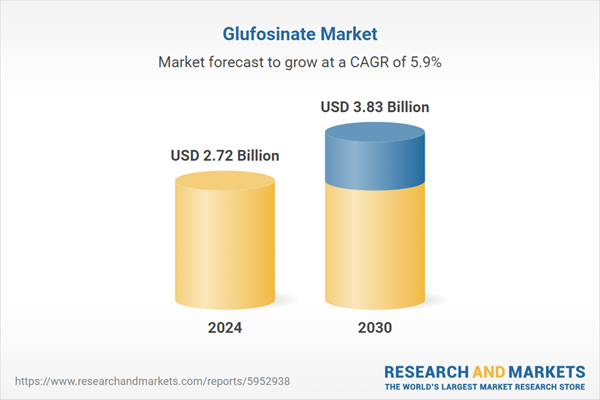

Market growth is driven by the increasing global need for effective weed control, particularly with the rising adoption of genetically modified glufosinate-tolerant crops. The expanding challenge of herbicide-resistant weeds, especially glyphosate-resistant species, further strengthens demand for glufosinate as an alternative herbicide. Regional agrochemical growth supports this trend, with CropLife India reporting agrochemical exports reaching USD 5.4 billion in 2022-23. However, stringent pesticide regulations across several key regions pose a major challenge, often delaying approvals and restricting access to certain markets.

Key Market Drivers

The increasing cultivation of genetically modified glufosinate-tolerant crops and the growing problem of herbicide-resistant weeds

Two core drivers are shaping the global glufosinate market: the rising cultivation of genetically modified glufosinate-tolerant crops and the escalating spread of herbicide-resistant weeds. Genetically modified crops engineered to tolerate glufosinate allow farmers to apply the herbicide post-emergence without harming the crop, significantly improving weed control efficiency and yield. Fundacion Antama’s May 2023 “Global GM Crop Area Review” reported that 202.2 million hectares of GM crops - including herbicide-tolerant varieties - were cultivated in 2022, reinforcing the market’s demand foundation. Meanwhile, the growing threat of herbicide-resistant weeds makes glufosinate essential in resistance-management programs.As glyphosate-resistant species proliferate, growers require herbicides with differing modes of action. According to the International Survey of Herbicide Resistant Weeds (Heap), cited in The Global Challenge of Herbicide-Resistant Weeds (September 2023), 530 herbicide-resistant cases across 272 species in 72 countries had been recorded, prompting increased reliance on glufosinate. Financial results from major producers reflect these dynamics; BASF’s 2024 Report noted its Agricultural Solutions segment recorded EUR 9.79 billion in sales, though glufosinate-ammonium prices faced pressure - illustrating the market’s sensitivity to pricing despite strong structural demand.

Key Market Challenges

The stringent regulatory frameworks governing pesticide usage in several key regions

Strict and evolving regulatory frameworks significantly constrain the growth of the global glufosinate market. Pesticide regulations often involve complex, lengthy approval timelines and can result in usage restrictions or bans, directly limiting market access. In the European Union, approval extensions for 13 active substances - including glufosinate - were issued under Implementing Regulation (EU) 2024/2781 due to delays in risk assessments, prolonging approvals only until May 2027.These regulatory uncertainties increase operational costs and complicate strategic planning for manufacturers. The Agricultural Industries Confederation (AIC) highlighted in June 2024 that ongoing delays in Great Britain’s pesticide regulatory system are creating business uncertainty and making certain active substances uneconomical to maintain in smaller markets. Such challenges impede the introduction and long-term viability of glufosinate-based products, thereby limiting market growth.

Key Market Trends

Technological advancements in glufosinate formulations

Advancements in formulation technologies are significantly improving glufosinate’s efficacy, stability, and application efficiency. Innovations aim to increase active ingredient performance while reducing application rates. For instance, BASF Agricultural Solutions introduced Liberty ULTRA in November 2023 - a new glufosinate formulation using Glu-L Technology that reduces use rates by 25% and is expected to be fully launched in 2025. Substantial investment in R&D supports these advancements; a 2024 CropLife International Members Survey by AgbioInvestor reported a 31.6% increase in synthesis and formulation research costs, reaching USD 64 million per new pesticide. These innovations enable more precise and effective weed control while supporting sustainability goals.Key Market Players Profiled:

- Bayer AG

- DuPont de Nemours, Inc.

- Syngenta Crop Protection AG

- UPL LTD

- Nufarm Limited

- Jiangsu Huangma Agrochemicals Co., Ltd

- BASF SE

- Hebei Veyong Bio-Chemical Co. Ltd

- ZHEJIANG YONGNONG CHEM. IND. CO., LTD

- Clariant AG

Report Scope:

In this report, the Global Glufosinate Market has been segmented into the following categories:By Crop Type:

- Genetically Modified Crops

- Conventional Crops

By Application:

- Agricultural

- Non-Agricultural

By Form:

- Liquid

- Dry

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Glufosinate Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Glufosinate market report include:- Bayer AG

- DuPont de Nemours, Inc.

- Syngenta Crop Protection AG

- UPL LTD

- Nufarm Limited

- Jiangsu Huangma Agrochemicals Co., Ltd

- BASF SE

- Hebei Veyong Bio-Chemical Co. Ltd

- ZHEJIANG YONGNONG CHEM. IND. CO., LTD

- Clariant AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.72 Billion |

| Forecasted Market Value ( USD | $ 3.83 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |