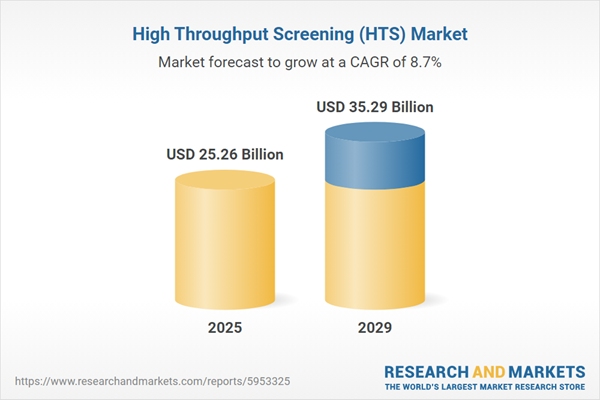

The high throughput screening (hts) market size is expected to see strong growth in the next few years. It will grow to $35.29 billion in 2029 at a compound annual growth rate (CAGR) of 8.7%. The growth in the forecast period can be attributed to increasing market size and growth rate, strategic developments by key players, rising demand for disease monitoring and drug discovery, rising prevalence of chronic diseases, growing focus towards implementation of ultra high throughput screening (UHTS) techniques. Major trends in the forecast period include technological advancements in high-throughput screening, growing focus towards implementation of ultra high throughput screening (UHTS) techniques.

The forecast of 8.7% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade barriers may impact U.S. pharmaceutical development by increasing prices of robotic liquid handlers and compound library plates imported from Switzerland and Singapore, raising early-stage drug discovery costs and reducing research and development efficiency. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing prevalence of chronic diseases is anticipated to drive the growth of the high-throughput screening (HTS) market in the coming years. Chronic disease refers to a long-term health condition that typically lasts three months or more. HTS allows for the rapid screening of large numbers of chemical compounds to identify potential drug candidates aimed at specific pathways or mechanisms involved in chronic diseases, which is crucial for effective long-term management. For example, in January 2023, the U.S. National Library of Medicine reported that the number of individuals aged 50 and older in the U.S. with at least one chronic condition is projected to reach 142.66 million by 2050. Thus, the growing prevalence of chronic diseases is expected to fuel the expansion of the HTS market.

Major companies operating in the high-throughput screening market are developing innovative products, such as multimode plate readers, to better serve their customers with advanced features. A multimode plate reader (MPR) is an advanced lab tool used in high-throughput screening, analyzing biological and chemical samples in microplates by integrating multiple detection modes for diverse assays within a single platform. For instance, in February 2023, PerkinElmer Inc., a US-based MedTech company, launched the EnVision Nexus system. The EnVision Nexus system stands out as the fastest and most sensitive multimode plate reader available, explicitly designed for demanding high-throughput screening (HTS) applications to expedite drug discovery efforts. With its unique technology, including dual detectors and optimized reagents like proprietary HTRF and AlphaLISA, coupled with the latest reagent kits, the platform offers researchers unparalleled assay flexibility, accuracy, speed, and sensitivity. Equipped with walkaway convenience options such as a plate stacker for 20 or 50 plates or full automation and integration for continuous 24/7 workflow-driven operations, the EnVision Nexus system empowers researchers to efficiently screen millions of samples with unprecedented efficiency.

In December 2023, PerkinElmer Inc., a US-based MedTech company, acquired Covaris Inc. for an undisclosed amount. With this acquisition, Covaris' growth potential is anticipated to be accelerated, while PerkinElmer's existing life sciences portfolio is poised to expand into the rapidly growing diagnostics end market. Covaris Inc. is a US-based provider of high-throughput screening solutions.

Major companies operating in the high throughput screening (HTS) market are Thermo Fisher Scientific Inc., AstraZeneca Plc, Danaher Corporation, Merck Group, GE HealthCare Technologies Inc., Corning Inc., Agilent Technologies Inc., Lonza Group Ltd., Charles River Laboratories International Inc, Beckman Coulter Inc., PerkinElmer Inc., Bio-Rad Laboratories, Tecan Group Ltd., Sygnature Discovery Ltd., Luminex Corporation, Hamilton Company, Crown Bioscience Inc., HighRes Biosolutions, NanoTemper Technologies GmbH, BMG LABTECH GmbH, Axxam SpA, Reprocell Inc., BioTek Instruments Inc, Aurora Biomed Inc., Cyclica Inc., Biomat Srl, Diana Biotechnologies s.r.o.

North America was the largest region in the high throughput screening market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the high throughput screening (HTS) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the high throughput screening (HTS) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The high-throughput screening (HTS) market consists of revenues earned by entities by providing services such as compound library screening, assay design and adaptation, and pilot screening. The market value includes the value of related goods sold by the service provider or included within the service offering. The high-throughput screening (HTS) market also includes sales of lab equipment and supplies, chemicals, assay development tools, and data processing software. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The main types of products and services in high-throughput screening (HTS) are consumables and reagents, instruments, software, and services. Consumables and reagents refer to the materials and chemicals used in the screening process, including sample containers, assay reagents, and other disposable items necessary for experimental procedures. The technology types are categorized into ultra-high-throughput screening, cell-based assays, lab-on-a-chip, and label-free technology, which are used in several applications such as target identification and validation, primary and secondary screening, toxicology assessment, and others. The end users include the pharmaceutical and biotechnology industries, academic and research institutes, contract research organizations, and others.

High-throughput screening (HTS) is a technique employed in drug discovery and various scientific domains to rapidly assess a large number of samples for biological activity. Its purpose is to identify active compounds, antibodies, or genes that modulate specific biological pathways, thereby expediting the drug discovery process.

The main types of products and services in high-throughput screening (HTS) are consumables and reagents, instruments, software, and services. Consumables and reagents refer to the materials and chemicals used in the screening process, including sample containers, assay reagents, and other disposable items necessary for experimental procedures. The technology types are categorized into ultra-high-throughput screening, cell-based assays, lab-on-a-chip, and label-free technology, which are used in several applications such as target identification and validation, primary and secondary screening, toxicology assessment, and others. The end users include the pharmaceutical and biotechnology industries, academic and research institutes, contract research organizations, and others.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

High Throughput Screening (HTS) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on high throughput screening (hts) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for high throughput screening (hts)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The high throughput screening (hts) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Products and Services: Consumables and Reagents; Instruments; Software and Services2) By Technology: Ultra-High-Throughput Screening; Cell-Based Assays; Lab-On-A-Chip; Label-Free Technology

3) By Application: Target Identification and Validation; Primary and Secondary Screening; Toxicology Assessment; Other Applications

4) By End User: Pharmaceuticals and Biotechnology Industry; Academics and Research Institute; Contract Research Organization; Other End Users

Subsegments:

1) By Consumables and Reagents: Assay Plates; Reagents and Assay Kits; Sample Preparation Kits; Detection Reagents2) By Instruments: Automated Liquid Handlers; Plate Readers; Robotics and Automation Systems; Microfluidic Devices

3) By Software and Services: Data Analysis Software; HTS Management Software; Consulting Services; Maintenance and Support Services

Companies Mentioned: Thermo Fisher Scientific Inc.; AstraZeneca Plc; Danaher Corporation; Merck Group; GE HealthCare Technologies Inc.; Corning Inc.; Agilent Technologies Inc.; Lonza Group Ltd.; Charles River Laboratories International Inc; Beckman Coulter Inc.; PerkinElmer Inc.; Bio-Rad Laboratories; Tecan Group Ltd.; Sygnature Discovery Ltd.; Luminex Corporation; Hamilton Company; Crown Bioscience Inc.; HighRes Biosolutions; NanoTemper Technologies GmbH; BMG LABTECH GmbH; Axxam SpA; Reprocell Inc.; BioTek Instruments Inc; Aurora Biomed Inc.; Cyclica Inc.; Biomat Srl; Diana Biotechnologies s.r.o

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this High Throughput Screening (HTS) market report include:- Thermo Fisher Scientific Inc.

- AstraZeneca Plc

- Danaher Corporation

- Merck Group

- GE HealthCare Technologies Inc.

- Corning Inc.

- Agilent Technologies Inc.

- Lonza Group Ltd.

- Charles River Laboratories International Inc

- Beckman Coulter Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories

- Tecan Group Ltd.

- Sygnature Discovery Ltd.

- Luminex Corporation

- Hamilton Company

- Crown Bioscience Inc.

- HighRes Biosolutions

- NanoTemper Technologies GmbH

- BMG LABTECH GmbH

- Axxam SpA

- Reprocell Inc.

- BioTek Instruments Inc

- Aurora Biomed Inc.

- Cyclica Inc.

- Biomat Srl

- Diana Biotechnologies s.r.o

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 25.26 Billion |

| Forecasted Market Value ( USD | $ 35.29 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |