Global Human Microbiome Market - Key Trends and Drivers Summarized

Is the Human Microbiome the Key to Unlocking Personalized Medicine and Understanding Disease?

The human microbiome has become a focal point in medical research and personalized healthcare, but why is it so essential for understanding disease and developing tailored treatments? The human microbiome refers to the trillions of microorganisms - bacteria, viruses, fungi, and other microbes - that live on and within the human body, particularly in the gut, skin, and mucosal surfaces. These microorganisms play a crucial role in maintaining health by influencing digestion, immune function, and even mental health.The significance of the human microbiome lies in its profound impact on nearly every aspect of human physiology and disease. Research has shown that imbalances in the microbiome, known as dysbiosis, are linked to various conditions, including gastrointestinal disorders, autoimmune diseases, obesity, diabetes, and mental health disorders. The study of the microbiome has opened new avenues for personalized medicine, as treatments can be tailored based on an individual's unique microbial composition. As researchers continue to uncover the intricate relationship between the microbiome and health, it is becoming clear that understanding the microbiome is key to disease prevention, diagnosis, and the development of innovative therapies.

How Has Technology Advanced Human Microbiome Research?

Technological advancements have revolutionized the study of the human microbiome, allowing for more comprehensive analysis and deeper insights into its role in health and disease. One of the most transformative technologies is next-generation sequencing (NGS), particularly 16S ribosomal RNA sequencing and whole-genome shotgun sequencing. These methods allow researchers to identify and quantify the microbial species present in a sample with remarkable precision. NGS has made it possible to explore the diversity and abundance of microbial communities in different parts of the body, providing a clearer picture of how the microbiome interacts with human physiology.Metagenomics, the study of genetic material recovered directly from environmental samples, has also advanced microbiome research by enabling scientists to study not only the composition but also the functional capabilities of microbial communities. By analyzing the genes present in a microbial community, researchers can infer the metabolic and biochemical pathways that these microbes are involved in. This has helped scientists understand how the microbiome influences processes like digestion, immune modulation, and the production of essential metabolites, such as vitamins and short-chain fatty acids, which are crucial for health.

Another significant advancement is the development of bioinformatics tools that can handle and interpret the vast amounts of data generated by microbiome research. Machine learning and artificial intelligence (AI) are increasingly being used to analyze complex microbiome datasets, identifying patterns and correlations that would be difficult to detect manually. These AI-driven tools allow researchers to explore how the microbiome affects disease progression, drug metabolism, and individual responses to treatments. By leveraging AI, scientists can predict how changes in the microbiome may influence health outcomes, enabling more targeted therapeutic interventions.

In vitro models, such as gut-on-a-chip devices and microbiome simulators, have also enhanced microbiome research. These models allow researchers to recreate and study the interactions between human cells and microbial communities in a controlled environment. Gut-on-a-chip technology, for example, mimics the conditions of the human gastrointestinal tract, providing insights into how gut microbes interact with human tissues. These in vitro models are particularly useful for studying the effects of diet, drugs, and probiotics on the microbiome without the need for human or animal trials.

Advances in metabolomics - the study of small molecules produced by metabolic processes - have deepened our understanding of the microbiome's role in health. Metabolomics enables scientists to analyze the chemical products of microbial metabolism, such as short-chain fatty acids, bile acids, and other metabolites that affect human physiology. By studying these metabolites, researchers can gain insights into how the microbiome contributes to conditions like inflammation, immune disorders, and metabolic diseases. This has significant implications for the development of microbiome-based therapies that target metabolic pathways to treat disease.

Why Is the Human Microbiome Critical for Health and Disease Management?

The human microbiome is critical for health and disease management because it plays a fundamental role in regulating many physiological processes, including digestion, immune function, and even mental health. The gut microbiome, in particular, has been shown to influence digestion and nutrient absorption, helping to break down complex carbohydrates, synthesize essential vitamins, and produce short-chain fatty acids, which are important for maintaining gut health. An imbalance in the gut microbiome, known as dysbiosis, can lead to gastrointestinal disorders like irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and even colon cancer.Beyond the gut, the microbiome influences the immune system. Microbial communities help train the immune system to recognize harmful pathogens while maintaining tolerance toward beneficial microbes. Dysbiosis has been linked to a range of immune-related conditions, including autoimmune diseases such as rheumatoid arthritis and multiple sclerosis. The microbiome's role in immune modulation suggests that restoring microbial balance could be a therapeutic strategy for managing these conditions.

The connection between the microbiome and metabolic health is also significant. Studies have shown that imbalances in gut bacteria are associated with metabolic disorders such as obesity, type 2 diabetes, and cardiovascular diseases. Certain microbial species are involved in regulating fat storage, insulin sensitivity, and inflammation. By modifying the microbiome through diet, prebiotics, probiotics, or microbiota transplants, it may be possible to improve metabolic health and reduce the risk of chronic diseases.

Mental health is another area where the microbiome has a profound impact. The gut-brain axis, a bidirectional communication system between the gut and the brain, is influenced by the gut microbiome. Research suggests that gut microbes produce neurotransmitters and other signaling molecules that affect mood, cognition, and mental health. Dysbiosis has been linked to mental health disorders such as anxiety, depression, and even neurodegenerative diseases like Alzheimer's. Understanding how the microbiome affects brain function is opening new possibilities for treating mental health conditions through microbiome-targeted therapies.

Human microbiome research is also advancing personalized medicine. Since each person's microbiome is unique, individualized microbiome profiling can provide insights into how a person might respond to specific treatments. For example, the microbiome affects how the body metabolizes drugs, meaning that microbiome composition could influence drug efficacy and toxicity. By analyzing a patient's microbiome, healthcare providers can predict drug responses more accurately and personalize treatments for conditions such as cancer, autoimmune diseases, and gastrointestinal disorders.

Microbiome-based therapies, such as fecal microbiota transplantation (FMT), probiotics, and prebiotics, are also gaining traction as strategies for managing diseases linked to dysbiosis. FMT has been highly effective in treating recurrent Clostridioides difficile infections, a serious gut infection caused by an imbalance of gut bacteria. Probiotics and prebiotics, which promote the growth of beneficial microbes, are being explored as treatments for a range of conditions, from digestive disorders to mental health issues. As microbiome research advances, these therapies have the potential to become mainstream treatments for restoring microbial balance and improving health outcomes.

What Factors Are Driving the Growth of the Human Microbiome Market?

Several factors are driving the rapid growth of the human microbiome market, including the increasing recognition of the microbiome's role in health and disease, advancements in microbiome analysis technologies, and the growing demand for personalized medicine. One of the primary drivers is the growing awareness of the microbiome's impact on a wide range of health conditions. As research uncovers the links between microbiome composition and diseases such as cancer, autoimmune disorders, metabolic syndrome, and mental health issues, there is a rising demand for microbiome-based diagnostics and treatments.Advancements in sequencing technologies and bioinformatics are also contributing to market growth. Next-generation sequencing (NGS) has made microbiome research more accessible and affordable, allowing for large-scale studies that provide deeper insights into the composition and function of microbial communities. These technological advancements have accelerated the development of microbiome-based diagnostics and therapeutics, paving the way for more targeted and effective interventions. Companies are increasingly leveraging these technologies to develop microbiome-based products, including probiotics, prebiotics, and microbiome-targeted drugs.

The rise of personalized medicine is another key factor driving growth. The microbiome's influence on drug metabolism, immune function, and overall health makes it a valuable tool for personalizing healthcare. By analyzing an individual's microbiome, healthcare providers can tailor treatments to a patient's unique microbial profile, improving the efficacy of treatments and reducing adverse effects. This trend is particularly relevant in areas such as cancer immunotherapy, where the microbiome has been shown to influence the success of certain treatments. As personalized medicine continues to gain momentum, microbiome profiling is expected to play a central role in individualized healthcare strategies.

The growing interest in microbiome-based therapeutics is another major driver. Fecal microbiota transplantation (FMT) has already proven successful in treating recurrent C. difficile infections, and ongoing research is exploring its potential in treating other diseases, such as ulcerative colitis, Crohn's disease, and even metabolic disorders. Probiotics and prebiotics, which modulate the microbiome to improve health, are becoming increasingly popular as consumers seek natural and non-invasive treatments. As more evidence emerges supporting the efficacy of these microbiome-based therapies, the market for microbiome-targeted products is expected to expand.

Regulatory support for microbiome-based products is also fueling market growth. Health authorities like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have recognized the potential of microbiome-based therapies and are providing clearer guidelines for their development and approval. This regulatory clarity is encouraging pharmaceutical and biotechnology companies to invest in microbiome research and product development, driving innovation in the field.

Increased consumer awareness of the role of gut health in overall wellness is another factor propelling the market forward. Probiotics, prebiotics, and dietary supplements aimed at improving gut health are becoming mainstream products as consumers seek to maintain healthy microbiomes. This consumer-driven interest in gut health is pushing companies to develop more microbiome-focused products, including functional foods, supplements, and over-the-counter treatments for digestive health.

With technological advancements, rising demand for personalized healthcare, and growing interest in microbiome-based therapies, the human microbiome market is poised for significant growth. As researchers continue to explore the complex relationships between the microbiome, health, and disease, microbiome-based solutions will play a central role in shaping the future of medicine, offering new ways to prevent, diagnose, and treat a wide range of conditions.

Report Scope

The report analyzes the Human Microbiome market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Disease (Gastrointestinal Diseases, Endocrine & Metabolic Disorders, Cancer, Infectious Diseases, Other Diseases); Technology (Genomics, Proteomics, Metabolomics); Application (Therapeutics, Diagnostics).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gastrointestinal Diseases segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of 28.6%. The Endocrine & Metabolic Disorders segment is also set to grow at 23.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $185.9 Million in 2024, and China, forecasted to grow at an impressive 27.3% CAGR to reach $417.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Human Microbiome Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Human Microbiome Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Human Microbiome Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Dow, Inc., DuPont de Nemours, Inc., Enterome SA, Merck & Co., Inc., Metabiomics Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 24 companies featured in this Human Microbiome market report include:

- Dow, Inc.

- DuPont de Nemours, Inc.

- Enterome SA

- Merck & Co., Inc.

- Metabiomics Corporation

- Microbiome Therapeutics, LLC.

- Osel, Inc.

- Second Genome

- Vedanta Biosciences, Inc.

- ViThera Pharmaceuticals, Inc.

- Yakult Honsha Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Dow, Inc.

- DuPont de Nemours, Inc.

- Enterome SA

- Merck & Co., Inc.

- Metabiomics Corporation

- Microbiome Therapeutics, LLC.

- Osel, Inc.

- Second Genome

- Vedanta Biosciences, Inc.

- ViThera Pharmaceuticals, Inc.

- Yakult Honsha Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

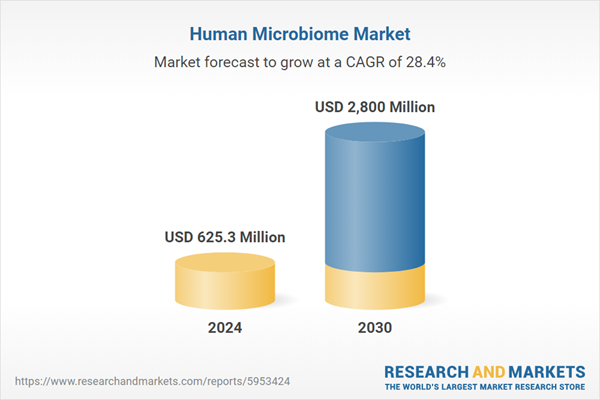

| Estimated Market Value ( USD | $ 625.3 Million |

| Forecasted Market Value ( USD | $ 2800 Million |

| Compound Annual Growth Rate | 28.4% |

| Regions Covered | Global |