Enzymes play a pivotal role in the bread improvers market, offering a variety of functions that enhance the quality, texture, and overall performance of baked goods, including bread. One of the primary functions of enzymes in BI is their ability to catalysed biochemical reactions, such as the breakdown of complex carbohydrates and proteins in the dough. This enzymatic activity leads to improved dough development, increased gas retention, and enhanced dough handling properties, resulting in bread with better volume, texture, and crumb structure. Therefore, the US market make use of 271.0 hundred tonnes of Enzymes in 2022.

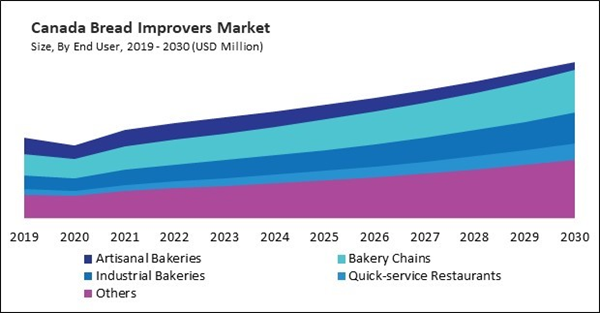

The US market dominated the North America Bread Improvers Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $431.4 million by 2030. The Canada market is experiencing a CAGR of 8.1% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 7.1% during (2023 - 2030).

The market has witnessed significant growth and transformation in recent years, driven by the ever-evolving demands of consumers and the dynamic landscape of the baking industry. Traditional breadmaking has roots dating back centuries and has undergone a remarkable evolution. Incorporating technological advancements and scientific understanding has created a new baking era. In this context, the need for improvers arises from optimizing and elevating bread quality, aligning with contemporary consumer preferences for superior taste, texture, and freshness.

Additionally, while the term "bread improvers" may suggest a singular application, these additives find versatile use across a broad spectrum of bakery products. Beyond traditional loaves, improvers enhance various bakery items, including rolls, baguettes, buns, and specialty breads. Moreover, their impact extends to non-bread items like pastries, cakes, and other baked goods, showcasing the adaptability of these additives in diverse culinary creations.

The Canadian food industry has shown a trend toward innovation and product diversification. As per the data from the Government of Canada, in 2022, the food and beverage processing industry was the largest manufacturing industry in Canada in terms of production value, with sales of goods manufactured worth $156.5 billion. In 2022, processed food and beverage product exports reached a noteworthy $54.3 billion in value, reflecting a 14.1% growth compared to 2021. This figure accounted for 34.7% of the total value of production. Hence, the rising food and beverage processing sector in North America will assist in the expansion of the regional market.

Based on Form, the market is segmented into Powdered, and Liquid. Based on Type, the market is segmented into Emulsifiers, Enzymes, Oxidizing Agents, Reducing Agents, and Acidulants. Based on Application, the market is segmented into Bread, Buns, & Rolls, Cakes, Pastries, Pizza Dough, and Others. Based on End User, the market is segmented into Artisanal Bakeries, Bakery Chains, Industrial Bakeries, Quick-service Restaurants, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Puratos NV/SA

- Corbion N.V.

- Lesaffre Group

- Koninklijke DSM N.V.

- International Flavors & Fragrances Inc

- Archer Daniels Midland Company

- Kerry Group PLC

- Bakels Worldwide (EMU AG)

- Oy Karl Fazer Ab

- Glanbia PLC

Market Report Segmentation

By Form (Volume, Hundred Tonnes, USD Billion, 2019-2030)- Powdered

- Liquid

- Emulsifiers

- Enzymes

- Oxidizing Agents

- Reducing Agents

- Acidulants

- Bread, Buns, & Rolls

- Cakes

- Pastries

- Pizza Dough

- Others

- Artisanal Bakeries

- Bakery Chains

- Industrial Bakeries

- Quick-service Restaurants

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Puratos NV/SA

- Corbion N.V.

- Lesaffre Group

- Koninklijke DSM N.V.

- International Flavors & Fragrances Inc

- Archer Daniels Midland Company

- Kerry Group PLC

- Bakels Worldwide (EMU AG)

- Oy Karl Fazer Ab

- Glanbia PLC