The automotive industry in Asia Pacific is experiencing rapid growth. White spirits are used in manufacturing automotive coatings, which are essential for protecting and enhancing the aesthetic appeal of vehicles. Consequently, the Asia Pacific region would generate USD 3,076.3 million in 2022. Also, Russia would utilize 132.3 kilo tonnes of high flash point white spirits by 2030. Additionally, the automotive industry in the Asia Pacific region is one of the largest consumers of white spirits, particularly for automotive coatings, paints, and cleaning products.

Rapid construction and infrastructure development have become defining features of the modern world, reshaping landscapes and urban environments on a global scale. Construction activity is experiencing significant growth on all continents due to urbanization, population expansion, and economic expansion. The primary outcome of this effort is the construction of vital infrastructure like roads, bridges, buildings, and utilities. Thus, as construction activity escalates, so does the need for white spirits to support these applications, driving the expansion of the market.

Additionally, Ongoing research and development efforts have led to the development of advanced white spirit formulations with improved performance characteristics, such as lower odor, faster drying times, and enhanced cleaning power. For instance, the introduction of nanotechnology has enabled the creation of nano-enhanced white spirits formulations. Hence, all these developments will further aid in the growth of the market.

However, the market encounters a formidable challenge in the form of substitution by alternative solvents and chemicals. Hydrocarbons, glycol ethers, and bio-based solvents are among the contenders that offer comparable properties and functionalities to white spirits. This competition stems from various factors, including cost-effectiveness, performance, and environmental considerations, all of which influence the attractiveness of substitutes over traditional white spirits. As a result, the availability of such substitutes poses a significant threat to the growth prospects of the market.

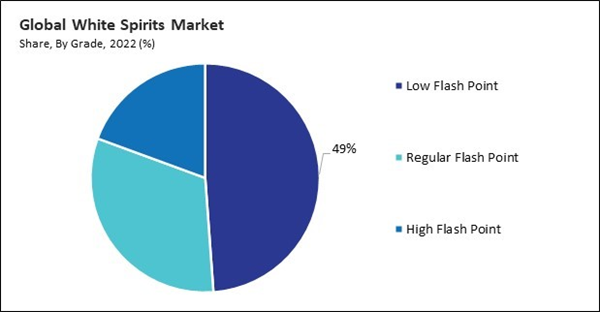

By Grade Analysis

On the basis of grade, the market is divided into low flash point, regular flash point, and high flash point. The low flash point segment acquired 48.8% revenue share in the market in 2022. Industries with strict safety regulations, such as the electronics, automotive, and aerospace sectors, often require solvents with low flash points to minimize fire hazards during manufacturing processes. Compliance with safety standards and regulations necessitates using solvents with lower flash points to reduce the risk of fire accidents and ensure workplace safety.By Application Analysis

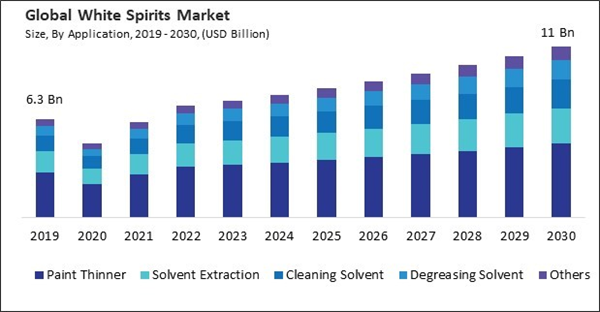

By application, the market is categorized into paint thinner, solvent extraction, cleaning solvent, degreasing solvent, and others. The degreasing solvent segment garnered a 10.4% growth rate in the market in 2022. In terms of volume, cleaning solvent consumed 1,342.9 kilo tonnes in 2022. White spirits are commonly used as base solvents in degreasing formulations due to their excellent solvency power and compatibility with various materials. Maintaining clean and degreased surfaces is crucial for quality control and maintenance in industrial settings. These advantages of white spirits will aid in the growth of the market.By Product Type Analysis

Based on product type, the market is segmented into type 1, type 2, type 3, and type 0. The type 1 segment garnered 51.31% revenue share in the market in 2022. Type 1 white spirits consist primarily of aliphatic, cycloaliphatic, and a small proportion of aromatic hydrocarbons. They typically contain less than 25% aromatic compounds, distinguishing them from other types of white spirits with higher aromatic content. The demand for type 1 white spirits is closely linked to infrastructure development activities such as construction, renovation, and maintenance projects.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired 23.3% revenue share in the market in 2022. White spirits play a vital role in various industrial manufacturing processes in North America, including metalworking, electronics, textiles, and chemicals. Industries rely on white spirits for cleaning, degreasing, and surface preparation, contributing to the overall demand for these solvents.List of Key Companies Profiled

- Idemitsu Kosan Co., Ltd.

- Shell plc

- Exxon Mobil Corporation

- TotalEnergies SE

- Thai Oil Public Company Limited (Petroleum Authority of Thailand (PTT))

- Indian Oil Corporation Ltd.

- Bharat Petroleum Corporation Limited

- DHC Solvent Chemie GmbH (BP Europa SE)

- Rahaoil, Inc.

- Alshall International Co.

Market Report Segmentation

By Grade (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Low Flash Point

- Regular Flash Point

- High Flash Point

- Paint Thinner

- Solvent Extraction

- Cleaning Solvent

- Degreasing Solvent

- Others

- Type 1

- Type 2

- Type 3

- Type 0

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Netherlands

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Idemitsu Kosan Co., Ltd.

- Shell plc

- Exxon Mobil Corporation

- TotalEnergies SE

- Thai Oil Public Company Limited (Petroleum Authority of Thailand (PTT))

- Indian Oil Corporation Ltd.

- Bharat Petroleum Corporation Limited

- DHC Solvent Chemie GmbH (BP Europa SE)

- Rahaoil, Inc.

- Alshall International Co.