Europe’s emphasis on Industry 4.0 principles, including digitalization, connectivity, and smart manufacturing, is accelerating the deployment of these motors in advanced automation systems. Consequently, the European region would acquire nearly, 21% of the total market share by 2030. Europe is at the forefront of industrial automation, with a robust ecosystem of manufacturers, integrators, and technology providers driving innovation and adoption of servo motor solutions.

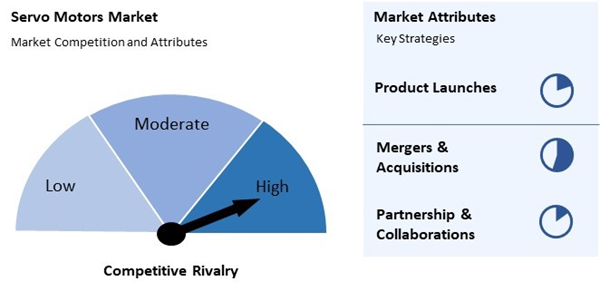

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, in February, 2024, ABB signed an agreement to acquire SEAM Group. This acquisition enhances ABB's Electrification Service offering with expertise in predictive maintenance, electrical safety, renewables, and asset management advisory services. Moreover, in October, 2023, Rockwell Automation took over Clearpath Robotics, a Canadia robotics company. This positions Rockwell as a leader in end-to-end production logistics solutions.

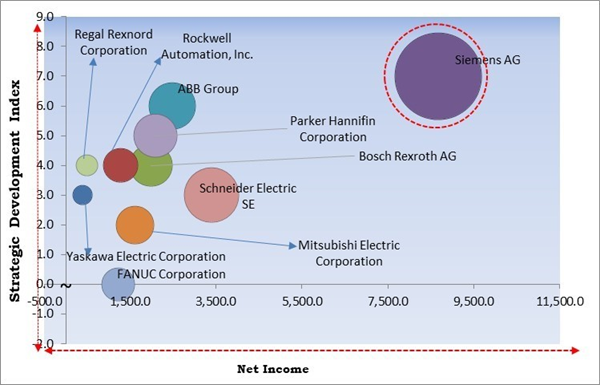

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Siemens AG is the forerunners in the Market. In July, 2023, Siemens acquired the EV division of Mass-Tech Controls Private Limited, a Mumbai-based company specializing in AC and DC chargers for electric vehicles (EVs). The acquisition aimed at enhancing Siemens' e-mobility portfolio to meet the growing demand in India's evolving EV market. Companies such as Schneider Electric SE, ABB Group and Parker Hannifin Corporation are some of the key innovators in Market.Market Growth Factors

Advances in servo motor controller technology have led to developing more powerful and precise controllers. Moreover, these motors are increasingly equipped with communication protocols that facilitate seamless integration with other components of Industry 4.0 systems. Hence, these aspects will drive the demand in the market.Industrial automation solutions, driven by these motors, significantly enhance production efficiency by automating repetitive tasks, reducing cycle times, and minimizing errors. Additionally, these motors provide precise positioning, speed control, and torque regulation capabilities, improving product quality and consistency. Hence, owing to these factors, there will be increased demand for these motors.

Market Restraining Factors

A substantial initial investment is needed to acquire, install, and integrate servo motor systems. This financial barrier can be particularly daunting for small and medium-sized enterprises (SMEs) or companies with constrained capital budgets, hindering their ability to adopt servo motor technology. Moreover, SMEs may face difficulty securing financing or loans to fund servo motor projects, as financial institutions may perceive such investments as high-risk or require stringent collateral or credit requirements. Thus, these factors can decrease demand for these motors in the upcoming years.By System Analysis

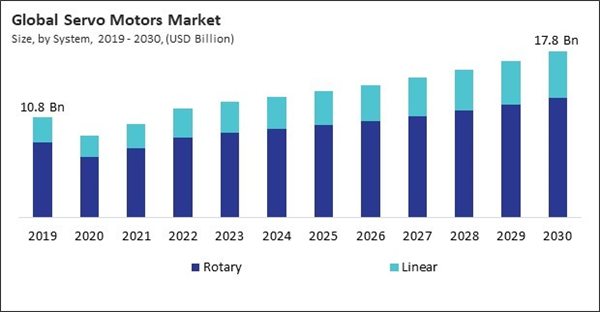

On the basis of system, the market is divided into linear and rotary. In 2022, the linear segment witnessed a 27% revenue share in the market. Linear servo motors provide precise and accurate linear motion, making them ideal for applications requiring tight tolerances and positioning accuracy.By Type Analysis

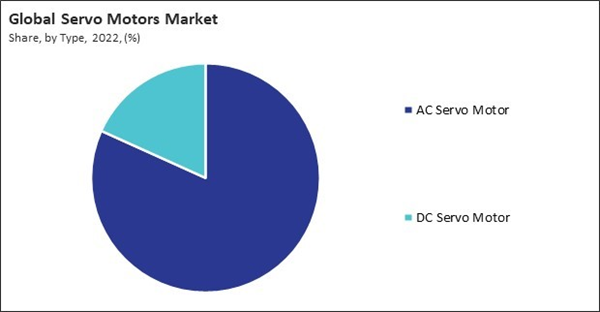

Based on type, the market is segmented into AC servo motor and DC servo motor. In 2022, the DC servo motor segment garnered an 18% revenue share in the market. DC servo motors are known for their high-performance capabilities, providing precise speed control, torque regulation, and dynamic responsiveness. With advancements in motor design, materials, and control algorithms, modern DC servo motors offer improved accuracy, speed, and stability, enabling superior motion control in diverse applications.By Application Analysis

Based on application, the market is divided into robotics, machine tools, electronic devices, printing & packaging technologies, and others. In 2022, the machine tools segment witnessed a 28% revenue share in the market. Multi-axis machining has become increasingly prevalent in this segment, enabled by these motors capable of driving complex motion profiles and synchronized movements across multiple axes. By leveraging these motors for multi-axis control, machine tools can perform intricate operations such as simultaneous milling, turning, and drilling with unprecedented accuracy and efficiency. Thus, these aspects can fuel the demand in the segment.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 37% revenue share in the market in 2022. The automotive and electronics industries are major consumers of these motors in the Asia Pacific region. With the rise of electric vehicles, smart manufacturing, and Industry 4.0 initiatives, there is a growing need for these motors in electric power steering systems, EV drivetrains, robotics, and automated assembly lines. Therefore, these aspects can lead to increased growth in the segment.Market Competition and Attributes

The Market is highly competitive due to industry growth, technological advancements, global presence, diverse applications, price competition, and meeting customer demands. This environment drives companies to innovate and improve continuously to stay competitive.

Recent Strategies Deployed in the Market

- May-2023: Mitsubishi Electric signed a partnership with Movensys, a Korean software company, to enhance its AC servo and motion control business. Under the partnership, Mitsubishi aimed to expand its servo business using Movensys' software-based motion control technologies.

- Sep-2022: ABB partnered with Samotics, an ESA technology provider, to enhance condition monitoring services using Samotics' plug-and-play ESA technology, SAM4, integrated into ABB's digital portfolio. The partnership would facilitate deeper insights into machine health and energy efficiency without field sensor mounting, benefiting various industrial sectors with optimized maintenance and reliability decisions.

- Aug-2022: Bosch Rexroth AG announced the acquisition of Elmo Motion Control, an Israeli electronics company. The acquisition strengthens Bosch Rexroth's factory automation capabilities.

- Oct-2021: Regal Rexnord Corporation announced the merger of Regal Beloit Corporation with Rexnord Corporation's Process & Motion Control Business. The merger would allow the company to provide broader components of offering enhanced digital and IoT capabilities.

- Mar-2021: Yaskawa Electric Corporation launched the Σ-X Series AC servo motors. Key features include industry-leading motion performance with high-speed response frequency and improved servo adjustment functions. The series also offers digital data solutions for preventive maintenance and equipment monitoring.

List of Key Companies Profiled

- Siemens AG

- ABB Group

- Yaskawa Electric Corporation

- Rockwell Automation, Inc.

- FANUC Corporation

- Mitsubishi Electric Corporation

- Parker Hannifin Corporation

- Schneider Electric SE

- Bosch Rexroth AG (Robert Bosch GmbH)

- Regal Rexnord Corporation

Market Report Segmentation

By System- Rotary

- Linear

- AC Servo Motor

- DC Servo Motor

- Robotics

- Machine Tools

- Printing & Packaging Technologies

- Electronic Devices

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Siemens AG

- ABB Group

- Yaskawa Electric Corporation

- Rockwell Automation, Inc.

- FANUC Corporation

- Mitsubishi Electric Corporation

- Parker Hannifin Corporation

- Schneider Electric SE

- Bosch Rexroth AG (Robert Bosch GmbH)

- Regal Rexnord Corporation