North America is often at the forefront of technological advancements in healthcare. Consequently, the North America segment captured $6,288.5 million revenue in the market in 2022. In North America, the high incidence of chronic diseases (e.g., neurological disorders and cardiovascular conditions) increases the demand for diagnostic solutions. IVD tests are crucial in early detection, monitoring, and personalized treatment strategies. Thus, the segment will grow rapidly in the upcoming years.

The primary objective of public health campaigns and educational initiatives is to enhance public consciousness regarding the dangers and manifestations of neurological disorders and cardiovascular diseases (CVDs). Increased access to health information empowers individuals to be more proactive about their health. Informed patients are more likely to request diagnostic tests and screenings based on their understanding of risk elements and the importance of early detection.

Additionally, as the global population ages, there is a higher prevalence of age-related health conditions, including cardiovascular diseases and neurological disorders. According to a report published by the American College of Cardiology in April 2021, cardiovascular disease is Asia's leading cause of mortality. From 1990 to 2019, the number of cardiovascular-related fatalities in Asia increased from 5.6 million to 10.8 million. Moreover, as per Eurostat, in 2020, there were 194,000 deaths in the EU resulting from mental and behavioral disorders, equivalent to 3.7 % of all deaths.

However, the regulatory pathway for IVD tests in cardiology and neurology often involves intricate and prolonged approval processes. The costs and resources required to meet regulatory standards may divert attention and funds away from research and development efforts, hindering the introduction of cutting-edge technologies to address evolving diagnostic needs. The stringent regulatory environment can result in limited market access for certain players, especially those lacking the financial means to navigate the complex approval processes.

Moreover, the onset of the pandemic led to disruptions in routine healthcare services, affecting the adoption of IVD tests in cardiology and neurology. The limitations imposed by lockdowns and social distancing measures accelerated the adoption of telemedicine and remote patient monitoring. In cardiology, there was a notable increase in the use of home-based IVD tests to ensure continued patient care while minimizing in-person visits. Therefore, the COVID-19 pandemic positively impacted the market.

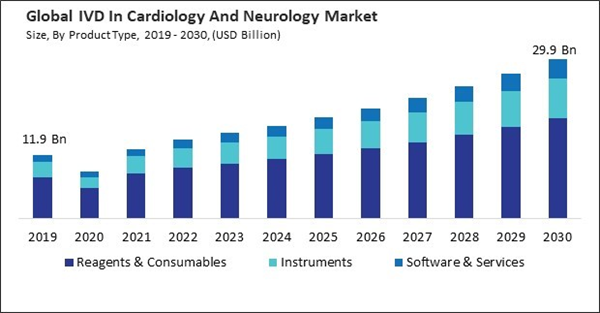

By Product Type Analysis

Based on product type, the market is segmented into instruments, reagents & consumables, and software & services. In 2022, the reagents and consumables segment garnered the 42.34% revenue share in the market. As the demand for diagnostic testing in cardiology and neurology rises, the need for reagents and consumables used in these tests tends to grow proportionately.By End Use Analysis

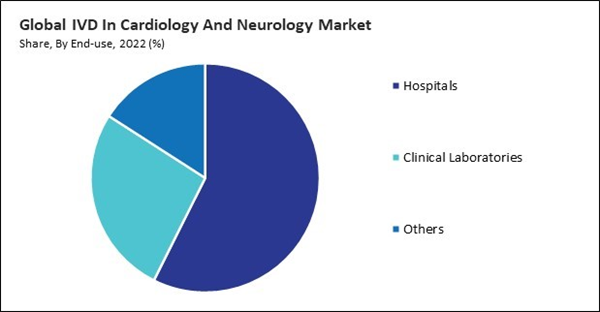

Based on end-use, the market is divided into hospitals, clinical laboratories, and others. In 2022, the clinical laboratories segment witnessed a 26.70% revenue share in the market. The growing incidence of neurological and cardiovascular disorders has prompted a surge in need for diagnostic examinations.By Technology Analysis

On the basis of technology, the market is divided into immunoassays, molecular diagnostics, hematology, and others. In 2022, the immunoassays segment witnessed the 38.08% revenue share in the market. Cardiology uses immunoassays to measure cardiac biomarkers such as troponins, creatine kinase-MB (CK-MB), and brain natriuretic peptide (BNP).By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe segment acquired a 28.81% revenue share in the market. Cardiology IVD tests in Europe often focus on cardiac biomarkers, lipid profiles, and genetic testing for hereditary cardiovascular conditions.List of Key Companies Profiled

- Thermo Fisher Scientific, Inc.

- F.Hoffmann-La Roche Ltd.

- Sysmex Corporation

- Siemens Healthineers AG (Siemens AG)

- Quest Diagnostics Incorporated

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Danaher Corporation (Beckman Coulter, Inc.)

- Becton, Dickinson and Company

- Natera, Inc.

Market Report Segmentation

By Product Type- Reagents & Consumables

- Instruments

- Software & Services

- Hospitals

- Clinical Laboratories

- Others

- Immunoassays

- Molecular Diagnostics

- Hematology

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Sysmex Corporation

- Siemens Healthineers AG (Siemens AG)

- Quest Diagnostics Incorporated

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Danaher Corporation (Beckman Coulter, Inc.)

- Becton, Dickinson and Company

- Natera, Inc.