Contactless smart cards are also used for healthcare credentialing and licensing purposes, including verifying the identity and qualifications of healthcare professionals. Consequently, the healthcare segment captured $880.9 million revenue in the market in 2023. These can store critical medical information like allergies, medical conditions, and emergency contacts. Patients can always carry contactless smart cards with them, allowing first responders and healthcare providers to quickly access vital medical information in emergencies and facilitating timely and informed medical interventions.

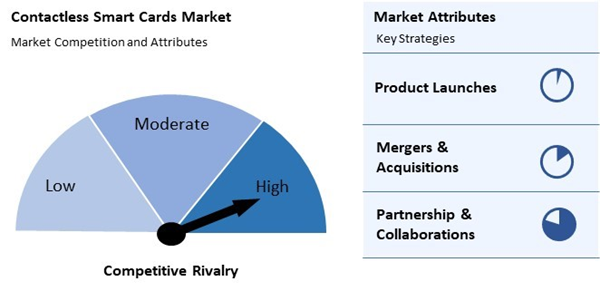

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November, 2022, IDEMIA SAS came into partnership with Sella Personal Credit, part of the larger Sella Banking Group. Through this partnership, both companies would launch a new card for featuring biometric authentication for both contact and contactless transactions. Additionally, In March 2022, Infineon Technologies joined hands with IDEX Biometric, a biometric company. This collaboration aimed to unify the TrustedBioÒ fingerprint authentication module from IDEX Biometrics with Infineon’s latest SLC38 security controller.

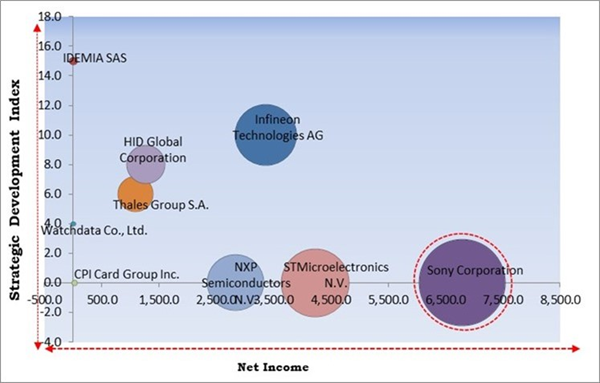

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Sony Corporation is the forerunner in the Market. Companies such as Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V. are some of the key innovators in Market. For Instance, In July, 2021, Infineon Technologies teamed up with IDEX Biometrics, the leading provider of advanced fingerprint identification and authentication solutions. This collaboration aimed to offer substantial enhancement at the card system level, which allows simple unification into current hot lamination card manufacturing processes.Market Growth Factors

Contactless ticketing solutions enhance the attendee experience by providing a convenient and hassle-free entry process. As technology evolves, these smart cards can be integrated with emerging technologies such as biometrics, wearables, and IoT devices to enhance further ticketing solutions' functionality, security, and convenience. Hence, contactless ticketing solutions for events and venues has been a pivotal factor in driving the growth of the market.Additionally, the daily transaction volume is substantially higher in densely populated urban areas than in rural areas. According to the report by the World Bank updated in 2023, 56% of the world's population, or 4.4 billion people, live in cities. By 2050, nearly 7 out of 10 individuals will reside in cities, representing more than doubling the current urban population. Therefore, the market is expanding significantly due to the expansion of urbanization and population.

Market Restraining Factors

The initial expenses of deploying contactless smart card infrastructure may be difficult for small and medium-sized enterprises to justify. These businesses may operate on tight budgets and prioritize other investments over contactless technology, hampering adoption. The high initial cost of implementing contactless smart card infrastructure may result in a longer period for businesses to realize a return on their investment. Thus, high initial cost can slow down the growth of the market.By Functionality Analysis

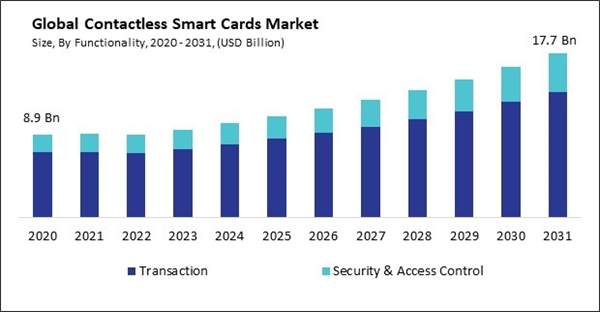

On the basis of functionality, the market is segmented into transaction and security & access control. In 2023, the transaction segment held the 77.93% revenue share in the market. These cards offer a convenient payment method. Users can complete transactions quickly and easily with a simple tap or wave of the card, eliminating the need to swipe or insert their card into a terminal.By Type Analysis

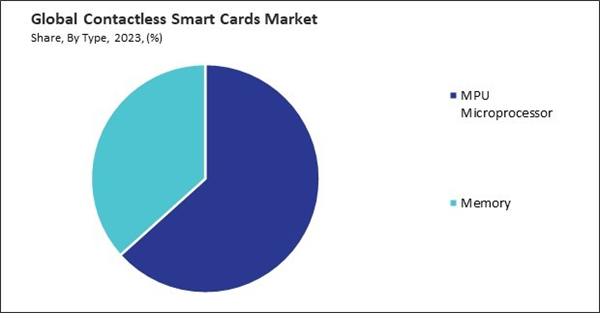

By type, the market is bifurcated into memory and MPU microprocessor. The memory segment acquired a 36.64% revenue share in the market in 2023. The memory segment of contactless smart cards comes in various capacities, ranging from low-memory to high-memory configurations. This flexibility allows card manufacturers and application developers to tailor the cards to specific use cases and requirements.By Industry Vertical Analysis

Based on industry vertical, the market is categorized into BFSI, retail, healthcare, hospitality, transportation & logistics, media & entertainment, and others. In 2023, the BFSI segment dominated the market with 26.21% revenue share. Banks and financial institutions issue contactless smart cards to their customers as debit cards, credit cards, or prepaid cards.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region acquired a 30.79% revenue share in the market. Payment processors, financial institutions, and merchants in North America have invested in contactless payment infrastructure, including POS terminals and payment networks, to support the growing demand for contactless transactions.Market Competition and Attributes

The market competition in the Market is robust and dynamic, fueled by advancements in technology and increasing adoption across various sectors. Established players in the industry engage in fierce competition by continuously enhancing their product offerings, improving security features, and expanding their geographical reach through strategic partnerships and acquisitions. Additionally, emerging startups and innovative companies disrupt the market by introducing novel solutions that cater to specific industry needs and consumer demands, driving further competition and innovation. As the demand for secure and convenient payment solutions continues to rise, players in the market vie for dominance through differentiation in product features, competitive pricing strategies, and efficient distribution networks, shaping a competitive landscape characterized by rapid technological advancements and evolving market dynamics.

Recent Strategies Deployed in the Market

- Oct-2023: Infineon Technologies AG took over GaN Systems, a company that specializes in producing gallium nitride (GaN) semiconductors, offering high-efficiency power devices for a range of applications. Through this acquisition, GaN Systems would significantly expedite Infineon's GaN strategy and enhance Infineon's dominance in power systems by mastering all pertinent power semiconductor technologies.

- Feb-2023: Infineon Technologies AG signed a partnership with TrustSEC, a leading company in the information security field, founded by internationally recognized information security and cryptography experts. Through this partnership, Infineon would be able to be indispensable in adhering to the updated white-label criteria for operating systems.

- Nov-2022: IDEMIA SAS came into partnership with Sella Personal Credit, a financial services entity specializing in personal loans and credit solutions, part of the larger Sella Banking Group. Through this partnership, both companies would launch a new card for featuring biometric authentication for both contact and contactless transactions.

- May-2022: HID Global Corporation took over Vizinex RFID, a company specializing in the development and manufacture of high-performance, customizable RFID tags tailored to meet specific industrial and business tracking needs. Through this acquisition, HID would be able to expand its product portfolio and geographical footprint globally.

- Mar-2022: Infineon Technologies joined hands with IDEX Biometric, a biometric company. This collaboration aimed to unify the TrustedBioÒ fingerprint authentication module from IDEX Biometrics with Infineon’s latest SLC38 security controller.

List of Key Companies Profiled

- Sony Corporation

- Watchdata Co., Ltd.

- Infineon Technologies AG

- IDEMIA SAS (Advent International, Inc.)

- NXP Semiconductors N.V.

- Thales Group S.A.

- HID Global Corporation (Assa Abloy AB)

- STMicroelectronics N.V.

- CardLogix Corporation

- CPI Card Group Inc. (Parallel49 Equity)

Market Report Segmentation

By Functionality- Transaction

- Security & Access Control

- MPU Microprocessor

- Memory

- BFSI

- Retail

- Transportation & Logistics

- Hospitality

- Healthcare

- Media & Entertainment

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Sony Corporation

- Watchdata Co., Ltd.

- Infineon Technologies AG

- IDEMIA SAS (Advent International, Inc.)

- NXP Semiconductors N.V.

- Thales Group S.A.

- HID Global Corporation (Assa Abloy AB)

- STMicroelectronics N.V.

- CardLogix Corporation

- CPI Card Group Inc. (Parallel49 Equity)