The construction segment procured a promising growth rate in the market in 2023. Construction machinery and equipment, such as excavators, bulldozers, cranes, and loaders, rely on alternators to supply electrical power for onboard systems, including engines, hydraulics, lights, and control panels. Consequently, the construction segment by end-use industry would generate 19.2% revenue share of the market by 2031. Also, Russia would utilize 1100.7 thousand units of medium voltage alternators by 2031. Alternators are integral to these machines, ensuring reliable operation and performance on construction sites.

EVs and hybrid vehicles are equipped with sophisticated onboard electronics, including infotainment systems, navigation systems, advanced driver assistance systems (ADAS), and climate control systems. These electronics require a stable and reliable electrical power source, which alternators provide by converting mechanical energy from the engine into electrical energy. Thus, because of the rise of EVs and hybrid vehicles, the market is anticipated to increase significantly.

Additionally, alternators play a critical role in transforming wind energy from kinetic to electrical energy, and wind turbines are an essential component of wind energy systems. The growing deployment of wind turbines onshore and offshore to harness wind power for electricity generation drives the demand for alternators. Hydroelectric power plants harness the potential energy of water to generate electricity. Therefore, the market is expanding significantly due to the rapid shift towards renewable energy sources.

However, cost pressures may lead to compromises in product quality as manufacturers seek to reduce production costs. Lower-quality components or materials may be used to cut costs, potentially resulting in inferior products prone to failures or malfunctions. This can damage the reputation of manufacturers and erode customer trust in the reliability of alternators. Thus, intense competition and cost pressures can slow down the growth of the market.

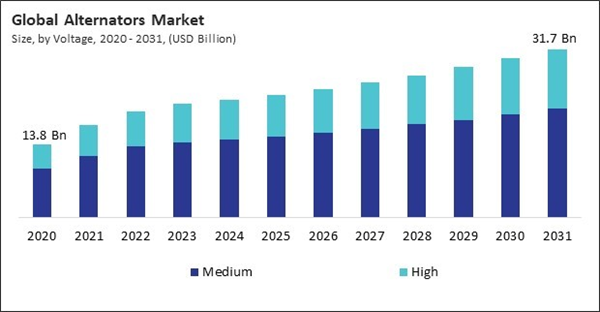

By Voltage Analysis

Based on voltage, the market is bifurcated into high and medium. The high segment garnered a significant 33.39% share in the market in 2023. The utilization of high voltage direct current (HVDC) transmission systems for long-distance electricity is on the rise due to their superior efficiency and reduced losses compared to traditional alternating current (AC) transmission systems. High voltage alternators are utilized in HVDC converter stations to convert AC power to DC power and vice versa, enabling the efficient transfer of electricity over long distances.By Phase Analysis

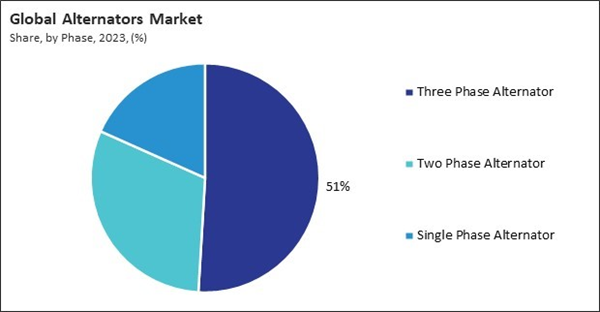

On the basis of phase, the market is segmented into three phase alternator, two phase alternators, and single-phase alternator. In 2023, the three-phase alternator segment held 50.93% revenue share in the market. Three-phase alternators are extensively used in industrial machinery and equipment to provide electrical power for manufacturing processes, conveyor systems, pumps, compressors, motors, and other industrial applications. They are preferred for their ability to deliver balanced power across three phases, ensuring smooth and efficient operation of industrial equipment in manufacturing plants, factories, refineries, and processing facilities.By End-Use Industry Analysis

By end-use industry, the market is categorized into automotive, power generation, construction, oil & gas, and others. The power generation segment recorded a 26.97% revenue share in the market in 2023. The oil & gas segment registered 2,680.3 thousand units in terms of volume in 2023. Alternators are fundamental components of conventional power plants, including coal-fired, natural gas-fired, and nuclear power plants. These alternators convert mechanical energy from turbines into electrical energy, which is then transmitted through power grids for distribution to homes, businesses, and industries.By Type Analysis

By type, the market is bifurcated into brushed alternators, brushless alternators, and permanent magnet alternators. In 2023, the brushed alternators segment witnessed 41% revenue share in the market. Brushed alternators are easier to maintain and repair than brushless alternators. The brushes and commutators in brushed alternators can be readily accessed and replaced when worn out, extending the operational lifespan of the alternator. This ease of maintenance makes brushed alternators suitable for applications where regular servicing and repairs are required, such as in industrial machinery and equipment.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region acquired a 31.2% revenue share in the market. North America is witnessing significant infrastructure development, including constructing roads, bridges, airports, railways, and commercial buildings. The construction industry in North America is experiencing growth due to urbanization, population growth, and economic development. North America is witnessing significant expansion in renewable energy installations, including wind farms, solar parks, and hydroelectric projects.Recent Strategies Deployed in the Market

- Nov-2023: Robert Bosch GmbH expanded its suite of starters and alternators for workshops, including products for passenger cars and commercial vehicles of many European and Asian brands. As part of its expansion, the company will increase its coverage for vehicles from various manufacturers. Additionally, starters and alternators are subjected to strict and consistent quality management all over the world to offer high quality and reliability.

- Apr-2023: Cummins, Inc. inked a definitive agreement with Tata Motors Limited (TML), a vehicle manufacturing company in India. Under this agreement, the companies will design and develop a range of low- to zero-emission technology products in India for commercial vehicles.

- Nov-2022: Cummins, Inc. came into partnership with Exergy Energy, LLC, an energy management service company. Under this partnership, Exergy will oversee the implementation of Cummins power system solutions, including generator sets, energy storage systems, and switching equipment, at customer sites.

- Aug-2022: Cummins, Inc. acquired Meritor, Inc., a provider of drivetrain, mobility, braking, aftermarket, and electric powertrain solutions for commercial vehicles and industrial markets. Under this acquisition, Cummins will add Meritor's products to its component business portfolio. Additionally, the acquisition will accelerate the growth of the core axle and brake businesses of Cummins by serving commercial truck, trailer, off-highway, defense, specialty, and aftermarket customers all over the world.

- Jun-2021: Prestolite Electric Incorporated entered a partnership with Brighton Cromwell LLC, a provider of maintenance kits and kitting services to the Defense Logistics Agency (DLA). Under this partnership, Prestolite Electric will expand its presence in the military industry by providing premium IdlePro Extreme alternators, PowerPro Extreme 12 and PowerPro Extreme 5 starters, and legacy Leece-Neville Heavy-Duty starters and alternators.

List of Key Companies Profiled

- Denso Corporation

- Mitsubishi Electric Corporation

- Valeo SA

- Robert Bosch GmbH

- HELLA GmbH & Co. KGaA (FORVIA S.E.)

- Hitachi, Ltd. (Hitachi Astemo, Ltd.)

- Cummins, Inc.

- Prestolite Electric Incorporated (Zhongshan Broad-Ocean Motor Co., Ltd.)

- Lucas Automotive Aftermarket

- BBB Industries, LLC (Clearlake Capital Group, L.P.)

Market Report Segmentation

By Voltage (Volume, Thousand Units, USD Billion, 2020-2031)- Medium

- High

- Three Phase Alternator

- Two Phase Alternator

- Single Phase Alternator

- Automotive

- Power Generation

- Construction

- Oil & Gas

- Others

- Brushed Alternators

- Brushless Alternators

- Permanent Magnet Alternators

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Denso Corporation

- Mitsubishi Electric Corporation

- Valeo SA

- Robert Bosch GmbH

- HELLA GmbH & Co. KGaA (FORVIA S.E.)

- Hitachi, Ltd. (Hitachi Astemo, Ltd.)

- Cummins, Inc.

- Prestolite Electric Incorporated (Zhongshan Broad-Ocean Motor Co., Ltd.)

- Lucas Automotive Aftermarket

- BBB Industries, LLC (Clearlake Capital Group, L.P.)