Strong Growth of Construction and Automotive Industries fuel the North America Adhesives and Sealants Market

The construction industry in various countries across the world is growing due to continuing industrialization and urbanization, increasing population, growing income of a middle-class population, and increasing infrastructural developments and investments in the construction industry. The construction industry in Mexico is growing due to economic growth and public investments in infrastructure projects. During 2019-2020, the country’s President and private sector representatives announced multiple projects as a part of the nation’s infrastructure plan. Mexico is also moving rapidly toward green and environmentally friendly construction activities. The construction industry in the country has embraced the green building movement. As per the data of Organisation Internationale des Constructeurs d'Automobiles (OICA), American countries recorded the production of ~16.2 million commercial and passenger cars in 2010, and this production rate has grown by more than 23% and registered the production of ~20 million commercial and passenger cars in 2019. Hence, the strong growth of the automotive industry in various countries across the region bolsters the demand for adhesives and sealants.North America Adhesives and Sealants Market Overview

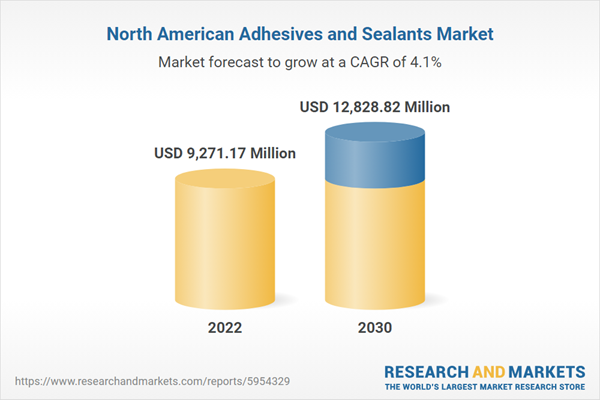

North America adhesives and sealants market is segmented into the US, Canada, and Mexico. The market is witnessing strong growth in North America due to the growing demand for adhesives and sealants from packaging, electrical & electronics, automotive, construction, and medical industries. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, North America registered a production of 13.42 million vehicles. The strong presence of the automotive industry in the region creates a huge demand for adhesives and sealants, as they are applied in applications such as dashboards and trims, electronic systems and engine compartments, and many other parts. The construction sector in North America is witnessing growth due to increased federal and state financing for the construction of commercial and institutional structures in the region. According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2022 was US$ 1,792.9 billion, a 10.2% increase from investments in 2021. The expansion of the construction sector is fueling the regional adhesives and sealants market growth. Governments of various countries in North America have significantly invested in technology and research programs in the aerospace sector. The region is a hub for major aircraft manufacturing companies such as Raytheon Technologies Corporation, The Boeing Company, and The Lockheed Martin Corporation. The growth of end-use industries is driving the adhesives and sealants market in North America.Exhibit: Nort

h America Adhesives and Sealants Market Revenue and Forecast to 2030 (US$ Million)

North America Adhesives and Sealants Market Segmentation

The North America adhesives and sealants market is segmented based on resin type, end use industry, and country.Based on resin type, the North America adhesives and sealants market is bifurcated into adhesives and sealants. The adhesives segment held a larger market share in 2022. Additionally, the adhesives segment is categorized into epoxy, polyurethane, acrylic, and others. Further, the sealants segment is subsegmented into silicone sealant, urethane sealant, acrylic sealant, polysulfide sealant, and others.

Based on end-use industry, the North America adhesives and sealants market is segmented into automotive, aerospace, paper and packaging, building and construction, electrical and electronics, medical, and others. The building and construction segment held the largest market share in 2022.

Based on country, the North America adhesives and sealants market is segmented into the US, Canada, and Mexico. The US dominated the North America adhesives and sealants market share in 2022.

Henkel AG and Co KGaA, HB Fuller Company, Sika AG, 3M Co, Huntsman International LLC, Dow Inc, Wacker Chemie AG, Parker Hannifin Corp, Dymax Corporation, and Astro Chemical Company Inc are some of the leading players operating in the North America adhesives and sealants market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America adhesives and sealants market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America adhesives and sealants market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America adhesives and sealants market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- Henkel AG and Co KGaA

- HB Fuller Company

- Sika AG

- 3M Co

- Huntsman International LLC

- Dow Inc

- Wacker Chemie AG

- Parker Hannifin Corp

- Dymax Corporation

- Astro Chemical Company Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | January 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 9271.17 Million |

| Forecasted Market Value ( USD | $ 12828.82 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 10 |