Development of Bio-Based Adhesives fuel the Asia Pacific Adhesives and Sealants Market

Bio-based materials are gaining traction in all fields due to their improved environmental footprint and independence from petroleum resources that come with their use. Bio-based adhesives are natural polymeric materials consisting of high molecular weight and utilize biocompatible and biodegradable polymers to join two surfaces. These polymers are composed of molecular building blocks linked together to form various large and complex structures. In recent years, there have been developments in bio-based adhesives. For instance, soy-based adhesives are developed to replace urea formaldehyde (UF) resins to avoid concerns related to formaldehyde toxicity. The adhesives formulated from soy protein exhibit desirable dry bonding strength and reduce the dependency on petroleum resins. The biobased raw materials utilized in the adhesive are produced from regenerative sources. This leads to the reduction of CO2 emissions compared to fossil raw materials in the supply chain. Further, biobased adhesives are suitable for packaging end use industry’s due to the clean and efficient bonding of outer coating of paper. Also, they can be used as an environmentally friendly alternative in the production of disposable drinking straws, crockery, and cutlery. Hence, owing to the rising concern and awareness about the social and environmental impacts of conventional materials, manufacturers of adhesives are shifting toward environment-friendly bio-based materials, which is expected to offer lucrative opportunities for the adhesives and sealants market growth during the forecast period .Asia Pacific Adhesives and Sealants Market Overview

Asia Pacific adhesives and sealants market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Industries such as the automotive, building & construction, paper & packaging, electrical & electronics are mainly driving the adhesives and sealants market in Asia Pacific. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc. delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles from 2021. As per the International Organization of Motor Vehicle Manufacturers report, in 2021, the countries in Asia Pacific produced ~46.73 million units of motor vehicles. The growing automotive industry in Asia Pacific is driving the demand for adhesives and sealants. The electronics manufacturing industry is an important part of manufactured exports for several Asian nations, including China, South Korea, and Japan. Adhesives provide a strong bond during electronics assembly while protecting components against potential damage. The growing construction and packaging industries in the region are also creating massive demand for different adhesives and sealants. The rising trend for online food ordering, high demand for packaged food products, and growing disposable income have surged the demand for packaging products, thereby positively impacting the adhesives and sealants market growth.Asi

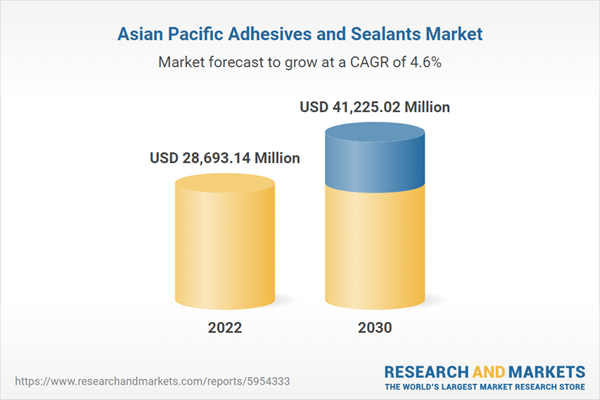

a Pacific Adhesives and Sealants Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Adhesives and Sealants Market Segmentation

The Asia Pacific adhesives and sealants market is segmented based on resin type, end use industry, and country. Based on resin type, the Asia Pacific adhesives and sealants market is bifurcated into adhesives and sealants. The adhesives segment held a larger market share in 2022. Additionally, the adhesives segment is categorized into epoxy, polyurethane, acrylic, and others. Further, the sealants segment is subsegmented into silicone sealant, urethane sealant, acrylic sealant, polysulfide sealant, and others.Based on end-use industry, the Asia Pacific adhesives and sealants market is segmented into automotive, aerospace, paper and packaging, building and construction, electrical and electronics, medical, and others. The building and construction segment held the largest market share in 2022.

Based on country, the Asia Pacific adhesives and sealants market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific adhesives and sealants market share in 2022.

Henkel AG and Co KGaA, HB Fuller Company, Sika AG, 3M Co, Huntsman International LLC, Dow Inc, Wacker Chemie AG, Parker Hannifin Corp, and Dymax Corporation are some of the leading players operating in the Asia Pacific adhesives and sealants market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific adhesives and sealants market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific adhesives and sealants market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific adhesives and sealants market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table of Contents

Companies Mentioned

- Henkel AG and Co KGaA

- HB Fuller Company

- Sika AG

- 3M Co

- Huntsman International LLC

- Dow Inc

- Wacker Chemie AG

- Parker Hannifin Corp

- Dymax Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | January 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 28693.14 Million |

| Forecasted Market Value ( USD | $ 41225.02 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |