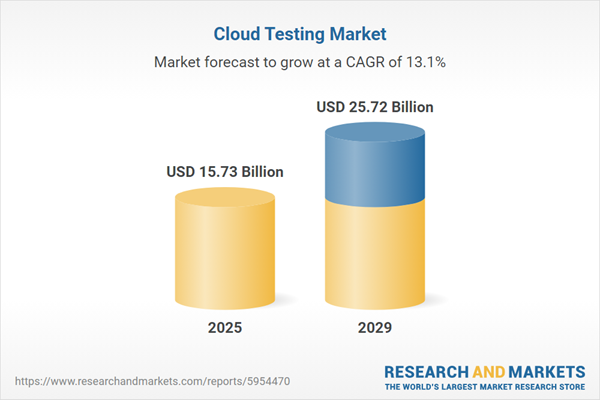

The cloud testing market size has grown rapidly in recent years. It will grow from $13.97 billion in 2024 to $15.73 billion in 2025 at a compound annual growth rate (CAGR) of 12.6%. The growth in the historic period can be attributed to the expansion of businesses globally, the rise of DevOps practices, the surge in mobile application development, the increasing adoption of IoT devices, cost efficiency, need for scalability and flexibility.

The cloud testing market size is expected to see rapid growth in the next few years. It will grow to $25.72 billion in 2029 at a compound annual growth rate (CAGR) of 13.1%. The growth in the forecast period can be attributed to increasing adoption of cloud services, growing emphasis on security testing in the cloud, increased demand for cloud testing solutions that address regulatory requirements, the increasing complexity of applications. Major trends in the forecast period include artificial intelligence (AI) and machine learning (ML) integration, edge computing expansion, 5G technology rollout, hybrid and multi-cloud strategies, cybersecurity prioritization, remote work optimization.

The surge in cloud adoption is anticipated to drive the growth of the cloud testing market in the forthcoming years. Cloud adoption is on the rise due to its cost-effectiveness, scalability, and accessibility. Cloud testing ensures that applications are scalable, cost-effective, and validated across platforms, optimizing resource utilization and enhancing quality assurance processes. For instance, as per the 2022 State of DevOps Study by Google Cloud Platform's DevOps Research and Assessment (DORA) team in January 2023, the adoption of multiple public clouds increased from 21% to 26% compared to 2021. Additionally, hybrid cloud usage surged from 25% in 2021 to 42.5% in 2022. Moreover, the utilization of public clouds, including multiple clouds, rose to 76% from 56% in 2021. These statistics underscore the growing adoption of cloud technologies, thereby propelling the demand for cloud testing solutions.

Leading companies in the cloud testing market are focusing on developing products with innovative technologies to consolidate their position in the market. An example of this is the Test Suite for Google Cloud launched by Catchpoint Systems, Inc., a US-based Internet resilience company, in January 2024. The Test Suite for Google Cloud is a comprehensive tool designed to streamline the end-to-end monitoring and evaluation of Google Cloud services from various customer-specified endpoints. This suite simplifies the configuration and maintenance of cloud service testing, leading to enhanced operational efficiency and user experience. By leveraging Google Cloud and Catchpoint best practices, IT organizations can quickly create different assessments for Google Cloud services, facilitating rapid issue discovery and troubleshooting. The user-friendly design of the Test Suite for Google Cloud aims to reduce complexity and time investment, making it accessible even to beginners.

In April 2024, U.S.-based application security company Veracode acquired Longbow Security for an undisclosed amount. This acquisition is part of Veracode’s strategy to bolster its cloud-native security risk management offerings. By incorporating Longbow’s solutions, Veracode aims to enhance asset discovery and threat exposure assessment capabilities within cloud and application environments. This deal is anticipated to strengthen Veracode’s ability to address the increasing demand for comprehensive visibility and efficient remediation in cloud-native application security. Longbow Security, also based in the U.S., specializes in managing security risks in cloud-native settings.

Major companies operating in the cloud testing market are Microsoft Corporation, Dell Inc., Amazon Web Services Inc., HP Inc., Accenture plc, The International Business Machines Corporation, Cisco Systems Inc., Oracle Corporation, Tata Consultancy Services Limited, Salesforce Inc., Google Cloud Platform, Capgemini SE, NTT DATA Corporation, Cognizant Technology Solutions Corp, Infosys Limited, DXC Technology Company, VMware Inc., Atos SE, HCL Technologies Limited, Wipro Ltd., CGI Inc., Tech Mahindra Ltd., EPAM Systems Inc., Softtek, Rackspace Technology Inc., Mphasis Limited, Virtusa Corporation, Mindtree Limited, Hexaware Technologies, Zensar Technologies Ltd.

North America was the largest region in the cloud testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cloud testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cloud testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The cloud testing market consists of revenues earned by entities by offering services such as infrastructure provisioning, test automation, compatibility testing, performance testing, and security testing. The market value includes the value of related goods sold by the service provider or included within the service offering. The cloud testing market also includes of sales of virtual machines (VMs), containers, cloud computing platforms, monitoring and logging tools, and security testing tools. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Cloud testing involves assessing the functionality, scalability, and reliability of web-based applications within a cloud computing environment. It replicates real-world user traffic to evaluate aspects such as functionality, security, and usability across different devices, browsers, and operating systems. This approach offers benefits such as scalability, cost savings, and improved team collaboration by mimicking actual user conditions such as location, device preferences, and network variations.

Key components of cloud testing include testing platforms, tools, and services. Testing platforms, also referred to as tools, are software or hardware solutions used to test infrastructure or applications. They facilitate scalable, efficient, and comprehensive testing of software across various environments, ensuring reliability and performance in cloud-based deployments. Cloud testing finds applications across organizations of diverse sizes, including small and medium enterprises as well as large enterprises, and spans across industries such as retail, transportation, information technology and telecom, banking and financial services, media and entertainment, and others.

The cloud testing research report is one of a series of new reports that provides cloud testing market statistics, including the cloud testing industry's global market size, regional shares, competitors with an cloud testing market share, detailed cloud testing market segments, market trends and opportunities, and any further data you may need to thrive in the cloud testing industry. This cloud testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cloud Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cloud testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cloud testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cloud testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Testing Platforms And Tools; Services2) By Organization Size: Small And Medium Enterprises; Large Enterprises

3) By End User: Retail And E-commerce; Transportation; Information Technology And Telecom; Banking Financial Services And Insurance (BFSI); Media And Entertainment; Other End Users

Subsegments:

1) By Testing Platforms And Tools: Performance Testing Tools; Functional Testing Tools; Security Testing Tools; Load Testing Tools; Automation Testing Tools; Others2) By Services: Consulting; Integration; Managed Services; Support And Maintenance

Key Companies Mentioned: Microsoft Corporation; Dell Inc.; Amazon Web Services Inc.; HP Inc.; Accenture plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Cloud Testing market report include:- Microsoft Corporation

- Dell Inc.

- Amazon Web Services Inc.

- HP Inc.

- Accenture plc

- The International Business Machines Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Tata Consultancy Services Limited

- Salesforce Inc.

- Google Cloud Platform

- Capgemini SE

- NTT DATA Corporation

- Cognizant Technology Solutions Corp

- Infosys Limited

- DXC Technology Company

- VMware Inc

- Atos SE

- HCL Technologies Limited

- Wipro Ltd.

- CGI Inc.

- Tech Mahindra Ltd

- EPAM Systems Inc.

- Softtek

- Rackspace Technology Inc.

- Mphasis Limited

- Virtusa Corporation

- Mindtree Limited

- Hexaware Technologies

- Zensar Technologies Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.73 Billion |

| Forecasted Market Value ( USD | $ 25.72 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |