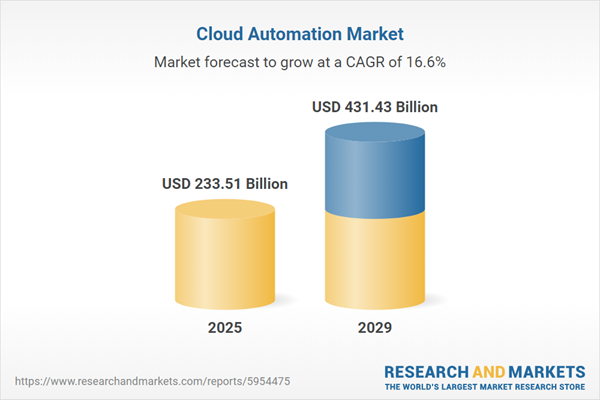

The cloud automation market size has grown rapidly in recent years. It will grow from $200.5 billion in 2024 to $233.51 billion in 2025 at a compound annual growth rate (CAGR) of 16.5%. The growth in the historic period can be attributed to growing demand for low-cost storage and faster data accessibility, easy application development and testing, growing adoption of cloud services, increasing adoption of cloud computing, increasing demand from large enterprises.

The cloud automation market size is expected to see rapid growth in the next few years. It will grow to $431.43 billion in 2029 at a compound annual growth rate (CAGR) of 16.6%. The growth in the forecast period can be attributed to rising investments in R&D and emerging automation solutions, hybrid cloud with cloud automation, cost optimization, need for improved operational efficiency, growing adoption of devOps toolchains. Major trends in the forecast period include the emergence of AI and machine learning, integration with artificial intelligence (AI) and machine learning (ML), disaster recovery and business continuity, container orchestration, serverless computing.

The increasing adoption of DevOps toolchains is set to drive the expansion of the cloud automation market. DevOps toolchains comprise integrated tools and processes utilized in DevOps practices to automate and streamline software development, testing, deployment, and monitoring. Factors such as the growing complexity of software development and the imperative for speed, efficiency, and collaboration are fueling the adoption of DevOps toolchains. Cloud automation empowers DevOps teams to automate repetitive operations, accelerate software delivery, boost agility, and optimize resource utilization. This results in improved productivity, scalability, and reliability of DevOps toolchains. For example, InfoSec Institute reported in January 2023 that infrastructure automation tools are projected to be part of 60% of firms' DevOps toolchains by 2023, leading to a 25% increase in application deployment effectiveness. Moreover, 56% of operations team members noted significant automation levels, marking a 10% rise from 2021. Consequently, the surge in DevOps toolchain adoption is propelling the growth of the cloud automation market.

Leading companies in the cloud automation sector are concentrating on developing innovative solutions, such as automation cloud tools, to automate manual processes and enhance their market competitiveness. Automation cloud tools encompass a range of software solutions designed to automate and streamline cloud computing processes. For instance, UiPath, a US-based software company, introduced Automation Cloud Robots in May 2022. This serverless solution executes cross-platform APIs and web-based automations without requiring VMs or robot configuration. Capable of handling up to 50 jobs in parallel, these robots are charged per execution minute through Robot Units managed by Automation Cloud Orchestrator. Offering instant automation with limitless SaaS capacity and no robot constraints, these robots represent a significant advancement in cloud automation technology. Through such innovative solutions, major players aim to solidify their position in the competitive cloud automation market.

In January 2023, Dell Inc., a US-based company offering a hybrid cloud solution and cloud infrastructure platform services, successfully acquired Cloudify Technologies Pvt. Ltd. for approximately up to $100 million. This strategic acquisition is geared towards enhancing Dell's cloud services business, with a particular focus on the DevOps space. The move is intended to foster innovation in Dell's edge offerings and strengthen its position in the cloud orchestration and automation sector. The acquisition aligns with Dell's broader strategy to provide comprehensive solutions for both public and private cloud opportunities. Cloudify Technologies Pvt. Ltd., based in Israel, is a company that specializes in providing cloud automation services through its open-source DevOps automation platform.

Major companies operating in the cloud automation market are Google LLC, Microsoft Corporation, Dell Technologies Inc., Amazon Web Services Inc., International Business Machines Corporation, Cisco Systems Inc., Oracle Corporation, Broadcom Inc., The Hewlett Packard Enterprise Company, DXC Technology Company, VMware Inc., NetApp Inc., Alibaba Cloud, Citrix Systems Inc., Progress Software Corporation, Terraform by HashiCorp, LogicMonitor Inc., Perforce Software Inc., Skytap Inc., Turbonomic, Morpheus Data LLC, Pulumi Corporation, CloudBolt Software, Opex Software LLP, CloudVelox Inc., Cloudify Platform Ltd., Snow Software, Mirantis Inc., Qualisystems Ltd., Red Hat Inc.

North America was the largest region in the cloud automation market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the cloud automation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the cloud automation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The cloud automation market includes revenues earned by entities by providing services such as infrastructure provisioning, orchestration, and deployment automation. The market value includes the value of related goods sold by the service provider or included within the service offering. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Cloud automation involves the utilization of automated tools and processes to execute workflows within a cloud environment, streamlining tasks that would typically require manual intervention. Its purpose is to reduce or eliminate manual efforts involved in provisioning and managing cloud computing resources, thereby enhancing workflow efficiency and enabling teams to establish continuous deployment strategies.

The primary components of cloud automation include software and services. Software comprises a collection of instructions and data that dictate how a computer executes specific tasks or functions, including applications, programs, and operating systems. It can be deployed across various modes such as private, public, and hybrid, catering to organizations of diverse sizes, ranging from small and medium enterprises (SMEs) to large enterprises. Cloud automation software finds application across multiple industries, including banking, financial services, and insurance (BFSI), healthcare, information technology (IT) and telecommunications (telecom), manufacturing, retail, among others.

The cloud automation market research report is one of a series of new reports that provides cloud automation market statistics, including cloud automation industry global market size, regional shares, competitors with a cloud automation market share, detailed cloud automation market segments, market trends and opportunities, and any further data you may need to thrive in the cloud automation industry. This cloud automation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cloud Automation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cloud automation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cloud automation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cloud automation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Software; Services2) By Deployment Type: Private; Public; Hybrid

3) By Organizational Size: Small And Medium Enterprise; Large Enterprise

4) By End-User: Banking, Financial Services, And Insurance (BFSI); Healthcare; Information Technology (IT) And Telecommunications (Telecom); Manufacturing; Retail; Other End-Users

Subsegments:

1) By Software: Cloud Management Software; Cloud Orchestration Software; Cloud Monitoring Software; Cloud Security Software; Cloud Integration Software2) By Services: Professional Services; Managed Services

Key Companies Mentioned: Google LLC; Microsoft Corporation; Dell Technologies Inc.; Amazon Web Services Inc.; International Business Machines Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Cloud Automation market report include:- Google LLC

- Microsoft Corporation

- Dell Technologies Inc.

- Amazon Web Services Inc.

- International Business Machines Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Broadcom Inc.

- The Hewlett Packard Enterprise Company

- DXC Technology Company

- VMware Inc.

- NetApp Inc.

- Alibaba Cloud

- Citrix Systems Inc.

- Progress Software Corporation

- Terraform by HashiCorp

- LogicMonitor Inc.

- Perforce Software Inc.

- Skytap Inc.

- Turbonomic

- Morpheus Data LLC

- Pulumi Corporation

- CloudBolt Software

- Opex Software LLP

- CloudVelox Inc.

- Cloudify Platform Ltd.

- Snow Software

- Mirantis Inc.

- Qualisystems LTD

- Red Hat Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 233.51 Billion |

| Forecasted Market Value ( USD | $ 431.43 Billion |

| Compound Annual Growth Rate | 16.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |