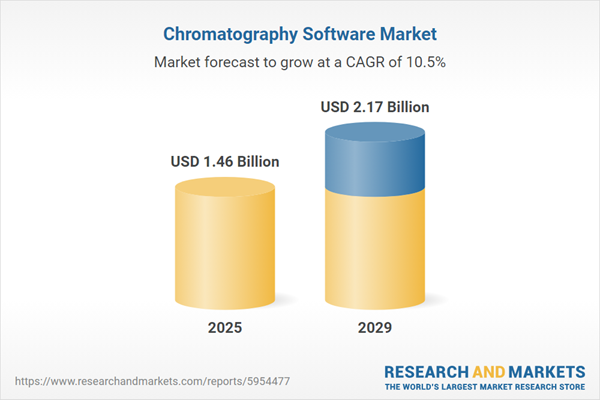

The chromatography software market size has grown rapidly in recent years. It will grow from $1.32 billion in 2024 to $1.46 billion in 2025 at a compound annual growth rate (CAGR) of 10.7%. The growth in the historic period can be attributed to advancements in analytical techniques, rising need for automation, stringent regulatory requirements, increasing complexity of analytical processes, integration with laboratory information management systems (LIMS).

The chromatography software market size is expected to see rapid growth in the next few years. It will grow to $2.17 billion in 2029 at a compound annual growth rate (CAGR) of 10.5%. The growth in the forecast period can be attributed to emergence of AI and machine learning integration, shift toward cloud-based solutions, focus on laboratory efficiency and productivity, integration with big data analytics, increased adoption of high-resolution mass spectrometry (HRMS). Major trends in the forecast period include automation and integration, cloud-based solutions, advanced data analysis, real-time monitoring, remote access and collaboration.

The growth in pharmaceutical production is anticipated to drive the expansion of the chromatography software market. Pharmaceutical production is shaped by advancements in healthcare, scientific progress, and shifting market demands. Chromatography is a key technique used in the industry for quality control and assurance during the manufacturing process. Chromatography software plays a crucial role in analyzing and interpreting chromatographic data, ensuring the quality and consistency of pharmaceutical products. For example, in February 2024, Oxford Economics, an economic advisory firm based in England, projected that the UK’s pharmaceutical output will grow at an average rate of 1.3% annually from 2024 to 2026, outpacing Italy's growth rate of 1.1% and the Nordic countries’ anticipated growth of 1% during the same period. Thus, the rising production of pharmaceuticals is fueling the growth of the chromatography software market.

Key players in the chromatography software sector are concentrating on the development of advanced software solutions tailored to meet the evolving needs of the pharmaceutical and analytical industries. One notable example is the release of Clarity 9 by DataApex, a Czechia-based software company, in August 2023. This latest version introduces a host of enhancements and features compared to its predecessor. Clarity 9 offers extensive chromatogram modification capabilities, including the overlaying of multiple chromatograms and electronic signature functionality. Moreover, it facilitates networked solutions, enabling offline chromatogram evaluation and method development, while also supporting language localization in multiple languages and integration with Laboratory Information Management Systems (LIMS) for streamlined sample submission and result output. Through such advancements, major players are poised to provide high-quality, efficient, and user-friendly chromatography software solutions, catering to the burgeoning demands of the pharmaceutical and analytical sectors.

In February 2023, Waters Corporation, a US-based analytical laboratory instrument manufacturing company, completed the acquisition of Wyatt Technology for $1.36 billion. This strategic move is aimed at strengthening Waters Corporation's presence in the rapidly expanding bioanalytical market. Additionally, the acquisition is expected to expand Waters Corporation's product portfolio and contribute to its financial growth. Wyatt Technology Corporation, headquartered in the US, specializes in the development and manufacturing of software for chromatography. The acquisition aligns with Waters Corporation's strategic goals of enhancing its offerings and market position in the analytical laboratory instrument sector.

Major companies operating in the chromatography software market are Hitachi, General Electric Company, Thermo Fisher Scientific Inc., Danaher Corporation, Agilent Technologies Inc., PerkinElmer Inc., Mettler-Toledo International Inc., Shimadzu Corporation, Shimizu Corporation, Bio-Rad Laboratories, Inc., Bruker Corporation, Water Cooperation, JASCO Corporation, DataApex, Scion Instruments, KNAUER Wissenschaftliche Geräte GmbH, Gilson Incorporated., Axel Semrau GmbH & Co. KG, SEDERE, Restek Corporation, Cecil Instrumentation Services Ltd., Sykam GmbH, Antec Scientific, GoSilico GmbH, BUCHI Labortechnik GmbH.

North America was the largest region in the chromatography software market in 2024. The regions covered in the chromatography software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the chromatography software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The chromatography software market consists of revenues earned by entities by providing services such as installation and configuration, technical support, software updates and maintenance, method development support, data analysis, and interpretation. The market value includes the value of related goods sold by the service provider or included within the service offering. The chromatography software market also includes sales of data processing and analysis tools, method development tools, reporting and documentation tools, data management systems, and connectivity tools. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Chromatography software is a specialized software designed to streamline the analysis and interpretation of data derived from chromatography techniques, a laboratory method utilized for separating, identifying, and quantifying components within a mixture. These techniques are crucial for dissecting and analyzing complex mixtures into their individual constituents.

The primary classifications of chromatography software include standalone and integrated variants. Standalone software represents a self-sufficient application requiring no additional software or connectivity for operation. It is available in web-based, on-premises, and cloud-based deployment options, offered in various versions including standard and customized editions. This software finds applications across diverse sectors such as pharmaceuticals, environmental testing, forensic analysis, and the food and beverage industry.

The chromatography software market research report is one of a series of new reports that provides chromatography software market statistics, including chromatography software industry global market size, regional shares, competitors with a chromatography software market share, detailed chromatography software market segments, market trends and opportunities, and any further data you may need to thrive in the chromatography software industry. This chromatography software market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Chromatography Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on chromatography software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for chromatography software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The chromatography software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Software Type: Standalone Software; Integrated Software2) By Deployment: Web Based; On-Premises; Cloud Based

3) By Version: Normal; Customized

4) By Application: Pharmaceutical industry; Environmental testing; Forensic testing; Food And Beverage Industry; Other Applications

Subsegments:

1) By Standalone Software: Data Acquisition Software; Data Analysis Software; Reporting Software; Control And Automation Software2) By Integrated Software: Laboratory Information Management Systems (LIMS); Enterprise Resource Planning (ERP) Software; Laboratory Execution Systems (LES); Chromatography Data Systems (CDS)

Key Companies Mentioned: Hitachi; General Electric Company; Thermo Fisher Scientific Inc.; Danaher Corporation; Agilent Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Chromatography Software market report include:- Hitachi

- General Electric Company

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Mettler-Toledo International Inc.

- Shimadzu Corporation

- Shimizu Corporation

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Water Cooperation

- JASCO Corporation

- DataApex

- Scion Instruments

- KNAUER Wissenschaftliche Geräte GmbH

- Gilson Incorporated.

- Axel Semrau GmbH & Co. KG

- SEDERE

- Restek Corporation

- Cecil Instrumentation Services Ltd.

- Sykam GmbH

- Antec Scientific

- GoSilico GmbH

- BUCHI Labortechnik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.46 Billion |

| Forecasted Market Value ( USD | $ 2.17 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |