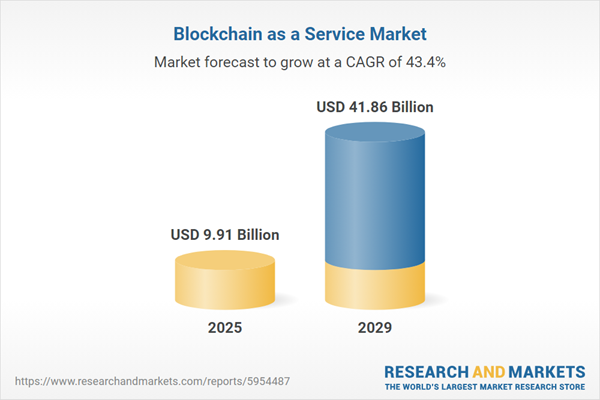

The blockchain as a service market size has grown exponentially in recent years. It will grow from $6.91 billion in 2024 to $9.91 billion in 2025 at a compound annual growth rate (CAGR) of 43.4%. The growth in the historic period can be attributed to cost efficiency initiatives, regulatory compliance requirements, demand for streamlined development processes, globalization and cross-border transactions, integration with existing enterprise systems.

The blockchain as a service market size is expected to see exponential growth in the next few years. It will grow to $41.86 billion in 2029 at a compound annual growth rate (CAGR) of 43.4%. The growth in the forecast period can be attributed to increasing adoption of decentralized finance (DeFi), rising emphasis on supply chain traceability, expansion of digital identity solutions, integration with internet of things (IoT) networks, growing demand for cross-industry applications. Major trends in the forecast period include increased adoption in emerging markets, expansion of use cases, rise of hybrid and multi-cloud deployments, integration with emerging technologies, focus on regulatory compliance and security.

The burgeoning adoption of smart contracts is poised to propel the expansion of the blockchain as a service (BaaS) market in the foreseeable future. Smart contracts, characterized by encoded terms and conditions that autonomously execute when predefined conditions are met, are witnessing increased adoption due to their ability to automate contractual agreements, enhancing efficiency, transparency, and trust across various industries. BaaS solutions facilitate the execution of smart contracts, enabling users to create, deploy, and interact with programmable contracts that enforce predefined rules and conditions automatically. Recent data from Alchemy Insights Inc. indicates a significant uptick in Ethereum smart contracts created, with a 24.7% increase in the first quarter of 2022, totaling 1.45 million contracts, surpassing the 1.16 million contracts generated in the previous quarter of 2021. This surge underscores the pivotal role of smart contracts in driving the growth of the blockchain as a service market.

Key players in the blockchain-as-a-service (BaaS) market are launching innovative products, such as blockchain-based data marketplaces, to strengthen their market position. A blockchain-powered data marketplace is a platform that leverages blockchain technology to enable secure and transparent data exchanges between different parties. For example, in May 2021, Fujitsu Limited, a Japan-based information and communications technology company, introduced the Fujitsu Web3 Acceleration Platform. This initiative aims to enhance cross-border collaboration and improve transaction efficiency across global economies through blockchain. The platform is designed to reduce the time required for cross-border securities settlements, which can take up to 48 hours. By using Extended Smart Contracts, it ensures secure, autonomous transactions without relying on third-party intermediaries. Fujitsu also intends to expand the use of this platform across various industries, advancing the adoption of Web3 technologies and improving blockchain network interoperability to create a more interconnected society.

In February 2022, Bharti Airtel Limited, a telecommunications company based in India, acquired a strategic stake in Aqilliz Pte Ltd. for an undisclosed amount. This acquisition is anticipated to empower Airtel by leveraging Aqilliz's expertise in blockchain as a service. The collaboration aims to enhance value exchange, strengthen Airtel's technological capabilities, and explore innovative applications of blockchain within the telecommunications industry. Aqilliz Pte Ltd., headquartered in Singapore, is a blockchain technology startup specializing in providing blockchain as a service.

Major companies operating in the blockchain as a service market are Amazon.com Inc., Microsoft Corporation, Alibaba Group Holding Limited, Nippon Telegraph and Telephone Corporation, Huawei Technologies Co. Ltd., Accenture PLC, International Business Machines Corporation, Deloitte Touche Tohmatsu Limited, Oracle Corporation, KPMG LLP, SAP SE, Hewlett Packard Enterprise, Tata Consultancy Services Limited, Capgemini SE, Cognizant Technology Solutions Corporation, Infosys Limited, Baidu Inc., VMware Inc., Wipro Limited, Altoros, Factom Inc., PayStand Inc., LeewayHertz, Stratis Group Ltd.

North America was the largest region in the blockchain as a service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the blockchain as a service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the blockchain as a service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The blockchain as a service (BaaS) market includes revenues earned by entities by providing services such as smart contracts execution, data management and analytics, tokenization services, and blockchain network management services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Blockchain as a service (BaaS) denotes a cloud-based service model aimed at delivering blockchain infrastructure, development tools, and management services through third-party cloud service providers. These offerings empower businesses to harness blockchain technology without the burden of constructing and upkeeping their own infrastructure, thereby facilitating the deployment of efficient and scalable blockchain solutions.

The primary categories of blockchain as a service offerings comprise tools and services. Tools encompass software applications, platforms, or solutions that furnish functionalities and capabilities tailored for specific tasks or operations. These services find predominant usage among both large enterprises and small and medium-sized enterprises (SMEs) across a spectrum of applications including payments, smart contracts, supply chain management, compliance management, trade finance, among others. They cater to various industry verticals such as banking, financial services, and insurance (BFSI), the government and public sector, manufacturing, retail and e-commerce, media and entertainment, transportation and logistics, healthcare, energy and utilities, among others.

The blockchain as a service market research report is one of a series of new reports that provides blockchain as a service market statistics, including blockchain as a service industry global market size, regional shares, competitors with a blockchain as a service market share, detailed blockchain as a service market segments, market trends and opportunities, and any further data you may need to thrive in the blockchain as a service industry. This blockchain as a service market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Blockchain as a Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on blockchain as a service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for blockchain as a service? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The blockchain as a service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Offering: Tools; Services2) By Enterprise Size: Large Enterprises; Small And Medium-sized Enterprises (SMEs)

3) By Application: Payments; Smart Contracts; Supply Chain Management; Compliance Management; Trade Finance; Other Applications

4) By Industry Vertical: Banking, Financial Services, And Insurance (BFSI); Government And Public Sector; Manufacturing; Retail And E-commerce; Media And Entertainment; Transportation And Logistics; Healthcare; Energy And Utilities; Other Industry Verticals

Subsegments:

1) By Tools: Blockchain Development Tools; Smart Contract Development Tools; Blockchain Analytics Tools; Blockchain Integration Tools; Blockchain Security Tools; Blockchain Testing Tools2) By Services: Blockchain Consulting; Blockchain Hosting; Blockchain Application Development; Smart Contract Development And Management; Blockchain Platform Management; Blockchain Security And Compliance Services; Blockchain Integration And Deployment Services

Key Companies Mentioned: Amazon.com Inc.; Microsoft Corporation; Alibaba Group Holding Limited; Nippon Telegraph and Telephone Corporation; Huawei Technologies Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Blockchain as a Service market report include:- Amazon.com Inc.

- Microsoft Corporation

- Alibaba Group Holding Limited

- Nippon Telegraph and Telephone Corporation

- Huawei Technologies Co. Ltd.

- Accenture PLC

- International Business Machines Corporation

- Deloitte Touche Tohmatsu Limited

- Oracle Corporation

- KPMG LLP

- SAP SE

- Hewlett Packard Enterprise

- Tata Consultancy Services Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Infosys Limited

- Baidu Inc.

- VMware Inc.

- Wipro Limited

- Altoros

- Factom Inc.

- PayStand Inc.

- LeewayHertz

- Stratis Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.91 Billion |

| Forecasted Market Value ( USD | $ 41.86 Billion |

| Compound Annual Growth Rate | 43.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |