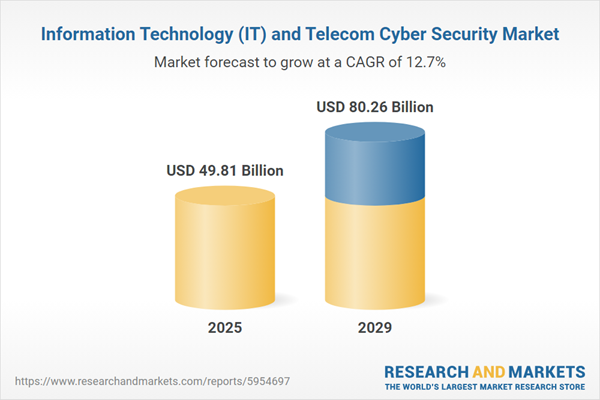

The information technology (IT) and telecom cyber security market size has grown rapidly in recent years. It will grow from $44.39 billion in 2024 to $49.81 billion in 2025 at a compound annual growth rate (CAGR) of 12.2%. The growth in the historic period can be attributed to growing reliance on digital infrastructure, rising cybercrime activities, increasing complexity of IT (information technology) ecosystems, high-profile data breaches, awareness of cybersecurity importance.

The information technology (IT) and telecom cyber security market size is expected to see rapid growth in the next few years. It will grow to $80.26 billion in 2029 at a compound annual growth rate (CAGR) of 12.7%. The growth in the forecast period can be attributed to emergence of new attack vectors, adoption of cloud computing, proliferation of mobile devices, rise in remote work and digital transformation, expansion of Internet of Things (IoT). Major trends in the forecast period include rise of zero trust architecture, focus on threat intelligence sharing, growth of ransomware and extortion attacks, emphasis on privacy and data protection regulations, increased demand for managed security services.

The increasing adoption of cloud computing is set to drive the growth of the information technology (IT) and telecom cybersecurity market in the foreseeable future. Cloud computing, a technology enabling users to access and utilize computing resources over the internet on a pay-per-use basis, is gaining prominence due to its ability to provide cost-effective, scalable, flexible, and secure IT solutions. This supports business agility, innovation, and growth in a digital and interconnected world. However, the adoption of cloud computing raises concerns about data privacy, compliance, and regulatory requirements, particularly in industries with stringent data protection regulations such as healthcare, finance, and government. To address these concerns, organizations are implementing cybersecurity solutions to ensure data privacy, regulatory compliance, and protection against data breaches and unauthorized access within the cloud and during data transfer. For example, in 2023, the European Commission reported a 4.2% increase in the adoption of cloud-based solutions in the European Union, with 45.2% of enterprises purchasing cloud computing services.

Leading companies in the information technology (IT) and telecom cybersecurity market are intensifying their focus on developing advanced solutions to gain a competitive edge. One notable advancement is Sentra Jagger, a generative AI (artificial intelligence) assistant designed for cloud data security. This software solution leverages artificial intelligence techniques to autonomously generate and implement security measures, policies, and protocols to protect data stored in cloud environments. In March 2024, Sentra, an Israel-based cloud data security company, launched Sentra Jagger, featuring swift threat analysis and rapid incident response. This platform reduces response times by up to 80%, reinforcing cybersecurity operations in the IT and telecom sectors. This signifies a significant shift towards artificial intelligence and automation in cybersecurity, enhancing threat analysis, providing real-time insights, and improving efficiency in addressing evolving cyber threats to safeguard critical data assets in the information technology and telecom cybersecurity realm.

In December 2023, Thales Group, a France-based technology company, acquired Imperva, Inc. for $3.6 billion. This acquisition strengthens cybersecurity solutions, expands market presence, and reinforces Thales' leadership in the information technology and telecom cybersecurity markets. Imperva, Inc., a US-based cybersecurity company, specializes in protecting data and application software, contributing to Thales' enhanced data protection capabilities against evolving cyber threats.

Major companies operating in the information technology (IT) and telecom cyber security market are Dell Technologies Inc., Intel Corporation, International Business Machines Corporation, Cisco Systems Inc., Broadcom, Telefonaktiebolaget Lm Ericsson, Bae Systems Inc., Palo Alto Networks Inc., Juniper Networks Inc., Fortinet Inc., Akamai Technologies Inc., Symantec Corporation, Splunk Inc., Micro Focus International, Check Point Software Technology Ltd., CrowdStrike, McAfee LLC, Trend Micro Incorporated, Zscaler Inc., Proofpoint Inc., AO Kaspersky Lab, Tenable Holdings Inc., Rapid7, Sophos, CyberArk Software Ltd., FireEye Inc., SecureWorks Corp., Qualys Inc., Varonis Systems Inc., Mimecast Ltd., Okta Inc.

North America was the largest region in the information technology (IT) and telecom cyber security market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the information technology (it) and telecom cyber security market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the information technology (it) and telecom cyber security market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The information technology (IT) and telecom cyber security market consists of revenues earned by entities by providing services such as cybersecurity consulting, incident response, penetration testing, vulnerability assessments, and managed security services. The market value includes the value of related goods sold by the service provider or included within the service offering. The information technology (IT) and telecom cyber security market also includes sales of products such as firewall systems, antivirus software, intrusion detection systems, encryption solutions, and identity and access management platforms. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Information technology (IT) and telecom cybersecurity encompasses a collection of measures, practices, and technologies specifically crafted to safeguard information technology systems, networks, devices, and data within the telecommunications industry from cyber threats and unauthorized access. This comprehensive approach aims to protect telecommunications infrastructure, networks, and services against various cyber threats. The primary focus is on ensuring the privacy, integrity, and availability of sensitive information and communications. The approach involves a multi-layered strategy that integrates technology, processes, and people to identify, assess, and effectively mitigate security risks.

The primary security types in information technology (IT) and telecom cybersecurity include network security, endpoint security, application security, cloud security, and others. Network security focuses on implementing measures to safeguard a computer network infrastructure from unauthorized access, misuse, modification, or denial of service. This ensures the confidentiality, integrity, and availability of data transmitted over the network. These security measures are deployed across various organizations, including small and medium enterprises as well as large enterprises, using both on-premises and cloud-based models. The end users span across sectors such as telecom service providers, e-commerce, enterprises, utilities, and government and defense entities.

The information technology (IT) and telecom cyber security market research report is one of a series of new reports that provides information technology (IT) and telecom cyber security market statistics, including information technology (IT) and telecom cyber security industry global market size, regional shares, competitors with information technology (IT) and telecom cyber security market share, detailed information technology (IT) and telecom cyber security market segments, market trends, and opportunities, and any further data you may need to thrive in the information technology (IT) and telecom cyber security industry. This information technology (IT) and telecom cyber security market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Information Technology (IT) And Telecom Cyber Security Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on information technology (it) and telecom cyber security market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for information technology (it) and telecom cyber security? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The information technology (it) and telecom cyber security market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Security Type: Network Security; Endpoint Security; Application Security; Cloud Security; Other Security Types2) By Organization Size: Small And Medium Enterprises; Large Enterprises

3) By Deployment Mode: On-Premises; Cloud-Based

4) By End-User Industry: Telecom Service Providers; E-commerce; Enterprises; Utilities; Government And Defense

Subsegments:

1) By Network Security: Firewalls; Intrusion Detection Systems (IDS); Intrusion Prevention Systems (IPS); Virtual Private Network (VPN); Network Access Control (NAC); Distributed Denial Of Service (DDoS) Protection; Unified Threat Management (UTM)2) By Endpoint Security: Antivirus Or Antimalware Software; Endpoint Detection and Response (EDR); Mobile Device Management (MDM); Data Loss Prevention (DLP); Encryption; Application Control; Device Control

3) By Application Security: Web Application Firewalls (WAF); Secure Software Development Life Cycle (SDLC); Application Security Testing; Code Review Tools; API Security; Identity And Access Management (IAM) For Applications

4) By Cloud Security: Cloud Access Security Brokers (CASBs); Cloud Encryption; Identity and Access Management (IAM) For Cloud; Security Information And Event Management (SIEM) For Cloud; Cloud Security Posture Management (CSPM); Multi-Factor Authentication (MFA); Cloud Workload Protection

5) By Other Security Types: Data Security And Privacy; Identity And Access Management (IAM); Security Orchestration, Automation, And Response (SOAR); Blockchain Security; Zero Trust Security Model; Threat Intelligence; Security Information And Event Management (SIEM)

Key Companies Mentioned: Dell Technologies Inc.; Intel Corporation; International Business Machines Corporation; Cisco Systems Inc.; Broadcom

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Information Technology (IT) and Telecom Cyber Security market report include:- Dell Technologies Inc.

- Intel Corporation

- International Business Machines Corporation

- Cisco Systems Inc.

- Broadcom

- Telefonaktiebolaget Lm Ericsson

- Bae Systems Inc.

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Fortinet Inc.

- Akamai Technologies Inc.

- Symantec Corporation

- Splunk Inc.

- Micro Focus International

- Check Point Software Technology Ltd.

- CrowdStrike

- McAfee LLC

- Trend Micro Incorporated

- Zscaler Inc.

- Proofpoint Inc.

- AO Kaspersky Lab

- Tenable Holdings Inc.

- Rapid7

- Sophos

- CyberArk Software Ltd.

- FireEye Inc.

- SecureWorks Corp.

- Qualys Inc.

- Varonis Systems Inc.

- Mimecast Ltd.

- Okta Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 49.81 Billion |

| Forecasted Market Value ( USD | $ 80.26 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |