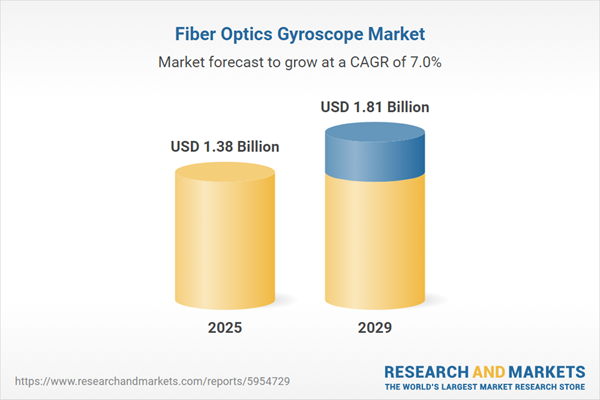

The fiber optics gyroscope market size has grown strongly in recent years. It will grow from $1.27 billion in 2024 to $1.38 billion in 2025 at a compound annual growth rate (CAGR) of 8.7%. The growth in the historic period can be attributed to rising automation industry, increased homeland security, rising demand for technologically advanced solutions, rapid growth of unmanned vehicles in defense and civilian applications, growing demand for commercial and military aircraft.

The fiber optics gyroscope market size is expected to see strong growth in the next few years. It will grow to $1.81 billion in 2029 at a compound annual growth rate (CAGR) of 7%. The growth in the forecast period can be attributed to rising need for precise motion control and robotics, increasing demand for accurate navigation and positioning systems, growing defense sector, rising need for advanced guidance and control systems, increasing demand for accurate navigation systems. Major trends in the forecast period include technological advancements in fiber optic gyroscopes, integration of fiber optic gyroscopes with autonomous vehicles, adoption of fiber optic gyroscopes in emerging economies, advancements in gyroscope technologies, development in the defense and aviation industry.

The increasing demand for precise motion control and robotics is expected to drive the growth of the fiber optic gyroscope market. Precise motion control refers to the ability to manage the movement of robotic systems with high accuracy, allowing them to perform tasks autonomously or semi-autonomously with reliability. Robotics, an interdisciplinary field, focuses on the design, construction, operation, and use of robots. The growing need for efficiency, accuracy, and automation across industries is fueling the demand for precise motion control and robotics. Fiber optic gyroscopes offer stable and accurate angular rate measurements, contributing to improved precision in motion control and robotics applications. For example, in September 2024, the International Federation of Robotics, a German-based organization, reported a 10% increase in the number of industrial robots installed, with 4,281,585 units operating globally in 2023, up from 2022. As a result, the rising demand for motion control and robotics is driving the fiber optic gyroscope market’s growth.

Leading companies in the fiber optics gyroscope market are actively developing innovative products to gain a competitive advantage. One notable advancement is the introduction of digital fiber-optic gyroscope inertial navigation systems, which leverage fiber-optic gyroscopes for measuring angular rates and inertial sensors for precise acceleration measurements. In October 2022, Advanced Navigation launched the Boreas D70, a digital fiber-optic gyroscope inertial navigation system that boasts a 40% reduction in size, weight, power, and cost compared to similar systems. Equipped with ultra-fast gyro compassing, AI-based fusion algorithms, dual-antenna real-time kinematic positioning, and a rich data-access web interface, the Boreas D70 offers high-performance metrics. Such innovations contribute to the competitive landscape in the fiber optics gyroscope market.

In August 2022, EMCORE Corporation completed the acquisition of KVH Industries's fiber optic gyroscope (FOG) and inertial navigation systems (INS) business segments for $55 million. EMCORE, a US-based provider of advanced inertial navigation products, aims to expand its customer base, including the U.S. Army, terrestrial applications, and new opportunities in the industrial autonomy market. The acquisition positions EMCORE as a key player in the fiber optics gyroscope market, leveraging the expertise and product portfolio gained from KVH Industries Inc., a US-based manufacturer of fiber optic gyroscope products. This strategic move aligns with EMCORE's growth objectives and enhances its market presence in the inertial navigation sector.

Major companies operating in the fiber optics gyroscope market are Northrop Grumman Corporation, Honeywell International Inc., Safran S.A, TDK Corporation, STMicroelectronics, Murata Manufacturing Co. Ltd., NXP Semiconductor, SAAB AB, Trimble Inc., Epson America Inc., iXBlue SAS, EMCORE Corporation, Luna Innovations, Advanced Navigation, Cielo Inertial Solutions Ltd., Furukawa (OFS), Fibernetics LLC, Silicon Sensing Systems Limited, Tamagawa Seiki Co. Ltd., Colibrys Ltd., Fizoptika Corporation, Nyfors Teknologi AB, NedAero Components B.V, Optolink LLC, FIBERPRO Inc., Ericco International.

North America was the largest region in the fiber optics gyroscope market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the fiber optics gyroscope market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the fiber optics gyroscope market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The fiber optic gyroscope market consists of sales of precision measurement systems, stabilization systems, navigation systems, and inertial navigation systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

A fiber optic gyroscope (FOG) serves as a highly precise rotation sensor employed in navigation and guidance systems for vehicles, including aircraft, spacecraft, and ships. This advanced sensor utilizes the principle of light interference within optical fibers to accurately and reliably detect rotational movements. It finds application in a variety of contexts where precise navigation and control systems are essential.

Fiber optic gyroscopes come in several types, including gyrocompasses, inertial navigation systems, inertial measurement units, and others. Gyrocompasses, for instance, function as non-magnetic compasses, utilizing a rapidly spinning disk and the Earth's rotation to ascertain the heading of a vehicle. These gyroscopes operate across different sensing axes such as 1-axis, 2-axis, and 3-axis, catering to a range of applications including tactical-grade uses, guidance for remotely operated vehicles, aeronautics and aviation, robotics, defense and homeland security, as well as industrial applications.

The fiber optics gyroscope market research report is one of a series of new reports that provides fiber optics gyroscope market statistics, including fiber optics gyroscope industry global market size, regional shares, competitors with a fiber optics gyroscope market share, detailed fiber optics gyroscope market segments, market trends and opportunities, and any further data you may need to thrive in the fiber optics gyroscope industry. This fiber optics gyroscope market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Fiber Optics Gyroscope Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on fiber optics gyroscope market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for fiber optics gyroscope? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The fiber optics gyroscope market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Device Type: Gyrocompass; Inertial Navigation System; Inertial Measurement Unit; Other Device Types2) By Sensing Axis: 1-Axis; 2-Axis; 3-Axis

3) By Application: Tactical Grade Applications; Remotely Operated Vehicle Guidance; Aeronautics And Aviation; Robotics; Defense And Homeland Security; Industrial

Subsegments:

1) By Gyrocompass: Marine Gyrocompasses; Land-Based Gyrocompasses2) By Inertial Navigation System (INS): Airborne INS; Land-Based INS; Marine INS

3) By Inertial Measurement Unit (IMU): High-Performance IMUs; Tactical IMUs; Consumer IMUs

4) By Other Device Types: Stabilization Systems; Navigation Systems For Aerospace; Robotics And Automation Systems

Key Companies Mentioned: Northrop Grumman Corporation; Honeywell International Inc.; Safran S.A; TDK Corporation; STMicroelectronics

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Fiber Optics Gyroscope market report include:- Northrop Grumman Corporation

- Honeywell International Inc.

- Safran S.A

- TDK Corporation

- STMicroelectronics

- Murata Manufacturing Co. Ltd.

- NXP Semiconductor

- SAAB AB

- Trimble Inc.

- Epson America Inc.

- iXBlue SAS

- EMCORE Corporation

- Luna Innovations

- Advanced Navigation

- Cielo Inertial Solutions Ltd.

- Furukawa (OFS)

- Fibernetics LLC

- Silicon Sensing Systems Limited

- Tamagawa Seiki Co. Ltd.

- Colibrys Ltd

- Fizoptika Corporation

- Nyfors Teknologi AB

- NedAero Components B.V

- Optolink LLC

- FIBERPRO Inc.

- Ericco International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.38 Billion |

| Forecasted Market Value ( USD | $ 1.81 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |