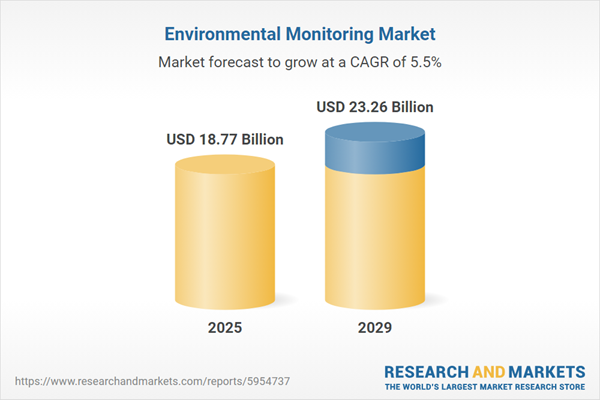

The environmental monitoring market size has grown strongly in recent years. It will grow from $17.52 billion in 2024 to $18.77 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to regulatory compliance, innovation in monitoring solutions, industrialization and urbanization, public awareness and concerns, environmental incidents and disasters.

The environmental monitoring market size is expected to see strong growth in the next few years. It will grow to $23.26 billion in 2029 at a compound annual growth rate (CAGR) of 5.5%. The growth in the forecast period can be attributed to advancements in sensor technology, integration with IoT and ai, emerging environmental regulations, growth in smart cities initiatives, increasing adoption of remote sensing technologies. Major trends in the forecast period include expansion of IoT integration, rise of ai-powered analytics, focus on air quality monitoring, emphasis on water quality management, integration of satellite and remote sensing data.

The growing level of air pollution is expected to drive the growth of the environmental monitoring market in the coming years. Air pollution refers to the presence of harmful or excessive substances in the Earth's atmosphere, which can negatively impact human health, the environment, and overall quality of life. The rise in air pollution is primarily due to increased emissions from industrial activities, vehicle exhaust, and other human sources. Environmental monitoring plays a crucial role in tracking pollution levels and trends over time, identifying pollution sources, assessing compliance with regulations, and guiding policy decisions to protect public health and the environment from the harmful effects of air pollution. For example, in February 2024, the Government of New South Wales, Australia, reported a 30% increase in particulate pollution (PM10 and PM2.5) in 2023 compared to the previous year. Additionally, the World Health Organization (WHO) stated that approximately 7 million premature deaths occur annually due to ambient and household air pollution. As a result, the rising level of air pollution is significantly driving the demand for environmental monitoring solutions.

Key players in the environmental monitoring market are actively developing innovative solutions, including ASIO environmental monitoring systems, to gain a competitive advantage. ASIO environmental monitoring systems comprise integrated networks of sensors, instruments, and technologies designed to measure various environmental parameters, such as air quality, water quality, soil conditions, weather patterns, and biodiversity. In June 2023, BIRD Aerosystems, an Israel-based defense technology and solutions company, introduced the ASIO environmental monitoring system. This cutting-edge solution focuses on detecting and addressing maritime pollution, particularly oil spills, using advanced technology such as the SEA EYE sensor. The ASIO system offers real-time detection and classification of oil and organic substances on the water's surface, facilitating swift response and mitigation efforts. With AI capabilities and prediction tools, the ASIO system enables authorities to manage environmental crises effectively, minimizing ecological and economic impacts while ensuring efficient cleanup operations.

In August 2022, Bentley Systems Inc., a US-based software development company, acquired Eagle.io for an undisclosed amount. This acquisition is intended to enhance Bentley Systems' capabilities in data collection, visualization, and analytics, with a particular focus on environmental monitoring and sustainability applications. Eagle.io, an Australia-based provider of environmental intelligence cloud solutions, brings expertise in delivering real-time environmental data insights to help organizations improve decision-making and sustainability practices.

Major companies operating in the environmental monitoring market are Siemens AG, Raytheon Technologies Corporation, Lockheed Martin Corporation, General Electric Company, Thermo Fisher Scientific Inc., Honeywell International Inc., 3M Company, Danaher Corporation, Merck KGaA, Texas Instruments Inc., Thales Group, Nidec Corporation, TE Connectivity Ltd., Emerson Electric Co., Agilent Technologies Inc., Teledyne Technologies Incorporated, AMS AG, bioMérieux SA, Shimadzu Corporation, PerkinElmer Inc., HORIBA Ltd., Spectris plc, Forbes Marshall, Raritan Inc., Powelectncs Limited, Environmental Sensors Inc.

North America was the largest region in the environmental monitoring market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the environmental monitoring market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the environmental monitoring market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The environmental monitoring market consists of revenues earned by entities by providing services such as air quality monitoring services, water quality monitoring services, remote sensing, and geographic information system (GIS) services. The market value includes the value of related goods sold by the service provider or included within the service offering. The environmental monitoring market also includes sales of sensors, analytical instruments, data loggers, and recorders. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Environmental monitoring involves a systematic approach to observing, measuring, and assessing diverse environmental factors with the goal of understanding and managing the condition of ecosystems, natural resources, and the broader environment. This process serves to safeguard ecosystems, human health, and overall environmental quality by furnishing crucial data for informed decision-making and the development of proactive ecological management strategies.

The primary types of environmental monitoring encompass particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement. Particulate detection involves the identification and measurement of solid or liquid particles suspended in a medium. Various sampling methods, such as continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring, are employed in this process. These monitoring techniques find applications in diverse areas, including air pollution, water pollution, soil pollution, and noise pollution. End-users benefiting from these environmental monitoring practices range from government agencies to consumer electronics, retail, and the medical sector.

The environmental monitoring market research report is one of a series of new reports that provides environmental monitoring market statistics, including environmental monitoring industry global market size, regional shares, competitors with a environmental monitoring market share, detailed environmental monitoring market segments, market trends and opportunities, and any further data you may need to thrive in the environmental monitoring industry. This environmental monitoring market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Environmental Monitoring Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on environmental monitoring market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for environmental monitoring? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The environmental monitoring market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Particulate Detection; Chemical Detection; Biological Detection; Temperature Sensing; Moisture Detection; Noise Measurement2) By Sampling Method: Continuous Monitoring; Active Monitoring; Passive Monitoring; Intermittent Monitoring

3) By Application: Air Pollution; Water Pollution; Soil Pollution; Noise Pollution

4) By End-User: Government; Consumer Electronics; Retail; Medical

Subsegments:

1) By Particulate Detection: PM2.5 Detection; PM10 Detection; Dust Detection2) By Chemical Detection: Gas Detection (CO2, CO, VOCs); Hazardous Chemical Detection; Air Quality Sensors

3) By Biological Detection: Pathogen Detection; Bioterrorism Agent Detection; Microbial Contamination Sensors

4) By Temperature Sensing: Ambient Temperature Sensors; High-Temperature Sensors; Infrared Temperature Sensors

5) By Moisture Detection: Humidity Sensors; Water Leak Detection; Soil Moisture Sensors

6) By Noise Measurement: Sound Level Meters; Acoustic Monitoring Sensors; Noise Pollution Monitoring Systems

Key Companies Mentioned: Siemens AG; Raytheon Technologies Corporation; Lockheed Martin Corporation; General Electric Company; Thermo Fisher Scientific Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Environmental Monitoring market report include:- Siemens AG

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- General Electric Company

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- 3M Company

- Danaher Corporation

- Merck KGaA

- Texas Instruments Inc.

- Thales Group

- Nidec Corporation

- TE Connectivity Ltd.

- Emerson Electric Co.

- Agilent Technologies Inc.

- Teledyne Technologies Incorporated

- AMS AG

- bioMérieux SA

- Shimadzu Corporation

- PerkinElmer Inc.

- HORIBA Ltd.

- Spectris plc

- Forbes Marshall

- Raritan Inc.

- Powelectncs Limited

- Environmental Sensors Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.77 Billion |

| Forecasted Market Value ( USD | $ 23.26 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |