Canada invests heavily in expanding and modernizing its railway infrastructure to accommodate growing passenger and freight transportation needs. Consequently, the North America market generated a revenue of USD 55,252.92 Thousands in 2023. Railway operators in North America are increasingly investing in modernizing their communication infrastructure to enhance safety, efficiency, and passenger experience. Therefore, these aspects will lead to increased demand in the segment.

Railway transportation is inherently complex, involving the coordination of numerous moving parts, including trains, track infrastructure, signaling systems, and personnel. In such a dynamic environment, communicating effectively and rapidly is essential to maintaining safe operations. Hence, these factors will boost the demand for train communication gateways systems in the coming years.

Additionally, Railway regulatory bodies worldwide impose stringent standards and regulations to uphold safety, efficiency, and interoperability within rail networks. These regulations encompass various aspects of railway operations, including track maintenance, signaling systems, rolling stock, and communication technologies. Thus, these aspects will help in the expansion of the market.

However, the initial cost outlay required for deploying train communication gateway systems can be prohibitive for railway operators, especially considering the extensive infrastructure investments and operational expenses already incurred. Procuring hardware, software licenses, installation, and integration costs contribute to these projects' substantial upfront capital expenditure. Hence, these factors can lead to reduced demand for train communication gateways systems.

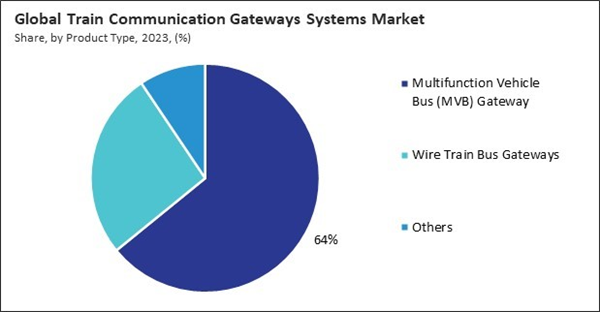

By Product Type Analysis

Based on product type, the market is segmented into wire train bus gateways, multifunction vehicle bus (MVB) gateway, and others. The multifunction vehicle bus (MVB) gateway segment held a 64% revenue share in the market in 2023. Adopting advanced train control systems, such as ETCS (European Train Control System) and CBTC (Communication-Based Train Control), has necessitated the deployment of sophisticated communication gateways to facilitate seamless integration and interoperability. Thus, these factors will fuel the demand in the segment.By Application Analysis

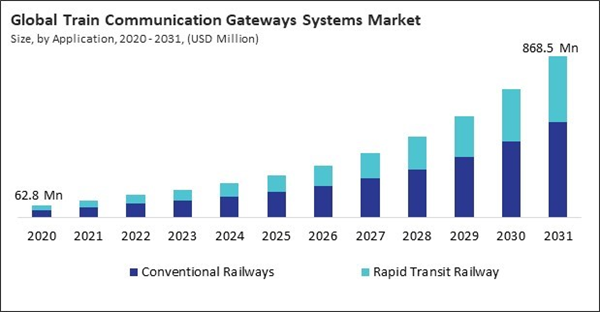

On the basis of application, the market is divided into conventional railways and rapid transit railway. In 2023, the rapid transit railway segment witnessed a 39.2% revenue share in the market. The global increase in population and urbanization has led to a heightened need for public transportation systems that operate efficiently. As per the data from the Eurostat, in 2021, broadly similar shares of the EU population were living in predominantly urban regions (40.5 %) and intermediate regions (38.7 %), while the remaining fifth (20.8 %) of the EU population lived in predominantly rural regions.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific segment acquired a 27.2% revenue share in the market. The Asia Pacific region has witnessed extensive investments in railway infrastructure, with governments and private investors funding the construction of new rail lines, high-speed rail networks, and urban mass transit systems. This infrastructure expansion has created a substantial demand for train communication gateways systems to support these networks' efficient and reliable operation. Thus, the segment will expand rapidly in the upcoming years.Recent Strategies Deployed in the Market

- Mar-2024: Advantech Co., Ltd. extended its collaboration with Nvidia Corporation, a technology company. Under this extended collaboration, Advantech will officially distribute industrial PCs certified with the NVIDIA AI Enterprise software platform, enabling the development and deployment of production-grade AI applications, including generative AI.

- Mar-2024: EKE-Electronics Ltd. entered a partnership with VR FleetCare, a maintenance service provider. Under this partnership, the companies will jointly develop advanced bogie and track condition monitoring systems to empower data-driven maintenance. Additionally, the partnership will improve train safety and reliability, increase cost-efficiency, and enhance passenger comfort.

- Jun-2023: Siemens AG took over Optrail S.r.l., an Italian technology company that offers algorithms for traffic management systems. Through this acquisition, Siemens gains a portfolio of Optrail that complements Siemens Mobility’s existing Train Planning System, strengthening its position as a supplier of software solutions to rail industry customers.

- Mar-2023: Duagon AG unveiled the F27P, a CompactPCI PlusIO (PICMG standard 2.30) CPU board suite. The F27P accommodates dual-core and quad-core CPUs like the AMD V14041 or the AMD V1807B, featuring a TDP range from a moderate 12 W to 54 W, offering high-performance capabilities suitable for scaling customer application computing power needs from mid- to high range. Additionally, it is well-suited for operation in harsh environments and finds applicability in the rail market, industrial automation, as well as the power and energy sectors.

- Jan-2023: Advantech Co., Ltd. launched the ITA-510NX and ITA-560NX, NVIDIA Jetson Orin NX-based computers for railway applications. The Advantech ITA510NX and ITA-560NX railway computers comply with railroad industry standards such as EN 50155 and fire protection standard EN 45545-2. Additionally, by leveraging the NVIDIA Jetson Edge AI platform to enable real-time autonomous decision-making and diagnostic monitoring for applications like autonomous driving, intelligent monitoring, and object/pattern recognition solutions.

List of Key Companies Profiled

- Advantech Co., Ltd.

- Siemens AG

- General Electric Company

- AMiT, spol. s r.o.

- Duagon AG

- SYS TEC electronic AG

- Quester Tangent Corporation

- HaslerRail AG

- INGETEAM, S.A.

- EKE-Electronics Ltd (EKE-Finance Ltd.)

Market Report Segmentation

By Application- Conventional Railways

- Rapid Transit Railway

- Multifunction Vehicle Bus (MVB) Gateway

- Wire Train Bus Gateways

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Advantech Co., Ltd.

- Siemens AG

- General Electric Company

- AMiT, spol. s r.o.

- Duagon AG

- SYS TEC electronic AG

- Quester Tangent Corporation

- HaslerRail AG

- INGETEAM, S.A.

- EKE-Electronics Ltd (EKE-Finance Ltd.)