e-commerce offers unparalleled convenience for Canadians, allowing them to shop for groceries, including peanut butter, from the comfort of their homes or on the go. With busy lifestyles and hectic schedules, many consumers appreciate the convenience of having peanut butter delivered directly to their doorstep. Therefore, the North America market garnered USD 2693.2 million revenue in 2023. Also, Canada market consumed 205.9 hundred Tonnes of crunchy peanut butter in 2023. Hence, these factors will boost the demand in the segment.

Protein is necessary for many biological processes, including the development and repair of muscles, the immune system, and the synthesis of hormones. Peanut butter is lauded for its relatively high protein content, making it an appealing choice for individuals seeking to increase their protein intake, such as athletes, fitness enthusiasts, and those following high-protein diets. Hence, these factors will boost the demand for peanut butter in the upcoming years.

Additionally, the surge in plant-based diets and vegan lifestyles has fueled the demand for peanut butter as a versatile, protein-rich, and sustainable alternative to animal-derived spreads. Because of its plant-based composition, nutritional advantages, adaptability in the kitchen, and affordability, it's a great alternative for anyone adopting a plant-based diet and looking for cruelty-free and eco-friendly food options. Thus, these aspects can assist in the expansion of the market.

However, Peanut butter manufacturers face considerable vulnerability to the fluctuating prices of peanuts, influenced by many factors ranging from weather conditions to geopolitical tensions. These variables can significantly impact peanut yields and prices, introducing uncertainty in sourcing raw materials and consequently affecting production costs and profit margins. Thus, these factors can lead to decreased demand for peanut butter in the upcoming years.

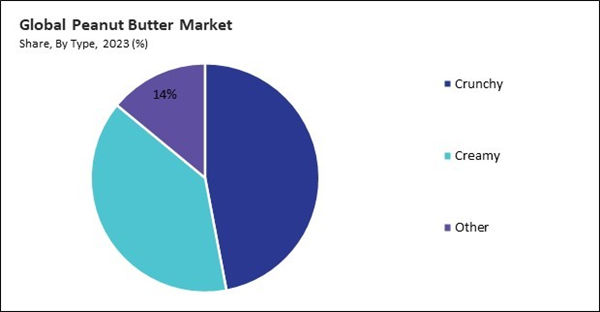

By Type Analysis

Based on type, the market is divided into creamy, crunchy, and others. The creamy segment recorded a 39% revenue share in the market in 2023. Hence, Russia market consumed 103.11 hundred Tonnes of creamy peanut butter in 2022. Creamy peanut butter is a popular option for sandwiches, toast, and baked goods because of its creamy and smooth texture, making it adaptable and spreadable. Its spreadability and uniform consistency appeal to consumers seeking convenience and ease of use in their culinary creations.By Distribution Channel Analysis

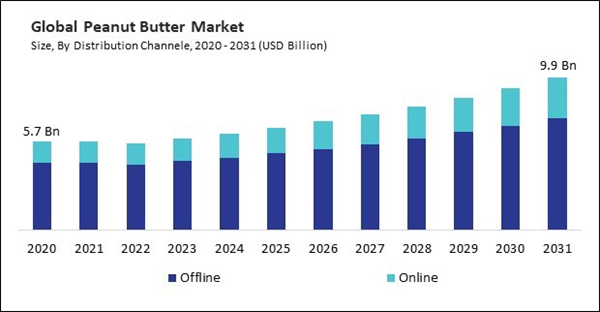

On the basis of distribution channel, the market is divided into offline and online. The offline segment recorded 75.5% revenue share in the market in 2023. Offline stores like supermarkets and hypermarkets typically boast a vast product assortment, including multiple brands, flavors, and packaging options of peanut butter. Customers with diverse interests and preferences are attracted to this extensive assortment, as it empowers them to conduct thorough product research and ultimately choose the one that most effectively fulfills their needs. Therefore, these aspects will fuel the demand in the segment.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific segment acquired a 21% revenue share in the market. The Asia Pacific region has seen a significant rise in health consciousness and awareness of the nutritional benefits of certain foods, including peanut butter. Growing consumer emphasis on health and wellbeing has led to a demand for healthful, high-protein, and high-fiber peanut butter products, as customers look for nutrient-dense, wholesome food options. Hence, the segment will grow rapidly in the coming years.Recent Strategies Deployed in the Market

- Feb-2024: The Hershey Company entered a partnership with Performance Food Group, a food distribution company. Through this partnership, Performance Food Group will integrate a diverse range of popular Hershey products into its dessert offerings, providing their customers with access to high-quality dessert options.

- Feb-2024: The Hershey Company launched Reese's Peanut Butter Mini Eggs Unwrapped. The product is designed for easy snacking and is available in an 8 OZ pack. Additionally, it will join the lineup of Reese's and Cadbury items.

- Nov-2023: The J.M. Smucker Company completed the acquisition of Hostess Brands, Inc., a bakery and cake shop company. With this acquisition, the J.M. Smucker Company strengthened its position in the baking products market, and the acquisition includes the Hostess® sweet baked snack brands, including Hostess®Donettes®, Twinkies®, CupCakes, DingDongs®, Zingers®, CoffeeCakes, HoHos®, Mini Muffins, and more.

- Sep-2023: M&M's, a brand of Mars, Inc., unveiled M&M's Peanut Butter Minis. This product combines the beloved flavor of M&M's Peanut Butter chocolate candies with the small, fun size of M&M's Minis, offering a deliciously rich peanut butter taste and a satisfyingly crunchy candy shell in every miniature bite.

- Mar-2023: The Hershey Company unveiled Hershey's Plant-Based Extra Creamy with Almonds and Sea Salt and Reese's Plant-Based Peanut Butter Cups. With these products, the company aims to meet consumer expectations, and Reese's Plant-Based Peanut Butter Cups will be available in 1.4-ounce packaging and Hershey's Plant-Based Extra Creamy with Almonds and Sea Salt will be available in 1.55-ounce packaging.

List of Key Companies Profiled

- The Procter & Gamble Company

- Unilever PLC

- Hormel Foods Corporation (MegaMex Foods, LLC)

- The Kraft Heinz Company

- Associated British Foods PLC (Wittington Investments Limited)

- The Hershey Company

- Mars, Inc.

- Dr. August Oetker KG

- The J.M Smucker Company

- Algood Food Company (Bowman Andros Products, LLC)

Market Report Segmentation

By Type (Volume, Hundred Tonnes, USD Billion, 2020-2031)- Crunchy

- Creamy

- Other

- Offline

- Online

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- The Procter & Gamble Company

- Unilever PLC

- Hormel Foods Corporation (MegaMex Foods, LLC)

- The Kraft Heinz Company

- Associated British Foods PLC (Wittington Investments Limited)

- The Hershey Company

- Mars, Inc.

- Dr. August Oetker KG

- The J.M Smucker Company

- Algood Food Company (Bowman Andros Products, LLC)