The Germany market dominated the Europe Equity Management Software Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $97.8 Million by 2031. The UK market is exhibiting a CAGR of 12.6% during (2024 - 2031). Additionally, The France market would experience a CAGR of 14.5% during (2024 - 2031).

The shift towards cloud-based equity management software continued to gain momentum. Cloud-based solutions offer scalability, accessibility, and flexibility, allowing companies to manage equity compensation programs from anywhere with an internet connection. Additionally, cloud-based platforms typically provide enhanced security features and seamless updates, making them attractive to organizations of all sizes. There is growing demand for equity management software that integrates seamlessly with existing HR and financial systems. Integration capabilities streamline data flows between software platforms, reducing manual errors and improving data consistency. This trend reflects the broader movement towards integrated human capital management (HCM) solutions encompassing various HR functions, including compensation and benefits administration.

Additionally, with increasingly complex regulatory requirements governing equity compensation, there was an emphasis on compliance and governance features in equity management software. Vendors enhancing their platforms to ensure compliance with regulations such as Sarbanes-Oxley (SOX), SEC reporting requirements, and accounting standards. Features such as audit trails, internal controls, and regulatory reporting capabilities becoming standard offerings. User experience became a key differentiator for equity management software vendors. Companies sought intuitive, user-friendly interfaces that simplify equity plan administration and empower employees to manage their equity awards effectively. Mobile optimization and self-service capabilities are also in demand, enabling employees to access equity-related information and perform transactions on the go.

The European Commission estimates that 24.3 million SMEs were operating in the EU-27 in 2022, making up 99.8% of all non-financial businesses. European SMEs are recognizing the importance of equity compensation programs as a strategic tool for attracting and retaining talent, incentivizing employees, and aligning their interests with the company's long-term success. Thus, all these factors will uplift the regional market’s expansion in the coming years.

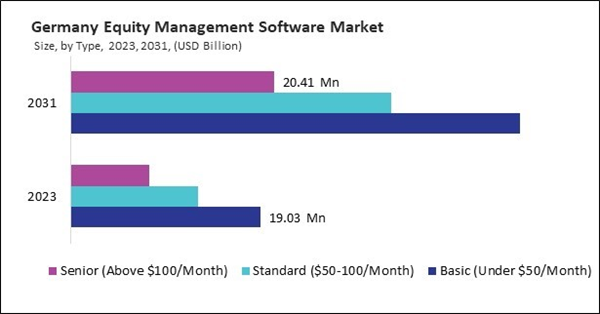

Based on Enterprise Size, the market is segmented into Large Enterprises, and Small & Medium-sized Enterprises. Based on Type, the market is segmented into Basic (Under $50/Month), Standard ($50-100/Month), and Senior (Above $100/Month). Based on Application, the market is segmented into Private Corporation, Listed Companies, Start-ups, and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

List of Key Companies Profiled

- JPMorgan Chase & Co.

- Preqin Ltd. (Dynamo Software)

- Eqvista Inc.

- Altvia Solutions, LLC

- Euronext N.V.

- Ledgy AG

- DEEP POOL Financial Solutions Limited

- eShares, Inc. (Carta, Inc.)

- Gust, Inc.

- Qapita Fintech Pte. Ltd.

Market Report Segmentation

By Enterprise Size- Large Enterprises

- Small & Medium-sized Enterprises

- Basic (Under $50/Month)

- Standard ($50-100/Month)

- Senior (Above $100/Month)

- Private Corporation

- Listed Companies

- Start-ups

- Others

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- JPMorgan Chase & Co.

- Preqin Ltd. (Dynamo Software)

- Eqvista Inc.

- Altvia Solutions, LLC

- Euronext N.V.

- Ledgy AG

- DEEP POOL Financial Solutions Limited

- eShares, Inc. (Carta, Inc.)

- Gust, Inc.

- Qapita Fintech Pte. Ltd.