The China market dominated the Asia Pacific Equity Management Software Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $115.2 Million by 2031. The Japan market is registering a CAGR of 13.6% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 15% during (2024 - 2031).

Equity management pertains to the establishment and administration of company owners. Equity management software programs offer various features and functionalities that let customers monitor, assess, and manage their stock holdings. Equity management software helps companies efficiently manage their equity compensation plans, including stock options, restricted stock units (RSUs), employee stock purchase plans (ESPPs), and other equity-based incentives. It automates the administration of grants, vesting schedules, exercises, and terminations, ensuring accuracy and compliance with regulatory requirements.

Additionally, equity management software provides tools for generating financial reports and accounting entries related to equity compensation. It streamlines calculating stock-based compensation expenses, valuing equity awards, and reconciling equity-related transactions with financial statements, enhancing financial reporting accuracy and transparency. Equity management software offers self-service portals and communication tools that enable employees to access information about their equity holdings, exercise options, and participate in educational programs. It promotes transparency and engagement by empowering employees to effectively understand and manage their equity compensation.

The India Brand Equity Foundation estimates that India has 633.9 lakh MSMEs. The micro sector comprises 630.5 lakh businesses, representing more than 99% of the total number of MSMEs in the country. Medium-sized enterprises comprise 0.05 lakh enterprises (0.01% of total MSMEs), while the small sector comprises 3.3 lakh enterprises (0.5%). Therefore, due to the above-mentioned factors, the equity management software market will grow significantly in this region.

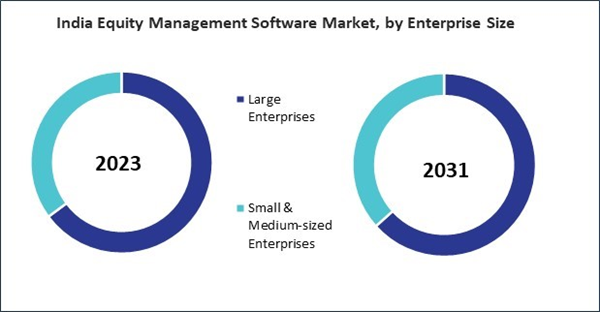

Based on Enterprise Size, the market is segmented into Large Enterprises, and Small & Medium-sized Enterprises. Based on Type, the market is segmented into Basic (Under $50/Month), Standard ($50-100/Month), and Senior (Above $100/Month). Based on Application, the market is segmented into Private Corporation, Listed Companies, Start-ups, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- JPMorgan Chase & Co.

- Preqin Ltd. (Dynamo Software)

- Eqvista Inc.

- Altvia Solutions, LLC

- Euronext N.V.

- Ledgy AG

- DEEP POOL Financial Solutions Limited

- eShares, Inc. (Carta, Inc.)

- Gust, Inc.

- Qapita Fintech Pte. Ltd.

Market Report Segmentation

By Enterprise Size- Large Enterprises

- Small & Medium-sized Enterprises

- Basic (Under $50/Month)

- Standard ($50-100/Month)

- Senior (Above $100/Month)

- Private Corporation

- Listed Companies

- Start-ups

- Others

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- JPMorgan Chase & Co.

- Preqin Ltd. (Dynamo Software)

- Eqvista Inc.

- Altvia Solutions, LLC

- Euronext N.V.

- Ledgy AG

- DEEP POOL Financial Solutions Limited

- eShares, Inc. (Carta, Inc.)

- Gust, Inc.

- Qapita Fintech Pte. Ltd.