Alkyl Polyglucosides (APGs) are valuable components in Industrial Cleaners, renowned for their powerful yet environmentally friendly cleaning properties. In industrial settings, APGs are utilized in various cleaning applications such as degreasers, metal cleaners, and equipment cleaners. Their high solvency and emulsification capabilities make them effective in removing tough contaminants like oils, greases, and residues from machinery, tools, and surfaces without causing harm to the environment or posing health risks to workers. Thus, the industrial consumed a total of 7.89 kilo tonnes of APG in 2023.

The China market dominated the Asia Pacific Alkyl Polyglucosides Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $110.9 million by 2031. The Japan market is registering a CAGR of 5.7% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 7.1% during (2024 - 2031).

APGs are commonly used in topical creams and ointments for skin conditions such as eczema, dermatitis, and psoriasis. Because of their delicate nature, they work well in formulas for sensitive skin, offering emulsification and moisturization without irritating. APGs function as mild surfactants in mouthwash and toothpaste, aiding in the solubilization and dispersion of the active components. Their non-toxic properties ensure safety for oral mucosa and soft tissues while effectively removing plaque and debris from teeth and gums.

Furthermore, ongoing research and development efforts in the market focus on performance optimization and product innovation to meet evolving customer needs and application requirements. Formulators are leveraging advances in surfactant chemistry, formulation technology, and process engineering to enhance the functionality, stability, and efficacy of APG-based products.

As China's industrial manufacturing sector continues to grow, there is a rising demand for surfactants, including APGs, widely used in industrial processes such as cleaning, degreasing, and formulating industrial chemicals. As per the data from the State Council of China in 2022, the nation will maintain its status as the world's leading producer goods as the proportion of global manufacturing output attributable to the nation's activities rises from 22.5 percent in 2012 to about 30 percent in 2021. Specifically, between 2012 and 2021, the nation's manufacturing output increased from 16.98 trillion yuan to 31.4 trillion yuan ($4.65 trillion). Additionally, Indian textile manufacturers are increasingly adopting green chemistry principles in their production processes, aiming to minimize hazardous chemicals and promote sustainability. As per the data from Invest India, the nation’s textile and apparel industry size is estimated to be around $165 Bn in 2022, with the domestic industry constituting $125 Bn and exports contributing $40 Bn. The industry's size is projected to grow at a 10% growth rate to reach $350 Bn by 2030. Hence, the rising industrial manufacturing and textile sector in Asia Pacific will drive the expansion of the regional market.

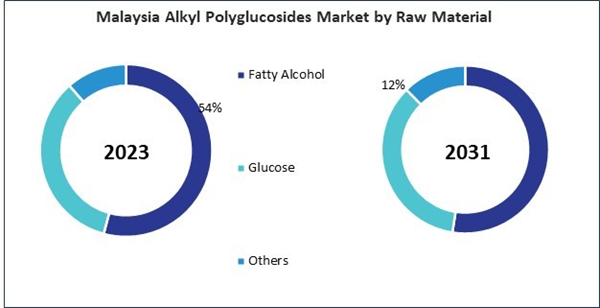

Based on Application, the market is segmented into Home Care, Cosmetics & Personal Care, Industrial, Textile, Oil & Gas, Water Treatment and Others. Based on Raw Material, the market is segmented into Fatty Alcohol, Glucose and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- BASF SE

- The Dow Chemical Company

- Croda International PLC

- LG Corporation

- Actylis (New Mountain Capital, LLC)

- Kao Corporation

- Seppic S.A. (L’Air Liquide S.A.)

- Airedale Chemical Holdings Limited

- Fenchem Biotek Ltd.

- Evonik Industries AG (RAG-Stifung)

Market Report Segmentation

By Application (Volume, Kilo Tonnes, USD Billion, 2020-31)- Home Care

- Cosmetics & Personal Care

- Industrial

- Textile

- Oil & Gas

- Water Treatment

- Others

- Fatty Alcohol

- Glucose

- Others

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- BASF SE

- The Dow Chemical Company

- Croda International PLC

- LG Corporation

- Actylis (New Mountain Capital, LLC)

- Kao Corporation

- Seppic S.A. (L’Air Liquide S.A.)

- Airedale Chemical Holdings Limited

- Fenchem Biotek Ltd.

- Evonik Industries AG (RAG-Stifung)