Global Bromine Market - Key Trends & Drivers Summarized

What Is Bromine, and Why Is It a Key Element in Various Industries?

Bromine is a dark, reddish-brown liquid at room temperature, notable for being one of only two elements on the periodic table that are liquid at standard conditions - the other being mercury. This halogen element is highly reactive and corrosive, particularly useful in a number of applications due to its ability to form compounds with many elements. Historically, bromine was predominantly used in the production of brominated flame retardants, which are chemicals added to textiles and plastics to make them less flammable. However, due to environmental and health concerns associated with these compounds, their use has declined, prompting a shift towards other bromine-based applications such as water treatment, where bromine compounds serve as powerful disinfectants, and in the pharmaceutical industry, where they are used in the synthesis of various drugs.How Is Bromine Extracted and Processed for Commercial Use?

Bromine is primarily extracted from seawater, natural brines, or through the mining of underground brine wells where it is found in high concentrations. The extraction process typically involves treating the brine with chlorine, which displaces the bromine. It is then purified through a method of blowing air through the liquid to evaporate the bromine, which is subsequently condensed and collected. Advances in extraction and processing technologies have significantly improved the efficiency and environmental impact of bromine production. These advancements include better brine management techniques and more effective capture systems that minimize bromine emissions and reduce waste, ensuring that bromine extraction remains economically viable and environmentally responsible.Emerging Uses of Bromine in Modern Technologies

As the use of brominated flame retardants declines, new and innovative uses for bromine are emerging in various technological fields. One significant area is in energy storage, where bromine-based batteries, particularly zinc-bromine flow batteries, offer an efficient solution for storing solar and wind energy. These batteries are capable of storing large amounts of energy for extended periods, making them ideal for grid stability and helping to address the intermittency issues associated with renewable energy sources. Another growing application is in the pharmaceutical sector, where bromine compounds are increasingly used in the synthesis of complex molecules used in drugs and medical treatments. Additionally, bromine is used in the production of photographic chemicals and as an intermediate in the manufacture of organic chemicals, further broadening its range of applications.What Drives the Growth in the Bromine Market?

The growth in the bromine market is driven by several factors, reflecting its diverse applications and the evolving needs of the industries it serves. Technological advancements that enhance the efficiency of bromine extraction and processing significantly contribute to its sustained market viability. The expanding demand for clean and reliable energy storage solutions, particularly in regions aggressively pursuing renewable energy, bolsters the use of bromine in battery technologies. Additionally, the pharmaceutical industry's ongoing research and development activities stimulate the need for bromine as a key component in drug manufacturing. Regulatory trends that promote environmental sustainability also play a crucial role, as industries seek bromine-based alternatives to less environmentally friendly chemicals. Lastly, the global increase in water treatment initiatives to ensure clean water supply is escalating the use of bromine in sanitation and disinfection processes. Together, these drivers ensure robust growth and continuous innovation within the bromine market.Report Scope

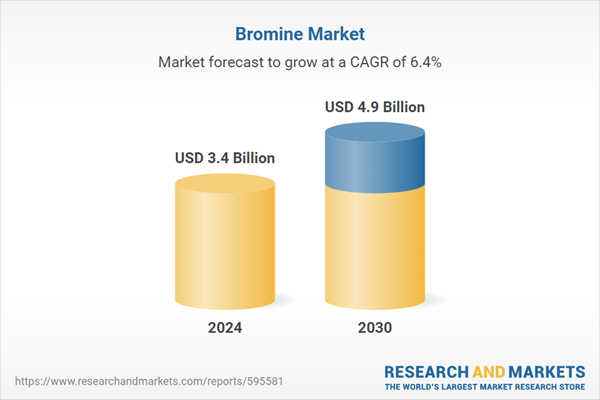

The report analyzes the Bromine market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Derivative (Organobromines, Clear Brine Fluids, Hydrogen Bromide, Other Derivatives); Application (Flame Retardants, Organic Intermediates, Drilling Fluids, Water Treatment Chemicals, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Organobromines segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of 6.4%. The Clear Brine Fluids segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $595 Million in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bromine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bromine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bromine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Albemarle Corporation, Mitsubishi Corporation, Tata Chemicals Ltd., Canadian Tire Corporation, Limited, Israel Chemicals Ltd. (ICL) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 26 companies featured in this Bromine market report include:

- Albemarle Corporation

- Mitsubishi Corporation

- Tata Chemicals Ltd.

- Canadian Tire Corporation, Limited

- Israel Chemicals Ltd. (ICL)

- Harmonic Health Pharmaceutical Company Limited

- Pentair International Holding Sarl

- Tata Chemicals Europe Ltd.

- Shandong Ocean Chemical Co., Ltd.

- Foshan Electrical and Lighting Co. Ltd.

- Ny New York Trading, Inc.

- Alliance Design and Development Group, Inc.

- Pool Pro Pty. Limited

- Granarolo S.P.A.

- Blanidas company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Albemarle Corporation

- Mitsubishi Corporation

- Tata Chemicals Ltd.

- Canadian Tire Corporation, Limited

- Israel Chemicals Ltd. (ICL)

- Harmonic Health Pharmaceutical Company Limited

- Pentair International Holding Sarl

- Tata Chemicals Europe Ltd.

- Shandong Ocean Chemical Co., Ltd.

- Foshan Electrical and Lighting Co. Ltd.

- Ny New York Trading, Inc.

- Alliance Design and Development Group, Inc.

- Pool Pro Pty. Limited

- Granarolo S.P.A.

- Blanidas company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |