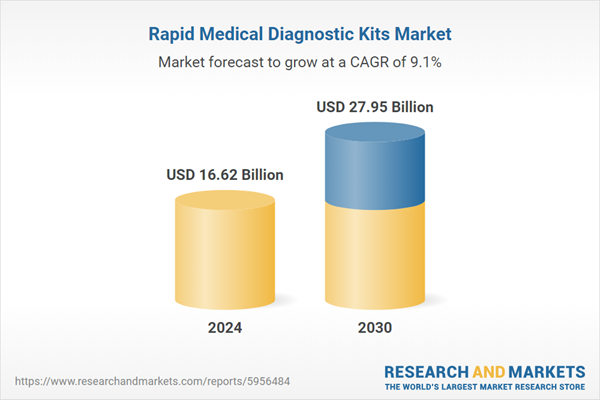

Infectious Disease Testing is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The escalating global burden of infectious and chronic diseases significantly underpins the expansion of the rapid medical diagnostic kits market by necessitating prompt and accessible diagnostic tools. Early detection is crucial for effective disease management and outbreak control, driving the adoption of solutions that offer quick results without extensive laboratory infrastructure. For instance, according to the Centers for Disease Control and Prevention, in 2024, more than 12 million dengue cases were reported, marking it as the highest year on record, underscoring the urgent need for rapid diagnostics in managing such widespread infectious threats.Key Market Challenges

The stringent and varied regulatory approval processes across different regions present a substantial impediment to the growth of the Global Rapid Medical Diagnostic Kits Market. These complex frameworks often necessitate extensive documentation, prolonged review periods, and substantial investment in compliance, creating significant barriers for manufacturers seeking to introduce new diagnostic solutions. The lack of harmonized regulations across major markets further exacerbates these challenges, requiring manufacturers to navigate multiple distinct and often overlapping requirements.Key Market Trends

Integration with digital health platforms and AI analytics represents a transformative shift in the rapid medical diagnostic kits market, moving beyond simple result generation to comprehensive data interpretation and patient management. This trend leverages artificial intelligence to enhance diagnostic accuracy, predict disease progression, and personalize treatment pathways by analyzing vast datasets from various diagnostic points. According to MedTech Europe, in 2024, Germany's Digital Health Applications (DiGA) pathway saw an 85% utilization rate of prescribed digital health solutions, indicating significant patient and clinician adoption of digitally integrated healthcare tools.Key Market Players Profiled:

- Artron Laboratories Inc.

- Alfa Scientific Designs, Inc.

- BD and Company

- bioMérieux SA

- BTNX, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Cardinal Health Inc.

- Creative Diagnostics

- F. Hoffmann-La Roche AG

Report Scope:

In this report, the Global Rapid Medical Diagnostic Kits Market has been segmented into the following categories:By Product:

- Over the Counter (OTC) Kits

- Professional Kits

By Application:

- Blood Glucose Testing

- Infectious Disease Testing

- Cardiometabolic Testing

- Pregnancy and Fertility Testing

- Fecal Occult Blood Testing

- Coagulation Testing

- Toxicology Testing

- Lipid Profile Testing

- Other Applications

By End Use:

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Rapid Medical Diagnostic Kits Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Artron Laboratories Inc.

- Alfa Scientific Designs, Inc.

- BD and Company

- bioMérieux SA

- BTNX, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Cardinal Health Inc.

- Creative Diagnostics

- F. Hoffmann-La Roche AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.62 Billion |

| Forecasted Market Value ( USD | $ 27.95 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |