Global Stem Cell Assay Market Overview

Stem cell assay is a laboratory technique utilized to assess the behaviour and properties of stem cells such as measuring their function. To study stem cell biology and investigate its potential therapeutic applications, stem cell assays are widely utilized across various sectors. The rising prevalence of chronic diseases such as cancer has increased the need for innovative therapies. With the global burden of new cancer cases predicted to reach approximately 30 million by 2040, the stem cell assay market demand is expected to witness a surge in the coming years.The market is experiencing a rising impetus for research and development activities in stem cell biology. Intensive research efforts are directed at utilizing stem cells in therapeutic applications, propelling the demand for stem cell assays. A study published in July 2023, revealed an innovative method to reverse cellular aging. The scientists involved in the study worked on expressing certain genes (Yamanaka factors) and converted adult cells into induced pluripotent stem cells (iPSCs). The researchers identified chemical cocktails that reverse cellular aging and restore youthful gene expression in less than a week without causing uncontrolled cell growth. Such developments led by robust research activities are estimated to fuel the stem cell assay market growth in the forecast period.

The market is also driven by the technological advancements in the sector resulting in improved efficiency and throughput of stem cell assays. Furthermore, the growing preference for personalized medicine and precision therapies will accelerate the market growth.

Global Stem Cell Assay Market Trends

Expansion of Stem Cell Applications

Growing applications in regenerative medicine and drug discovery are driving the demand for stem cell assays.Technological Innovations in Assay Platforms

Rising advancements in screening and 3D culture technologies are expected to enhance the efficiency of assays and aid improved outcomes.Regulatory and Ethical Frameworks

Development and standardization of global regulatory and ethical frameworks are influencing the stem cell assay market dynamics.Increased Investment in Research and Development Activities

Increasing investment in research and development activities to meet diverse clinical needs is positively influencing the market sizeGlobal Stem Cell Assay Market Segmentation

Global Stem Cell Assay Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Kits and Reagents

- Instruments

- Services

Market Breakup by Technology

- Flow Cytometry

- High-Content Screening

- PCR

- Spectrophotometry

- Microarray

- Other Technologies

Market Breakup by Assay Type

- Viability/Cytotoxicity Assays

- Isolation/Purification Assays

- Differentiation Assays

- Proliferation Assays

- Apoptosis Assays

- Other Assay Types

Market Breakup by Cell Type

- Adult Stem Cells

- Embryonic Stem Cells

- Induced Pluripotent Stem Cells (iPSCs)

Market Breakup by Application

- Drug Discovery and Development

- Regenerative Medicine and Therapy Development

- Clinical Research

- Other Applications

Market Breakup by End User

- Pharmaceutical and Biotechnology Companies

- Research Institutes

- Contract Research Organizations (CROs)

- Other End Users

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Stem Cell Assay Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- PerkinElmer, Inc.

- GE Healthcare

- Bio-Rad Laboratories, Inc.

- STEMCELL Technologies Inc.

- Cell Biolabs, Inc.

- Promega Corporation

- Lonza Group

- Miltenyi Biotec

- Cell Signaling Technology, Inc.

- Agilent Technologies, Inc.

- R&D Systems (a Bio-Techne brand)

- Bio-Techne Corporation

- Cytiva (formerly GE Healthcare Life Sciences)

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- PerkinElmer, Inc.

- GE Healthcare

- Bio-Rad Laboratories, Inc.

- STEMCELL Technologies Inc.

- Cell Biolabs, Inc.

- Promega Corporation

- Lonza Group

- Miltenyi Biotec

- Cell Signaling Technology, Inc.

- Agilent Technologies, Inc.

- R&D Systems (a Bio-Techne brand)

- Bio-Techne Corporation

- Cytiva (formerly GE Healthcare Life Sciences)

Table Information

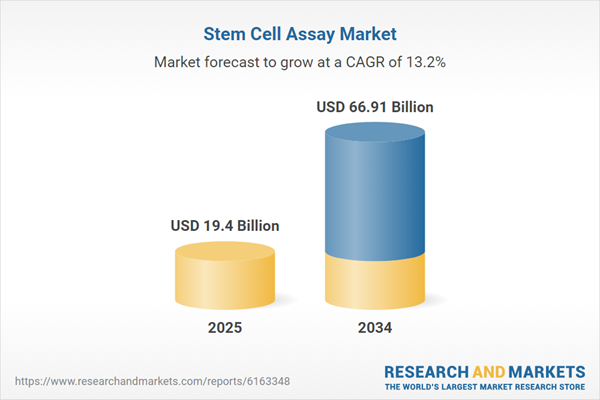

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 19.4 Billion |

| Forecasted Market Value ( USD | $ 66.91 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |