Analytics is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Global AI Platform Lending Market is significantly propelled by advanced AI and machine learning capabilities. These technologies empower lenders to analyze extensive and diverse datasets, moving beyond traditional metrics to identify complex patterns crucial for assessing borrower creditworthiness. This analytical precision supports informed decision-making and drives product innovation. According to IBM, October 2023, "Global AI Adoption Index 2023", 40% of financial services institutions reported actively deploying artificial intelligence, indicating significant integration.Key Market Challenges

The Global AI Platform Lending Market faces a substantial impediment in navigating complex data privacy concerns and the rapidly evolving regulatory landscape surrounding artificial intelligence applications in finance. The absence of clear, harmonized frameworks for these technologies creates significant compliance uncertainties for financial institutions. This regulatory ambiguity often translates into increased legal and operational overheads, as entities must dedicate considerable resources to monitoring and adapting to disparate and frequently updated regulations across various jurisdictions.Key Market Trends

Embedded Lending Integration with Non-Financial Platforms represents a significant shift by integrating credit products directly into customer journeys on non-financial platforms. This approach enhances convenience and expands the market for lending by creating new distribution channels beyond traditional financial institutions. Consumers and businesses can thus obtain financing at the precise moment of need, such as during e-commerce transactions or within business management software. For example, according to the GSMA's 'State of the Industry Report on Mobile Money 2025', 44% of mobile money providers offered credit services as of June 2024, demonstrating lending integration into non-traditional platforms.Key Market Players Profiled:

- Tavant Technologies Inc.

- ICE Mortgage Technology, Inc.

- Fiserv, Inc.

- Pegasystems Inc.

- Newgen Software Technologies Limited

- Social Finance, LLC

- Blend Labs, Inc.

- Nucleus Software Exports Ltd.

- Sigma Infosolutions Ltd.

- Upstart Network, Inc.

Report Scope:

In this report, the Global AI Platform Lending Market has been segmented into the following categories:By Type:

- Natural Language Processing

- Deep Learning

- Machine Learning

- Others

By AI Type:

- Analytics

- Text

- Visual

- Others

By End-User:

- Bank

- Government

- Education

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global AI Platform Lending Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tavant Technologies Inc.

- ICE Mortgage Technology, Inc.

- Fiserv, Inc.

- Pegasystems Inc.

- Newgen Software Technologies Limited

- Social Finance, LLC

- Blend Labs, Inc.

- Nucleus Software Exports Ltd.

- Sigma Infosolutions Ltd.

- Upstart Network, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

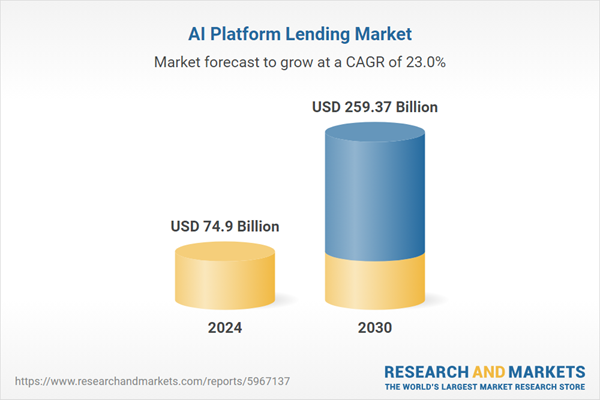

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 74.9 Billion |

| Forecasted Market Value ( USD | $ 259.37 Billion |

| Compound Annual Growth Rate | 23.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |