Large Enterprises is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The pervasive adoption of remote and hybrid work models fundamentally drives the global End User Computing market by necessitating flexible and secure access to corporate resources from diverse locations and devices. This paradigm shift demands robust solutions that extend the traditional office environment, ensuring operational continuity and employee productivity. Organizations increasingly prioritize technologies enabling seamless collaboration irrespective of physical presence. According to FlexJobs' 2025 Remote Work Stats & Trends Report, in December 2024, 81% of respondents indicated remote work as the most important factor in their job selection, underscoring a critical employee preference influencing enterprise technology investments.Key Market Challenges

A significant challenging factor for the global End User Computing market is managing heightened security concerns within decentralized environments and diverse device landscapes. This complexity directly hampers market growth by increasing the operational burden of ensuring robust data protection and regulatory compliance across numerous endpoints. The expanded attack surface presented by widespread remote and hybrid work models, coupled with diverse personal devices accessing corporate resources, necessitates continuous vigilance and specialized cybersecurity expertise.Key Market Trends

The expansion of Unified Endpoint Management (UEM) solutions represents a significant trend in the global End User Computing market, driven by the escalating complexity of managing diverse devices and applications across distributed workforces. UEM platforms consolidate the management of desktops, laptops, smartphones, and tablets under a single console, providing consistent security policies and streamlined operational workflows. This trend empowers organizations to maintain control over corporate data and access points regardless of device type or location.Key Market Players Profiled:

- Nutanix, Incorporation

- Fujitsu Limited

- Tech Mahindra Limited

- HCL Infosystems Limited

- IGEL Technology GmbH

- Infosys Limited

- LTIMindtree Limited

- NetApp, Incorporated

- Nucleus Software Exports Limited

- Cloud Software Group, Incorporated

Report Scope:

In this report, the Global End User Computing Market has been segmented into the following categories:By Organization Size:

- Large Enterprises

- Small & Medium Enterprises

By Deployment:

- On-Premise

- Cloud

By End-User:

- IT & Telecom

- BFSI

- Healthcare

- Retail

- Other

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global End User Computing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nutanix, Incorporation

- Fujitsu Limited

- Tech Mahindra Limited

- HCL Infosystems Limited

- IGEL Technology GmbH

- Infosys Limited

- LTIMindtree Limited

- NetApp, Incorporated

- Nucleus Software Exports Limited

- Cloud Software Group, Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

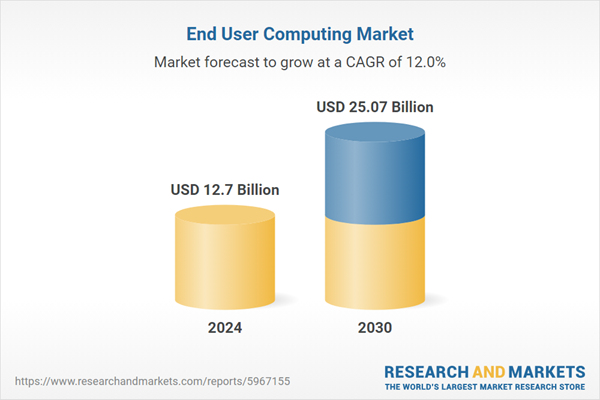

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.7 Billion |

| Forecasted Market Value ( USD | $ 25.07 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |