Hygiene products represent a significant segment within the market, with nonwoven fabrics being extensively used in various personal care and hygiene applications. Polypropylene nonwoven fabrics offer several advantages that make them ideal for hygiene products, including softness, breathability, fluid absorption, and barrier properties. Hence, the total consumption of Hygiene products in the US was 1,132.1 Kilo Tonnes in 2023.

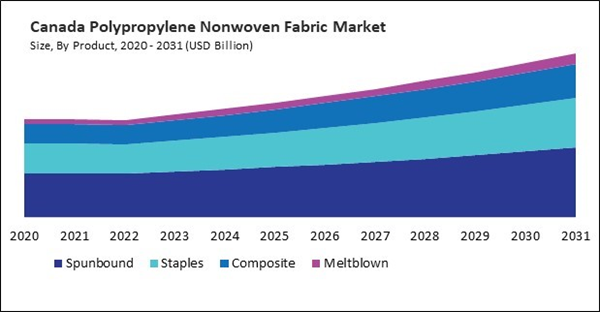

The US market dominated the North America Polypropylene Nonwoven Fabric Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $7,954.7 Million by 2031. The Canada market is experiencing a CAGR of 6.1% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 6.8% during (2024 - 2031).

Polypropylene nonwoven fabrics have emerged as dynamic and influential products in the landscape, playing a pivotal role across a diverse spectrum of industries. Characterized by using polypropylene fibres, these nonwoven fabrics have become integral components in numerous applications, showcasing versatility, cost-effectiveness, and performance excellence.

The growth of the market lies in synthesizing cutting-edge technology, sustainable practices, and the pursuit of novel solutions to address the evolving requirements of end-use industries. Manufacturers and suppliers within this market are continually seeking advancements, fostering innovation in product development, manufacturing processes, and eco-friendly practices.

As the demand for light-duty vehicles, including multi-purpose and electric ones, continues to rise in Canada, polypropylene nonwoven fabrics find extensive applications in interior components such as carpets, seat covers, and headliners. According to Statistics Canada, the total number of road motor vehicles registered in Canada was 26.3 million in 2022, up 0.3% from 2021. Light-duty vehicles accounted for 91.7% of total registrations in 2022, with multi-purpose vehicles surpassing passenger cars for the first time as Canada's most common vehicle type. Electric vehicles accounted for 3.0% of light-duty vehicle registrations in 2022, up from 2.3% in 2021. Likewise, due to the demand for electric and hybrid vehicles in Mexico, polypropylene nonwoven fabrics are likely to experience increased usage in this sector, contributing to lightweighting initiatives, interior customization, and sustainability efforts within the automotive manufacturing process. Therefore, the expanding regional automotive and EV sectors is propelling the market's growth.

Based on Application, the market is segmented into Hygiene, Medical, Geotextiles, Industrial, Furnishings, Carpet, Agriculture, Automotive and Others. Based on Product, the market is segmented into Spunbound, Staples, Composite and Meltblown. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Kimberly-Clark Corporation

- Berry Global Group, Inc.

- Schouw & Co.

- Mitsui Chemicals, Inc.

- Toray Industries, Inc.

- Freudenberg SE

- Ahlstrom

- Berkshire Hathaway, Inc.

- SABIC (Saudi Arabian Oil Company)

- Asahi Kasei Corporation

Market Report Segmentation

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)- Hygiene

- Medical

- Geotextiles

- Industrial

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Spunbound

- Staples

- Composite

- Meltblown

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Kimberly-Clark Corporation

- Berry Global Group, Inc.

- Schouw & Co.

- Mitsui Chemicals, Inc.

- Toray Industries, Inc.

- Freudenberg SE

- Ahlstrom

- Berkshire Hathaway, Inc.

- SABIC (Saudi Arabian Oil Company)

- Asahi Kasei Corporation