North America region is a hub for automotive research and development, driving the demand for simulation software to support these activities. The automotive sector in North America is a leader in technological innovations that necessitate comprehensive simulation for testing and development, including autonomous driving, electric vehicles (EVs), and connected vehicles. Therefore, the North America region generated $1,651.8 million revenue in the market in 2023. Mexico has a well-established automotive manufacturing ecosystem, with a strong presence of major automotive manufacturers and suppliers.

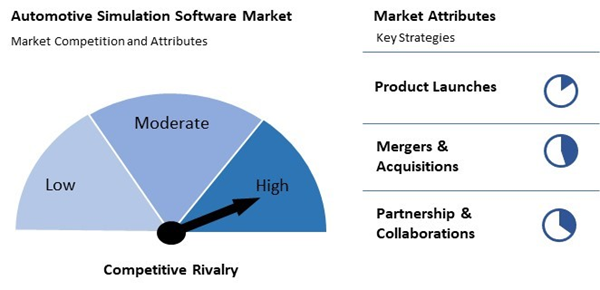

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October 2023, PTC, Inc. completed the acquisition of pure-systems GmbH. Under this acquisition, Pure-systems integrated with PTC, aligning seamlessly with PTC's Codebeamer application lifecycle management (ALM) solution and in July 2023, Altair Engineering, Inc. completed the acquisition of OmniV, a technology out of XLDyn, LLC, a product development company. Under this acquisition, Altair strengthened its simulation portfolio with OmniV, which empowers open model-based systems engineering (MBSE) practice across systems, simulation, testing, product development, and control engineering.

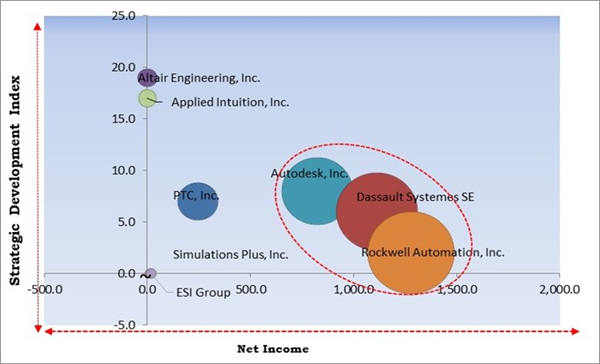

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Autodesk, Inc., Dassault Systemes SE, and Rockwell Automation, Inc. are the forerunners in the Market. In October 2023, Autodesk, Inc. entered a definitive agreement to acquire FlexSim Software Products, Inc. Under this acquisition, Autodesk would gain FlexSim’s factory simulation technology, which complements Autodesk’s existing factory design solutions. And Companies such as Altair Engineering, Inc., PTC, Inc., and Applied Intuition, Inc. are some of the key innovators in Market.Market Growth Factors

Modern vehicles have advanced features and technologies such as driver-assistance systems (ADAS), electrification, and connectivity. Effective operation of ADAS is dependent on an intricate network of sensors, actuators, and control algorithms. This requires thorough simulation and testing to ensure their reliability and safety in real-world scenarios. Thus, the increasing complexity of automotive systems driven by technological advancements drives the demand for automotive simulation software.Additionally, Governments worldwide are increasingly focused on reducing the environmental impact of vehicles and improving road safety, leading to the implementation of stricter regulations. For example, the Environmental Protection Agency (EPA) sets emissions standards for vehicles to reduce air pollution and greenhouse gas emissions in the United States. Thus, stringent government regulations are a prominent driving force behind the growth of the market.

Market Restraining Factors

Automotive simulation software can be expensive, particularly for smaller companies or those in emerging markets. Software licenses for automotive simulation tools can be substantial, with prices varying based on the complexity and functionality of the software. For example, a comprehensive simulation package like Siemens' Simcenter Amesim can cost tens of thousands of dollars per license. Thus, while automotive simulation software offers immense benefits in terms of design optimization and cost savings in the long run, its high initial cost can be a significant barrier to adoption.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

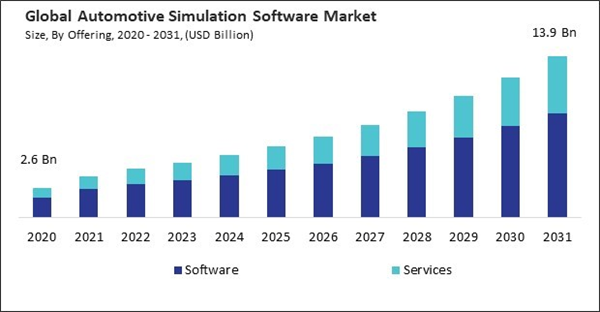

By Offering Analysis

Based on offering, the market is characterized into software and services. The services segment procured a 31.7% revenue share in the market in 2023. Service providers often have access to the latest simulation technologies and tools, allowing automotive companies to benefit from state-of-the-art solutions without investing in them directly. Outsourcing simulation services provides automotive companies with the flexibility to scale their simulation capabilities up or down based on project requirements without having to invest in additional resources internally. These factors are propelling the demand for automotive simulation services.By Software

The software segment is further divided into computer aided engineering simulation software, electromagnetic simulation software, training/human-in-the-loop (HITL) simulation software, ADAS simulation software, and others. The computer aided engineering simulation software segment acquired 38.14% revenue share in the market in 2023. The automotive industry significantly drives the rising demand for computer aided engineering (CAE) simulation software. Automakers and suppliers use CAE tools to simulate various aspects of vehicle design and performance, such as structural analysis, crashworthiness, aerodynamics, thermal management, and fluid dynamics. These simulations help optimize vehicle designs for safety, performance, and efficiency while reducing the need for physical prototypes and testing.By Services

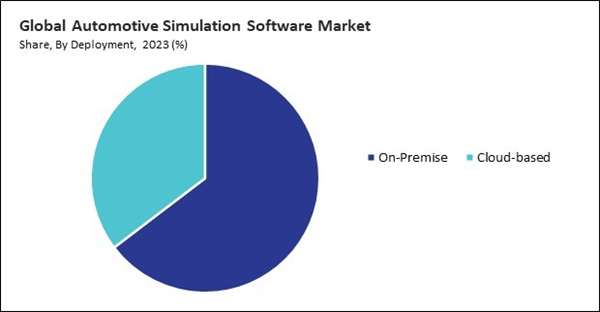

The services segment is divided into simulation development services and training, support & maintenance. The simulation development services segment witnessed 72% revenue share in the market in 2023. Simulation development services providers offer expertise in simulation software and methodologies, helping automotive manufacturers and suppliers leverage simulation to improve product quality, reduce time-to-market, and minimize the need for physical prototypes. Automotive companies are turning to simulation to model and test various aspects of vehicle design and performance, from crashworthiness and structural integrity to aerodynamics and thermal management.By Deployment Analysis

On the basis of deployment, the market is classified into on-premise and cloud-based. The on-premise segment procured 64.6% revenue share in the market in 2023. On-premise deployment allows automotive companies full control over their data, critical for protecting sensitive information related to vehicle designs, prototypes, and simulations. For complex simulations that require high-performance computing resources, on-premise deployment can provide better performance and lower latency compared to cloud-based solutions. These benefits are propelling the growth of the segment.By Application Analysis

By application, the market is divided into designing & development, testing & validation, supply chain simulation, and others. The testing & validation segment witnessed a 25.6% revenue share in the market in 2023. Simulation enables faster testing and validation cycles, allowing automotive companies to market new vehicles and technologies more quickly. The technology allows for virtual testing of vehicle systems and components, reducing the need for expensive physical prototypes and testing facilities.By End-User Analysis

Based on end-user, the market is segmented into OEM, automotive component manufacturers, and others. The OEM segment garnered 52.8% revenue share in the market in 2023. Simulation software enables OEMs to reduce the cost of product development by minimizing the need for physical prototypes and testing. OEMs increasingly use digital twins - virtual representations of physical vehicles - for design, testing, and maintenance. Simulation software plays a key role in creating and utilizing digital twins.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded a 29.3% revenue share in the market in 2023. Asia-Pacific is among the regions where the automotive industry is expanding the quickest, with China, India, and Japan at the forefront. This growth drives the demand for simulation software to support the development of new vehicles and technologies. Moreover, consumers in Asia Pacific are increasingly demanding vehicles with advanced safety features, fuel efficiency, and innovative technologies, driving the need for simulation software to develop these vehicles.Market Competition and Attributes

The Market is characterized by intense competition driven by the growing complexity of automotive systems and the demand for virtual testing solutions. Key players such as Autodesk, Inc., Dassault Systemes SE, and Rockwell Automation, Inc. dominate the market, offering a range of simulation solutions tailored to different aspects of automotive design and development. Competition is spurred by advancements in simulation technology, the need for faster time-to-market for new vehicle models, and the rise of autonomous and electric vehicle development. Emerging startups and niche players further contribute to the competitive landscape.

Recent Strategies Deployed in the Market

- Mar-2024: Applied Intuition, Inc. came into partnership with Porsche AG, an automobile manufacturer. Under this partnership, the companies will join efforts on the development of automotive software while retaining ownership of their respective software to minimize reliance on black-box suppliers, simplify complexity, and accelerate implementation speed.

- Mar-2024: Applied Intuition, Inc. launched an automated parking development solution for advanced driver-assistance systems (ADAS) and automated driving (AD). The solution allows ADAS and AD development teams to develop, test, and deploy ML-based or classical automated parking systems (APS) up to 12 times faster with enhanced safety and reliability. Additionally, automated parking systems (APS) enable vehicles to self-park, improving safety and comfort for drivers.

- Feb-2024: Dassault Systemes SE came into a partnership with BMW AG, an automobile manufacturing company. Under this partnership, BMW will utilize the 3DEXPERIENCE platform to accelerate the development of all vehicles, from their ideation to their production.

- Jan-2024: Applied Intuition, Inc. entered into a partnership with Valeo, an automotive technology company. Through this partnership, the companies will provide a digital twin platform for ADAS sensor simulation to allow automotive original equipment manufacturers (OEMs) to bring safe and reliable ADAS features to market quickly.

- Oct-2023: Altair Engineering, Inc. acquired OmniQuestTM, Inc., an optimization software company based in Michigan. Through this acquisition, Altair further enhanced its optimization position in the market, driving lightweight and structurally efficient designs all over the world. Additionally, the acquisition brought great expertise to the automotive sector, particularly in Formula 1 racing, where Genesis has a strong position and is widely utilized for composite design applications.

List of Key Companies Profiled

- Altair Engineering, Inc. (IMG Companies, LLC)

- Autodesk, Inc.

- PTC, Inc.

- Dassault Systemes SE

- The MathWorks, Inc.

- Rockwell Automation, Inc.

- ESI Group (Keysight Technologies Netherlands B.V.)

- Simulations Plus, Inc.

- GSE Systems, Inc.

- Applied Intuition, Inc.

Market Report Segmentation

By Offering

- Software

- Computer Aided Engineering Simulation Software

- Electromagnetic Simulation Software

- Training/Human-in-the-Loop (HITL) Simulation Software

- ADAS Simulation Software

- Others

- Services

- Simulation Development Services

- Training, Support & Maintenance

By Deployment

- On-Premise

- Cloud-based

By Application

- Designing & Development

- Testing & Validation

- Supply Chain Simulation

- Others

By End-user

- OEM

- Automotive Component Manufacturers

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Altair Engineering, Inc. (IMG Companies, LLC)

- Autodesk, Inc.

- PTC, Inc.

- Dassault Systemes SE

- The MathWorks, Inc.

- Rockwell Automation, Inc.

- ESI Group (Keysight Technologies Netherlands B.V.)

- Simulations Plus, Inc.

- GSE Systems, Inc.

- Applied Intuition, Inc.