Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative introduction to the evolving contract logistics environment, strategic pressures, and necessary executive priorities for operational resilience

The contract logistics landscape sits at the intersection of global trade dynamics, rapid technological change, and shifting customer expectations. This introduction frames the critical strategic themes executives must consider as they navigate a business environment characterized by volatility and opportunity. It highlights the operational levers that matter most-network design, digital integration, workforce models, and sustainability-and positions them as the central determinants of near-term competitiveness and long-term resilience.As stakeholders pursue cost-efficiency, service differentiation, and carbon reduction concurrently, the ability to translate strategy into repeatable operational practices becomes essential. In particular, executives must weigh trade-offs between centralized scale and distributed responsiveness, between proprietary systems and platform-enabled ecosystems, and between asset-light flexibility and asset-heavy control. This introduction therefore primes decision-makers to think holistically about trade-offs, investments, and organizational alignment that will underpin sustainable advantage in contract logistics.

How technology, sustainability mandates, supply chain reconfiguration, and customer experience expectations are collectively reshaping contract logistics strategies

Contract logistics is undergoing a period of transformational change driven by several converging forces that are redefining how value is created and delivered. First, advanced digital capabilities such as predictive analytics, warehouse robotics, and real-time track-and-trace systems are shifting the performance frontier, enabling providers to compress lead times and reduce error rates while improving visibility across complex networks. These technologies are not incremental; they are reconfiguring workflows, labor requirements, and capital allocation decisions.Second, sustainability mandates and customer expectations are pushing logistics providers to embed carbon reduction strategies across transport modes, packaging, and facility operations. This shift elevates lifecycle thinking in network design and procurement, and it accelerates adoption of alternative fuels and electrification where appropriate. Third, supply chain reconfiguration-driven by resilience objectives and geopolitical dynamics-has increased the importance of flexible capacity, nearshoring, and diversified sourcing. Consequently, providers that can offer adaptive solutions across varied geographies and commodity types will gain preference.

Fourth, the continued growth of e-commerce and the demand for superior last-mile experiences are reshaping service portfolios and pricing structures. This trend elevates cross-border capabilities, route optimization, and localized fulfillment models. Finally, labor dynamics and skills shortages are prompting firms to rethink talent strategies and invest in upskilling, automation, and human-machine collaboration to maintain productivity gains. Together, these shifts form a new operational playbook where digital maturity, sustainability, strategic agility, and human capital are the primary differentiators.

Evaluating the cumulative operational, pricing, and strategic implications of United States tariff measures announced in 2025 on contract logistics networks

The tariff measures enacted by the United States in 2025 have produced a cumulative set of effects across contract logistics operations, cost structures, and strategic planning. Operationally, tariff-induced changes in trade flows have modified inbound and outbound transportation patterns, with some shippers shifting sourcing closer to end markets to mitigate duty exposure. This reorientation has increased demand for flexible warehousing solutions, expedited cross-border documentation services, and enhanced customs brokerage capabilities.On pricing, tariffs have exerted upward pressure on landed costs for specific product categories, compelling logistics providers and customers to reassess pricing arrangements, contractual terms, and pass-through strategies. Providers that offer differentiated value through cost avoidance mechanisms such as tariff classification optimization, duty drawback management, and bonded warehousing have strengthened their commercial propositions. Simultaneously, carriers and freight forwarders have adapted routing and modal mixes to minimize tariff impacts while balancing lead-time and cost imperatives.

Strategically, the tariff environment has accelerated decisions around nearshoring, supplier diversification, and inventory placement to reduce exposure to fluctuating duties. Firms with agile network architectures and multi-country distribution footprints have been better positioned to reroute volumes and preserve service continuity. Additionally, compliance complexity increased, prompting investments in customs expertise and digital trade documentation to prevent delays and penalties. Overall, the cumulative effect of tariffs in 2025 has been to elevate resilience investments and to reward providers that integrate trade compliance and advisory capabilities into their service portfolios.

Segment-level intelligence revealing service, transport mode, customer scale, sourcing model, and end-use nuances that drive differentiated logistics value propositions

A granular view of segmentation surfaces the service and customer attributes that determine demand patterns and margin opportunity across contract logistics. When viewed through the lens of service type, core offerings include aftermarket logistics, distribution, transportation management, and warehousing. Distribution services extend into cross-border solutions, last-mile delivery, and route optimization, reflecting the premium associated with speed, visibility, and consumer experience. Transportation management encompasses fleet management, load optimization, and multi-modal transport, underscoring the importance of orchestration across modes. Warehousing includes cross-docking, inventory management, and order fulfillment, each requiring distinct process design and technology investments to meet service level expectations.Sourcing model remains a clear segmentation axis with insourcing and outsourcing representing divergent value propositions. Insourcing favors control and customization for vertically integrated players or sensitive product categories, whereas outsourcing offers scalability, specialized expertise, and potential capital efficiency, particularly for companies facing demand volatility. Mode of transportation is another critical differentiator: airways, roadways, and waterways each deliver trade-offs in speed, cost, and carbon intensity. Airways can be further differentiated by charter services and commercial carriers, roadways by rail and trucking options, and waterways by bulk carriers and container shipping, which informs modal selection for different commodities.

Customer size shapes service needs and procurement dynamics, with large enterprises typically seeking integrated global solutions and complex SLAs, while small and medium enterprises prioritize flexible, cost-effective offerings that minimize operational overhead. End-use segmentation across aerospace, automotive, electronics, energy and chemicals, food and beverages, industrial and manufacturing, pharmaceuticals and healthcare, and retail and e-commerce reveals divergent regulatory, handling, and traceability requirements. Each vertical imposes specific constraints on inventory turns, packaging, temperature control, and compliance, thereby driving specialized service bundles and differentiated pricing.

Regional dynamics and strategic priorities across major territories that influence capacity planning, trade flows, and service delivery in contract logistics

Regional dynamics exert a profound influence on contract logistics strategies, as providers and shippers must align capacity, regulatory expertise, and service design with local market realities. In the Americas, demand concentrates on integrated distribution networks to serve large domestic markets with sophisticated retail and e-commerce channels. This region also exhibits pronounced expectations for rapid fulfillment and robust cross-border trade facilitation between neighboring countries, prompting investments in customs capabilities and last-mile innovation.Europe, the Middle East & Africa presents a diverse tapestry of regulatory regimes, infrastructure maturity, and trade corridors. Within this geography, compliance complexity and the push for decarbonization have elevated demand for advisory services and green-forward logistics solutions. The need for multi-jurisdictional orchestration also favors providers that can manage complex cross-border flows and fragmented urban distribution environments. In Asia-Pacific, high-density manufacturing hubs and fast-growing consumer markets drive demand for scalable warehousing, multi-modal connections, and agile transportation management. Rapid e-commerce penetration in several markets intensifies requirements for localized fulfillment, reverse logistics, and route optimization to satisfy consumer expectations.

Across these regions, regional nuances necessitate differentiated go-to-market approaches: investment priorities and service packaging should reflect local labor markets, infrastructure constraints, regulatory frameworks, and customer behavior. Consequently, firms that adapt regional capabilities to global standards while maintaining local execution excellence will capture value from cross-border trade and regional growth vectors.

Competitive intelligence synthesizing provider capabilities, strategic investments, partnership models, and performance differentiators within contract logistics ecosystem

Competitive dynamics within contract logistics are defined less by raw scale alone and more by the depth of capabilities, partnership models, and speed of innovation. Leading providers increasingly differentiate through targeted investments in digital platforms that enable end-to-end visibility, predictive planning, and customer self-service portals. These investments improve operational predictability, reduce exception handling, and create opportunities for premium services tied to intelligence and outcomes rather than simple throughput.Strategic partnerships and ecosystem plays have emerged as critical mechanisms for expanding service breadth without incurring prohibitive capital costs. Alliances with technology vendors, specialized carriers, and local logistics specialists allow providers to assemble capability stacks tailored to specific industries or geographies. Additionally, providers that combine advisory capabilities-such as trade compliance, tariff optimization, and sustainability consulting-with operational execution win more integrated mandates from enterprise customers.

Operational excellence remains a differentiator, where firms that deploy standardized processes, rigorous KPIs, and continuous improvement cultures achieve superior service reliability. Human capital strategies that emphasize training, ergonomics, and collaborative automation increase productivity and reduce turnover in labor-constrained markets. Finally, M&A and selective organic expansion continue to reshape the competitive set, with value creation concentrated among organizations that integrate acquisitions quickly and align them to a unified technology and service delivery model.

Clear, prioritized and actionable recommendations enabling industry leaders to capitalize on digital transformation, resilience, and sustainability in contract logistics

Industry leaders should prioritize a set of actionable moves that balance short-term resilience with long-term competitiveness. First, accelerate targeted digital investments that deliver quick operational ROI-examples include inventory visibility platforms, transportation management systems with multi-modal optimization, and modular warehouse automation that can scale with demand. Prioritizing integrable solutions reduces implementation risk and enables faster realization of benefits.Second, embed trade and tariff expertise into commercial offerings to help customers navigate regulatory complexity and protect margins. This approach positions providers as strategic partners rather than transactional vendors. Third, pursue network flexibility by combining strategically located scalable warehousing with agile transportation contracts and modular service packages. This mix supports rapid reallocation of capacity in response to demand shifts or trade policy changes.

Fourth, formalize sustainability targets tied to measurable KPIs and operational initiatives such as route consolidation, low-emission transport options, and energy-efficient facilities. Linking sustainability to cost savings and brand value will increase internal buy-in and customer appeal. Fifth, invest in workforce development by implementing upskilling programs, ergonomic redesign, and human-machine collaboration models to mitigate labor shortages and increase productivity. Finally, adopt a partnership-first approach for specialized capabilities, leveraging alliances to expand geographic reach and service breadth without overextending capital resources.

Transparent research methodology outlining primary and secondary approaches, data validation, and analytical frameworks that underpin the market study

The research underpinning this analysis applied a mixed-methods approach combining primary interviews, expert consultations, and rigorous secondary research to ensure evidence-based conclusions. Primary inputs included structured interviews with supply chain executives, logistics service providers, and industry advisors, which provided qualitative insights into operational priorities, investment plans, and competitive dynamics. These interviews were complemented by expert roundtables focused on technology adoption, trade compliance, and sustainability practice to validate emergent themes.Secondary research involved comprehensive review of regulatory publications, trade data, industry white papers, and technology vendor specifications to corroborate operational and market-level observations. Data triangulation was employed to cross-validate findings across sources and remove biases inherent to single-source inputs. Analytical frameworks used in the study included capability mapping, scenario analysis for tariff and trade disruptions, and value-chain decomposition to isolate profitability drivers by service type and end-use sector.

Quality control procedures included peer review by subject-matter experts and iterative validation cycles with interview participants to refine interpretations and ensure accuracy. Where applicable, methodological limitations and assumptions have been documented to provide transparency on the boundary conditions of the analysis. This robust methodology supports confident, actionable conclusions for executives seeking to adapt strategy and operations to current industry realities.

Concluding synthesis that encapsulates major findings, strategic implications, and the imperative actions for stakeholders in contract logistics

The synthesis of insights across service segments, transport modes, regional dynamics, and competitive behaviors yields a clear imperative: adaptability and integrated capability matter more than ever. Providers that combine digital maturity, trade expertise, and sustainable operations can translate complexity into customer value and defensible margins. The interplay between tariffs, regionalization, and shifting customer expectations underscores the need for flexible network design and sophisticated commercial models.For shippers, the takeaway centers on partner selection and capability alignment: choose providers that demonstrate not only operational reliability but also the ability to advise on trade policy impacts, optimize modal choices, and execute sustainable solutions. For providers, the path forward requires focused investment in technology that delivers measurable operational gains, disciplined integration of partnerships and acquisitions, and people strategies that stabilize the workforce while enabling higher-value work.

In conclusion, stakeholders who act decisively to align strategy, operations, and investments with the structural changes described in this analysis will secure competitive advantage. The coming years will reward those able to combine agility with depth-organizing networks that are both resilient to disruption and tuned to capture emerging commercial opportunities.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Contract Logistics Market

Companies Mentioned

The key companies profiled in this Contract Logistics market report include:- A.P. Møller - Mærsk A/S

- Americold Realty Trust, Inc.

- Armada Supply Chain Solutions, LLC

- C.H. Robinson Worldwide, Inc.

- CJ Logistics Corporation

- CMA CGM Group

- DHL Group

- DP World Limited

- DSV A/S

- Expeditors International of Washington, Inc.

- FedEx Corporation

- GEODIS by SNCF Group

- GXO Logistics, Inc.

- Hellmann Worldwide Logistics SE & Co. KG

- Indo Trans Logistics Corporation

- Japan Post Group

- Kuehne+Nagel Group

- Lineage, Inc.

- LOGISTEED, Ltd.

- Neovia Logistics Services, LLC

- Nippon Express Holdings Inc.

- Nippon Yusen Kabushiki Kaisha

- Penske Corporation, Inc.

- Ryder System, Inc.

- Sankyu Group

- Schneider National, Inc.

- Schnellecke Logistics SE

- Total Quality Logistics

- Uber Freight Holding Corporation

- United Parcel Service, Inc.

- XPO, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

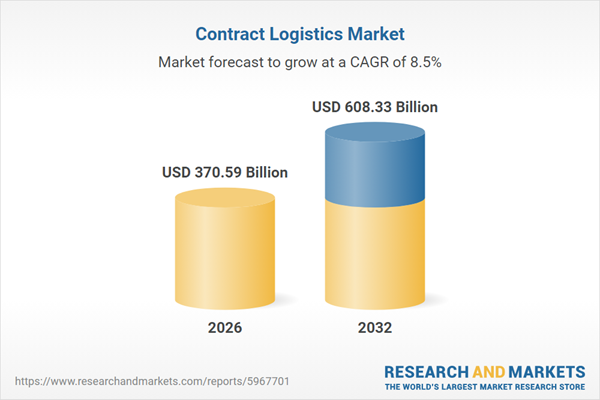

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 370.59 Billion |

| Forecasted Market Value ( USD | $ 608.33 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |