Speak directly to the analyst to clarify any post sales queries you may have.

Foundational overview of how sustainability, materials innovation, and digital technologies are remapping pharmaceutical device development and supply chains

The pharmaceutical device ecosystem is undergoing a dual transformation driven by sustainability imperatives and rapid digitalization. Across product portfolios, stakeholders are moving beyond incremental improvements toward holistic lifecycle approaches that reconcile materials selection, manufacturing processes, and end-of-life considerations. This shift encompasses a diverse product taxonomy where delivery devices such as auto-injectors, inhalers, prefilled syringes, and transdermal patches intersect with IoT and monitoring systems, manufacturing and packaging equipment, quality control instrumentation, and sterilization technologies.Materials innovation has emerged as a critical axis of change, with biodegradable polymers including PBAT, PHA, and PLA competing against composite materials, glass, metal, and recycled plastics for application in primary and secondary packaging as well as in device components. Simultaneously, enabling technologies such as 3D printing across fused deposition modeling, selective laser sintering, and stereolithography; artificial intelligence and automation; IoT-enabled platforms; and nanotechnology are converging to unlock new design paradigms and operational efficiencies. These developments reshape how contract manufacturing organizations, contract research organizations, hospitals and clinics, pharmaceutical companies, and research institutes source, validate, and deploy equipment and consumables. As distribution channels evolve from traditional direct sales and distributor relationships toward e-commerce-enabled fulfillment, the industry must reconcile sustainability goals with regulatory stringency and complex supply chain realities.

How convergent advances in materials, additive manufacturing, IoT, and automation are catalyzing systemic transformation across device lifecycles and supplier networks

The landscape is being transformed by a set of interlocking shifts that reconfigure product lifecycles, supplier relationships, and regulatory engagement. Designers and manufacturers are prioritizing closed-loop thinking; for example, packaging strategies now evaluate blister packaging machines-both multi-lane and single-lane configurations-alongside bottle filling lines that operate inline or as rotary systems to reduce waste and energy intensity. At the same time, manufacturing equipment such as coating machines, granulation systems, and tablet presses are being re-evaluated for compatibility with lower-impact materials and higher-mix production runs driven by personalized medicine.Digitalization is accelerating traceability and predictive quality. Data analytics platforms and sensor networks embedded in IoT-enabled monitoring systems create continuous visibility across cold chain management and drug manufacturing processes, enabling earlier detection of deviation and more targeted sterilization interventions involving autoclaves, ethylene oxide sterilizers, or gamma irradiation systems. Additive manufacturing and automation reduce tooling waste and support design iterations for parenteral and inhalation delivery formats, including dry powder and metered dose inhalers. These advances recalibrate procurement priorities for quality control equipment such as chromatography systems and spectrometers, and they compel end users and suppliers alike to reconsider contractual models, lifecycle responsibilities, and investment timing to capture the efficiency and sustainability gains available through integrated technology stacks.

Strategic consequences of the United States tariff landscape driving reshaped sourcing, localization strategies, and technology-driven cost mitigation in 2025

The introduction of United States tariffs effective in 2025 introduces a new dimension to strategic sourcing and capital investment planning for device manufacturers and their suppliers. Tariff dynamics alter cost structures across imported materials ranging from glass and metals to imported composite components and recycled plastics, and they can influence the relative economics of adopting domestic production routes for items such as blister packaging machinery, bottle filling systems, and sterilization equipment. In response, some organizations will accelerate localization strategies for critical equipment and raw materials, while others will recast supply chain resilience through dual-sourcing, nearshoring, or increased inventory buffering.Beyond procurement implications, tariff pressures can shift technology adoption pathways. For example, increased costs for imported precision tooling may incentivize investment in 3D printing technologies-fused deposition modeling, selective laser sintering, and stereolithography-reducing dependency on cross-border supply chains for complex components. Similarly, higher input costs may prompt greater uptake of automation, AI-driven process optimization, and IoT-enabled monitoring to lower operational expenditures and protect margins. Contract manufacturing organizations, contract research organizations, and pharmaceutical companies will need to reassess capital allocation decisions with an eye toward balancing near-term cost exposure against long-term productivity and compliance imperatives. Throughout this period of recalibration, stakeholders should prioritize transparent supplier dialogues and scenario planning to mitigate operational disruption while preserving strategic momentum toward sustainability objectives.

Detailed segmentation-driven insights revealing distinct adoption patterns across product types, materials, technologies, applications, end users, and distribution pathways

Segmentation-based analysis reveals differentiated value drivers and adoption barriers across product types, material selections, enabling technologies, applications, end users, and distribution pathways. Within product type segmentation, delivery devices that include auto-injectors, inhalers-subdivided into dry powder and metered dose-prefilled syringes, and transdermal patches coexist with IoT and monitoring systems comprised of data analytics platforms and sensors, as well as manufacturing equipment such as coating machines, granulation systems, and tablet presses. Packaging equipment spans blister packaging machines with multi-lane and single-lane architectures, bottle filling machines that operate inline or rotary, cartoning machines, and sachet packaging lines, while quality control relies heavily on chromatography systems and spectrometers and sterilization choices encompass autoclaves, ethylene oxide, and gamma irradiation modalities.Material type segmentation frames sustainability trade-offs and regulatory considerations. Biodegradable polymers, including PBAT, PHA, and PLA, offer end-of-life benefits but require validation for compatibility with drug chemistry and sterilization methods. Composite materials, glass, metal, and recycled plastics carry different implications for device longevity, recyclability, and lifecycle footprint. Technology segmentation shows distinct adoption curves: 3D printing modalities like FDM, SLS, and SLA support rapid prototyping and low-volume production, AI and automation boost process control, IoT-enabled systems provide real-time visibility, and nanotechnology opens pathways for advanced delivery and sensor miniaturization. Application segmentation across cold chain management, drug delivery-both inhalation and parenteral modes-drug manufacturing and packaging, and quality control reveals where investments create the most immediate operational and environmental returns. End-user segmentation that includes contract manufacturing organizations, contract research organizations, hospitals and clinics, pharmaceutical companies, and research institutes highlights varying purchasing cycles, validation burdens, and scalability requirements. Finally, distribution channel segmentation across direct sales, distributors, and e-commerce determines time-to-market dynamics and service expectations for sustainable device offerings.

How regional regulatory priorities, manufacturing capacity, and innovation ecosystems across the Americas, Europe Middle East & Africa, and Asia-Pacific shape device sustainability trajectories

Regional dynamics shape priorities and competitive advantage across Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique regulatory environments, supply base characteristics, and innovation ecosystems. In the Americas, emphasis on domestic manufacturing resilience and a robust ecosystem of contract manufacturing organizations has driven investments in automation, advanced packaging lines, and sterilization capacity, while demand for biodegradable polymers and recycled plastics is tempered by regulatory compatibility testing and logistics considerations.Europe Middle East & Africa exhibits strong regulatory emphasis on sustainability disclosures and circularity principles, amplifying interest in biodegradable polymers such as PBAT, PHA, and PLA and in secondary packaging innovations that reduce material use. The region’s dense cluster of research institutes and pharmaceutical companies accelerates adoption of AI, nanotechnology, and high-precision quality control instrumentation. Asia-Pacific remains a production powerhouse with substantial capabilities in manufacturing equipment and bottle filling technologies, and it leads in scaling additive manufacturing for both tooling and end-use components. Nevertheless, Asia-Pacific stakeholders are increasingly focused on managing cross-border supply chain risk and meeting evolving sustainability standards demanded by global customers. Across all regions, cold chain management and IoT-enabled monitoring are rising priorities for biologics and temperature-sensitive products, reshaping infrastructure investment and logistics partnerships worldwide.

Competitive behaviors and strategic pivots from product and service providers accelerating sustainable materials adoption and integrated digital offerings

Company behavior reflects strategic positioning along sustainability and digitalization vectors, with leading manufacturers and equipment suppliers adapting product portfolios and service models to meet rising demand for low-impact materials and connected systems. Some firms are differentiating through materials science partnerships that expand the use cases for biodegradable polymers and composite blends, while others are investing in modular equipment architectures-such as multi-lane blister packaging platforms and convertible bottle filling lines-to offer flexible throughput solutions for customers transitioning to smaller, more sustainable batch profiles.On the technology front, vendors are integrating data analytics platforms and sensor suites with chromatography systems and spectrometers to deliver end-to-end quality assurance and to facilitate remote validation and predictive maintenance. Service-oriented competitors are bundling sterilization workflows, including autoclave and gamma irradiation options, with logistics and cold chain monitoring to reduce handoffs and total lifecycle emissions. Contract manufacturers and contract research organizations are pivoting toward value-added services, leveraging 3D printing for rapid tooling, and offering validation expertise for novel materials and delivery formats. Across the competitive landscape, companies that combine materials know-how, automation, and IoT-enabled service layers are best positioned to capture multinational customers’ sustainability and compliance requirements.

Actionable strategic initiatives for senior executives to operationalize sustainability goals while maintaining regulatory compliance and manufacturing resilience

Industry leaders should prioritize a set of practical actions to convert sustainability commitments into operational outcomes while safeguarding quality and compliance. First, integrate material selection criteria into early-stage design reviews to assess compatibility of biodegradable polymers and recycled plastics with sterilization processes and drug formulations, thereby minimizing costly downstream rework. Next, expand pilot programs for additive manufacturing and automation to reduce tooling waste and validate production scale-up pathways that complement existing coating, granulation, and tablet-press workflows. Parallel investments in IoT-enabled monitoring and data analytics platforms will create the visibility required to optimize cold chain management and to support predictive maintenance across blister packaging and bottle filling assets.Furthermore, reassess supplier strategies in light of tariff-driven cost shifts by diversifying vendor portfolios and developing nearshoring options for critical equipment and materials. Collaborate with contract manufacturing organizations, contract research organizations, and research institutes to co-develop validation protocols for new materials and delivery formats such as auto-injectors and inhalation systems. Finally, embed circularity metrics into procurement and product performance dashboards to align commercial incentives with lifecycle outcomes, and prioritize partnerships with sterilization and quality control providers to ensure that innovation does not compromise patient safety or regulatory compliance.

Robust, triangulated research methodology combining primary expert interviews, technical document review, and scenario-based capability assessments to ensure actionable findings

This research synthesizes primary and secondary intelligence through a structured methodology designed to capture technical nuance and commercial relevance. Primary inputs include structured interviews and workshops with device designers, manufacturing engineers, procurement leaders, and quality assurance professionals across contract manufacturing organizations, contract research organizations, hospitals and clinics, pharmaceutical companies, and research institutes. These engagements provided qualitative insights into equipment utilization patterns, materials qualification hurdles, and the operational impacts of digitalization and tariff dynamics.Secondary inputs include a systematic review of technology whitepapers, regulatory guidance documents, standards for sterilization and materials use, and supplier technical specifications for equipment such as blister packaging machines, bottle filling systems, chromatography systems, and sterilization platforms. Cross-validation employed case studies of recent implementations involving 3D printing modalities, IoT-enabled monitoring rollouts, and pilot biodegradation trials for PBAT, PHA, and PLA-based components. Analytical approaches combined comparative technical assessments, scenario analysis of supply chain perturbations, and capability mapping to identify where investments yield the greatest sustainability and operational returns. Quality assurance for the research emphasized triangulation across sources and reconciliation of conflicting evidence with subject-matter experts.

Conclusive synthesis emphasizing coordinated investments in materials, manufacturing, and digital systems to realize resilient and sustainable pharmaceutical device ecosystems

The synthesis of trends and segmentation insights underscores a clear imperative: sustainability and digitalization are mutually reinforcing priorities that require coordinated investments across materials science, manufacturing equipment, quality control, and distribution systems. Delivery devices and packaging equipment must be rethought with lifecycle outcomes in mind, leveraging biodegradable polymers where chemically compatible and adopting flexible manufacturing platforms to minimize waste. Concurrently, integrating AI, automation, and IoT-enabled monitoring will not only improve process reliability but also reduce the environmental footprint through energy optimization and predictive maintenance.Leadership will be judged by the ability to translate sustainability commitments into validated, scalable operations without sacrificing patient safety or regulatory rigor. By aligning procurement, R&D, and operations teams around shared metrics and by pursuing collaborative validation pathways with contract manufacturers and research institutions, organizations can mitigate tariff-driven cost volatility while accelerating progress toward circularity. The path forward emphasizes pragmatic experimentation, selective scaling of proven technologies, and transparent supplier partnerships to realize resilient, sustainable device ecosystems across global regions.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Sustainable Devices in Pharmaceutical Market

Companies Mentioned

The key companies profiled in this Sustainable Devices in Pharmaceutical market report include:- 3M Company

- Amcor PLC

- AptarGroup, Inc.

- Baxter International Inc.

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Fresenius SE & Co. KGaA

- GE HealthCare Technologies Inc.

- Interuniversity Microelectronics Centre

- Johnson & Johnson Services, Inc.

- Medtronic PLC

- Royal Philips

- Siemens Healthineers AG

- Stryker Corporation

- Terumo Corporation

- Zimmer Biomet Holdings, Inc.

Table Information

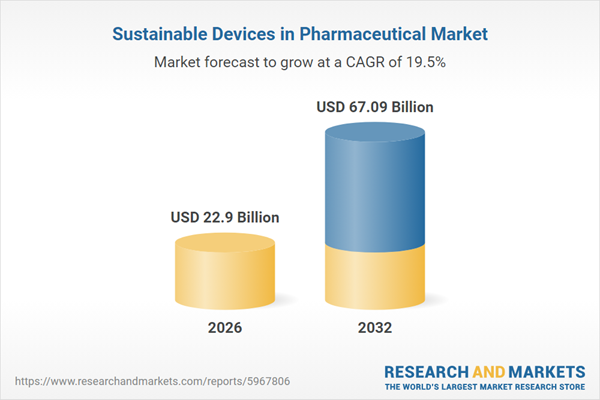

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 22.9 Billion |

| Forecasted Market Value ( USD | $ 67.09 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |