This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

These high standards of craftsmanship ensure that luxury goods not only look exquisite but also stand the test of time. The materials used are often of the highest quality, with precious metals, fine woods, and top-grade fabrics providing a level of durability and longevity that far surpasses mass-produced alternatives. The allure of luxury goods extends beyond their physical attributes to the prestige associated with owning them. Many luxury brands boast storied histories and legacies that span generations, adding a sense of heritage and distinction to their products. Brands like Chanel, Hermès, and Rolls-Royce have become synonymous with elegance and sophistication, embodying a lifestyle that many aspire to.

Owning a luxury item can be seen as a status symbol, a signifier of one's taste and success. It is often about more than the product itself, it is about being part of a community that appreciates the finer things in life and values tradition and excellence. Luxury goods have been a symbol of wealth, status, and opulence for centuries. From the ornate jewelry of ancient Egypt to the designer handbags of modern times, these items have always held a fascination for people around the world.

Luxury goods are high-quality, expensive items that are often associated with a particular brand or designer. They can range from clothing, accessories, and cosmetics to automobiles, real estate, and even travel experiences. The high price tag of these goods is often due to the quality of materials used, the craftsmanship involved, the brand's reputation, and the perceived value they offer. The allure of luxury goods lies in their ability to signify social status and success. Owning a luxury item can be a way of demonstrating one's wealth and taste.

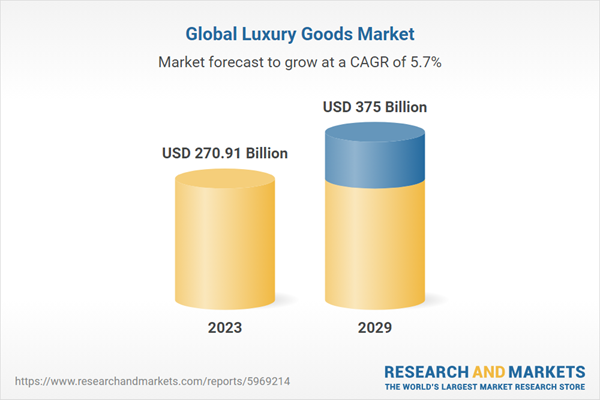

According to the research report, “Global Luxury Goods Market Outlook, 2029”, the market is anticipated to cross USD 375 Billion by 2029, increasing from USD 270.91 Billion in 2023. The market is expected to grow with 5.69% CAGR by 2024-29. Luxury goods often come with an element of exclusivity, whether through limited production runs, personalized customization options, or members-only offerings. This exclusivity creates a sense of rarity and uniqueness that is highly attractive to collectors and connoisseurs alike. Customization and bespoke services allow customers to tailor luxury items to their preferences, creating one-of-a-kind pieces that reflect their individual style and personality.

This personal touch elevates the experience of owning luxury goods, making it a truly special and meaningful investment. While the essence of luxury remains rooted in quality and exclusivity, the industry is also evolving to meet the changing tastes and values of modern consumers. Sustainability and ethical practices are becoming increasingly important, with many luxury brands now prioritizing eco-friendly materials and responsible sourcing. Moreover, the digital age has transformed how luxury goods are marketed and sold. Online platforms and social media have made luxury more accessible and visible to a wider audience, while also offering new avenues for storytelling and customer engagement.

The luxury goods market operates on different principles than the ordinary goods market. Demand for luxury goods often increases with a rise in price, a phenomenon known as the Veblen effect. This is in contrast to the law of demand, which states that an increase in price will lead to a decrease in demand. Moreover, luxury brands often invest heavily in marketing and branding to create a desirable image and maintain their reputation. They also focus on providing exceptional customer service to enhance the shopping experience and build customer loyalty. Luxury goods have a significant impact on society. They influence fashion trends, set beauty standards, and shape consumer behavior. Moreover, luxury goods often have a unique design or superior quality that sets them apart from ordinary goods. They can also provide a sense of exclusivity, as many luxury brands limit the production of their items to maintain their value and desirability.

Market Drivers

- Wealth Growth in Emerging Markets: Emerging markets, particularly in Asia, are experiencing demographic shifts, with a growing middle class and young, affluent consumers who are eager to indulge in luxury goods. Increased globalization and international travel expose consumers in emerging markets to luxury brands and trends, driving demand for luxury goods.

- Digital Innovation and E-Commerce: Luxury brands are embracing e-commerce platforms and virtual showrooms to reach consumers globally. The online presence provides a convenient and accessible shopping experience, attracting tech-savvy consumers. Luxury brands are investing in cutting-edge technology such as augmented reality (AR) and virtual reality (VR) to offer immersive and personalized shopping experiences.

Market Challenges

- Counterfeiting and Intellectual Property: Counterfeit goods can damage brand reputation and erode customer trust. This requires constant vigilance in combating the production and distribution of fake products. Luxury brands need to continuously invest in legal measures, anti-counterfeiting technologies, and brand protection strategies to safeguard their intellectual property.

- Sustainability and Ethical Sourcing: Consumers increasingly demand sustainable and ethical practices across the supply chain, from raw material sourcing to production methods and distribution. Achieving sustainability often involves significant investments in research, innovation, and supply chain adjustments, which can be challenging for established luxury brands.

Market Trends

- Sustainable and Ethical Luxury: Luxury brands are turning to sustainable materials such as recycled fabrics, ethical leather, and lab-grown gems to reduce their environmental impact. Brands are exploring circular economy models, including product repair, resale, and recycling programs, to promote resource efficiency and reduce waste.

- Personalization and Customization: Luxury brands offer tailored and bespoke services, allowing customers to customize products according to their preferences, from monogramming to unique design choices. Limited edition releases and collaborations create a sense of exclusivity and scarcity, appealing to collectors and connoisseurs.

- Phygital Integration: Luxury brands are blending physical and digital experiences ('phygital') to create seamless customer journeys. For example, customers can browse online and complete their purchase in-store, or vice versa. Brands are exploring virtual reality and augmented reality to offer innovative experiences such as virtual fashion shows, digital try-ons, and immersive showrooms.

The luxury goods market is dominated by the clothing and apparel sector for several compelling reasons that go beyond the allure of high fashion. At the core, clothing and apparel serve as an integral form of self-expression, allowing individuals to communicate their identity, style, and social status. This desire for expression fuels consumer interest and drives sales in the luxury fashion market. Luxury clothing and apparel are crafted with exceptional attention to detail and craftsmanship, utilizing the finest materials available. From the threads and textiles to the final stitching and tailoring, each garment is a masterpiece in its own right.

This superior quality not only ensures longevity but also contributes to the unique experience of owning and wearing luxury pieces. Consumers are willing to invest in these products for their superior craftsmanship, rarity, and lasting value. Additionally, luxury clothing brands often have rich histories and prestigious legacies that resonate with consumers. Brands such as Chanel, Gucci, and Louis Vuitton have established themselves as symbols of elegance, sophistication, and exclusivity over the decades. Their storied pasts and iconic designs make their products highly sought after and cherished by individuals who value tradition and heritage.

The influence of celebrity culture and social media has also played a significant role in elevating the clothing and apparel sector in the luxury goods market. Celebrities and influencers often endorse luxury fashion brands, showcasing their designs to a vast audience. This exposure not only boosts brand visibility but also creates aspirational value, prompting consumers to desire and emulate the looks they see on public figures. Furthermore, the fashion industry is known for its innovative and ever-evolving nature. Luxury brands continuously push the boundaries of design, experimenting with new styles, patterns, and fabrics.

This constant reinvention keeps the market dynamic and enticing, attracting both loyal customers and new enthusiasts eager to stay ahead of the trends. Luxury clothing and apparel also offer a sense of exclusivity, with limited editions and unique designs that are not mass-produced. Owning a rare piece from a luxury brand provides a sense of pride and individuality, setting consumers apart from the mainstream market. This exclusivity is a key driver of demand, as individuals seek out luxury items to differentiate themselves. Additionally, the personalized and immersive shopping experience offered by luxury fashion brands contributes to their market dominance. High-end boutiques often provide exceptional customer service, creating a luxurious environment that makes customers feel special and valued. This experience, coupled with tailored services such as bespoke tailoring and customization, enhances customer loyalty and elevates the perceived value of luxury clothing.

Women lead the luxury goods market because they have historically been the primary consumers of luxury fashion and accessories, seeking high-quality, stylish, and unique products to express their individuality and enhance their lifestyle.

The luxury goods market is often characterized by the prominence of women as primary consumers, a trend rooted in both cultural and economic factors. Historically, luxury goods have been associated with women more than men, partly due to societal norms that emphasize women's roles as fashion trendsetters and connoisseurs of aesthetics. Over time, this association has evolved, and women have become key drivers of luxury goods markets for several reasons. Women's fashion choices are more diverse and expansive than men's, offering a broader range of products including clothing, accessories, footwear, handbags, and jewelry.

This extensive variety allows luxury brands to cater to different tastes, preferences, and occasions, driving demand among female consumers. Women seek unique and stylish items to express their personal identity and stand out in social settings, leading to an affinity for luxury products. Moreover, women have increasing economic power and independence, contributing to their ability to invest in luxury goods. Over the past few decades, women have made significant strides in the workplace, achieving higher levels of education and securing leadership roles across industries. This empowerment has translated into greater disposable income, enabling women to spend on high-quality, luxurious items that match their lifestyle and aspirations.

Luxury brands recognize the importance of female consumers and often design their marketing strategies to appeal directly to women. They create narratives that empower women, celebrating their achievements and individuality. Additionally, luxury brands collaborate with female celebrities and influencers who set trends and endorse products, further strengthening the connection between women and luxury goods. Another key factor is the emotional connection women form with luxury products. For many women, purchasing a luxury item is not merely a transaction but an experience that brings joy and satisfaction.

Luxury brands capitalize on this emotional aspect by offering personalized shopping experiences, attentive customer service, and exclusive events that resonate with female customers. In terms of fashion and design, women's luxury goods often feature intricate details, innovative craftsmanship, and bold aesthetics, which appeal to women who value quality and originality. Luxury brands frequently launch exclusive collections, limited editions, and collaborations with renowned designers, providing women with unique and coveted items that stand out in their wardrobes. Furthermore, women tend to be more engaged with trends and fashion movements, staying updated on the latest styles through social media, magazines, and online platforms.

This awareness drives their interest in luxury goods and their desire to be part of the latest fashion movements. Brands capitalize on this by engaging with women through digital platforms, offering a seamless and interactive shopping experience. The impact of gifting and tradition also plays a role in the relationship between women and luxury goods. Gifts of luxury items such as jewelry and designer accessories have long been associated with special occasions and celebrations, perpetuating the notion that luxury goods are an essential part of a woman's life.

Retail stores lead the luxury goods market because they offer a tangible, immersive shopping experience that cannot be replicated online, allowing consumers to personally engage with high-end products, receive personalized service, and partake in the prestigious lifestyle associated with luxury brands.

Retail stores play a pivotal role in the luxury goods market due to their ability to provide a personalized, immersive shopping experience that online platforms cannot replicate. Luxury brands invest significantly in creating sophisticated retail environments that exude elegance and exclusivity. These brick-and-mortar locations serve as brand showcases, offering consumers the opportunity to experience the essence of the luxury brand in a tangible and sensory manner. Customers can physically see, touch, and try on luxury products, such as clothing, accessories, and jewelry, gaining a true appreciation for the quality and craftsmanship.

This direct interaction helps establish an emotional connection with the product, fostering a sense of trust and loyalty towards the brand. Luxury retail stores are known for their exceptional customer service, which is a cornerstone of the luxury shopping experience. Sales associates are trained to offer personalized attention, catering to each customer's specific needs and preferences. This high-touch service enhances the overall experience, making customers feel valued and special, further solidifying their loyalty to the brand. Moreover, luxury retail stores often provide exclusivity and privacy, creating an environment where customers can shop comfortably and confidently.

Many stores offer private appointments and VIP services, allowing customers to enjoy a more intimate and personalized shopping experience. This exclusivity reinforces the perception of luxury and prestige associated with the brand. The ambiance of luxury retail stores is carefully curated to reflect the brand's identity and values. From the store's design and decor to the music and lighting, every detail is meticulously planned to create a luxurious and memorable experience for customers. This attention to detail not only elevates the shopping experience but also reinforces the brand's image and reputation.

Luxury retail stores also serve as venues for special events, launches, and collaborations, offering customers unique opportunities to engage with the brand and its latest products. These events foster a sense of community among customers and create memorable experiences that strengthen their connection to the brand. Furthermore, luxury retail stores provide consumers with immediate gratification. Customers can walk away with their purchases, eliminating the waiting time associated with online shopping.

This instant access to luxury goods enhances the overall experience and satisfaction of the customer. While online shopping has grown in popularity, especially during the COVID-19 pandemic, luxury retail stores continue to lead the market due to their ability to offer experiences that cannot be replicated virtually. Many luxury consumers still prefer the tangible, personalized experience of shopping in-store, valuing the opportunity to engage with products and brand representatives in a meaningful way.

Europe leads the luxury goods market due to its deep-rooted history and tradition of craftsmanship, iconic luxury brands, and strong cultural appreciation for high-quality fashion and design, attracting global consumers who seek authentic, exceptional, and prestigious luxury experiences.

Europe has long been recognized as the epicenter of the luxury goods market, and its leading position can be attributed to several intertwined factors that highlight its dominance in the industry. At the forefront is Europe's deep-rooted history and tradition of exceptional craftsmanship and artistry, which spans centuries and forms the backbone of the continent's luxury heritage. European countries such as France, Italy, and Switzerland are renowned for their masterful artisanship in fashion, accessories, watches, jewelry, and more. These regions have cultivated a rich tradition of skilled craftsmanship that has been passed down through generations.

This expertise is reflected in the high-quality, meticulously crafted luxury goods that European brands produce, making them highly sought after worldwide. Europe is home to some of the most iconic and prestigious luxury brands, including Chanel, Louis Vuitton, Gucci, Prada, and Rolex, among others. These brands have established themselves as symbols of elegance, exclusivity, and sophistication. Their rich histories and legacies contribute to the allure of their products and the strong global demand for European luxury goods. The cultural appreciation for fashion and design is deeply ingrained in European society, particularly in fashion capitals such as Paris, Milan, and London.

These cities host major fashion events and exhibitions that set the trends for the global industry. The creative innovation and artistic expression found in European luxury goods continue to attract consumers from around the world who seek distinctive, high-quality products. Europe's luxury industry benefits from strong regulatory frameworks and quality control measures that ensure authenticity and excellence in luxury goods. The 'Made in Italy' and 'Made in France' labels, for example, carry significant weight in the luxury market, as they signify superior quality and craftsmanship. This commitment to excellence builds consumer trust and loyalty, further solidifying Europe's leading position.

The European luxury market also thrives due to its emphasis on customer experience and personalized service. European luxury brands often provide exceptional service through exclusive boutiques and flagship stores, creating immersive shopping experiences for customers. These experiences include bespoke tailoring, customization, and personalized consultations, all of which enhance the appeal of European luxury goods. Moreover, Europe's strong tourism industry plays a vital role in the luxury goods market. Tourists from around the world flock to European cities for their cultural attractions and shopping experiences.

This influx of international visitors contributes significantly to the sales of luxury goods in the region, as tourists seek out iconic European brands during their travels. Europe's strategic location and well-developed logistics networks enable luxury brands to efficiently distribute their products across the continent and beyond. The accessibility of European luxury goods worldwide has helped maintain the region's prominence in the global market.

Recent Developments

- April 2023: Hey Harper, a Portugal-based luxury jewelry maker, launched Titled ICONS, a new capsule collection of jewelry products in the U.K. The collection includes the GILDED THORNS Ear Cuff, PETALS SPIRAL Bracelet, CRYSTAL BLOOM Ring, GARDEN OF LIGHT Brooch, and others.

- In August 2023, Tapestry announced to acquire Capri Holdings, home to iconic brands Jimmy Choo, Michael Kors, and Versace, in a deal worth USD 8.5 billion. Tapestry, which owns luxury brands like Coach, Kate Spade, and Stuart Weitzman, expects to close the deal in 2024, creating an American fashion giant better positioned to compete in the luxury market against European heavyweights.

- In March 2022, Shiseido to launch new clean beauty brand Ulé as part of skin beauty push to its clean beauty portfolio. It plans to grow its skin beauty portfolio to account for 75% of total sale in 2022.

- In April 2022, Luxottica undertook acquisition of 90.9% of Giorgio Fedon to enter the packaging and eyeglass cases industry.

- In November 2022: The multinational cosmetic corporation, Estee Lauder Companies, Inc., acquired the luxury goods company, Tom Ford, known for its high-end footwear, bags, and accessories. This acquisition aims to broaden its reach in the luxury beauty products market in China.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Luxury Goods market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product Type

- Clothing and Apparel

- Jewellery

- Watches

- Footwear

- Bags

- Other Types

By End User

- Women

- Men

- Children

By Distribution Channel

- Retail Stores

- Multi-Brand Retail Stores

- Luxury Boutiques

- Online Retail

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the analyst started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the analyst had primary data, they started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Luxury Goods industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cisco Systems, Inc

- International Business Machines Corporation

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Trend Micro Inc

- Extreme Networks, Inc

- Huawei Technologies Co., Ltd

- Darktrace plc

- McAfee Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 270.91 Billion |

| Forecasted Market Value ( USD | $ 375 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |