This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

As cities around the world grapple with the challenges of urbanization, congestion, and pollution, electric buses offer a compelling solution to transform public transportation into a cleaner, more sustainable mode of mobility. By harnessing the power of electricity to propel buses, transit agencies can reduce emissions, improve air quality, and enhance the overall quality of life for urban residents. One of the concerns surrounding electric buses is their range, or the distance they can travel on a single charge. However, advancements in battery technology have led to improvements in electric bus range. For example, VDL Bus & Coach's new generation Citea achieved a continuous driving range of over 500 kilometers.

Similarly, MAN's Lion's City E 12 achieved a range of 550 km on a single charge during a test monitored by TÜV SÜD. Electricity consumption is another important factor to consider when evaluating electric buses. The amount of electricity consumed by an electric bus depends on various factors, such as the vehicle's weight, battery capacity, and driving conditions. For instance, cold weather can affect the range of electric buses, with studies showing up to a 23% decrease in range for hydrogen-powered buses in cold temperatures. However, regenerative braking can help offset this decrease by converting heat generated during braking into electricity to recharge the batteries.

Several governments in Europe are undertaking a wide range of initiatives to increase the adoption of e-buses in the region. For instance, in August 2021, the European Commission announced the Under Clean Vehicle Directive which was aimed to procure 45% of the vehicles with zero emission buses by 2025 and 65% by 2030 in European countries. Besides, the Indian Government launched the FAME II scheme in April 2019 to increase the penetration of electric vehicles such as scooters, buses, bikes, and trucks.

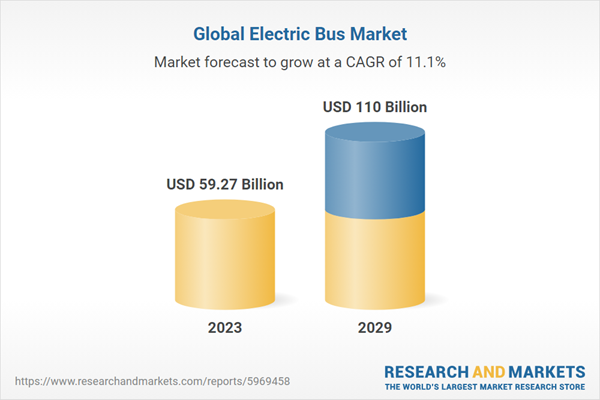

According to the research report, “Global Electric Bus Market Outlook, 2029”, the market is anticipated to cross USD 110 Billion by 2029, increasing from USD 59.27 Billion in 2023. The market is expected to grow with 11.14% CAGR by 2024-29. Unlike their diesel counterparts, electric buses produce zero tailpipe emissions, significantly reducing air pollution in urban areas. This reduction in harmful pollutants such as nitrogen oxides (NOx) and particulate matter (PM) has tangible benefits for public health, especially in densely populated cities where air quality is a major concern. While electric buses may have a higher upfront cost than traditional diesel buses, they offer lower operating costs over their lifetime.

Electric propulsion systems are more energy-efficient and require less maintenance than internal combustion engines, leading to substantial savings on fuel and maintenance expenses for transit agencies. Electric buses are quieter than their diesel counterparts, offering a more pleasant and peaceful ride for passengers and reducing noise pollution in urban environments. The smooth and vibration-free operation of electric motors also enhances passenger comfort, making public transit a more attractive option for commuters. Electric buses are more energy-efficient than diesel buses, converting a higher percentage of energy from the grid into propulsion.

Additionally, regenerative braking systems capture kinetic energy during deceleration and convert it back into electrical energy, further improving efficiency and reducing overall energy consumption. Electric bus technology is continuously evolving, with advancements in battery technology, charging infrastructure, and vehicle design driving improvements in range, performance, and efficiency. This flexibility allows transit agencies to tailor their electric bus fleets to meet specific operational requirements and adapt to future developments in the electric vehicle industry.

Several players in the global electric bus market are largely focused on investing heavily in research and development and the incorporation of new technologies in electric buses. For instance, in May 2022, electric vehicles and technology company, Pinnacle Mobility Solutions Private Limited (EKA) entered into a partnership with an autonomous driving company based in Canada. The partnership with NuPort Robotics aims to introduce ADAS of level 2 autonomy in its electric bus range in India. EKA will be testing a variety of autonomous features developed by NuPort.

Market Drivers

- Environmental Concerns: The pressing need to mitigate climate change and reduce air pollution is a significant driver for the adoption of electric buses. As cities strive to meet carbon emission reduction targets and improve air quality, electric buses offer a sustainable alternative to traditional diesel and gasoline-powered vehicles. Governments and regulatory bodies worldwide are implementing stricter emissions standards and incentivizing the transition to electric vehicles (EVs), including buses, to address these environmental challenges.

- Advancements in Technology: Rapid advancements in battery technology, electric drivetrains, and charging infrastructure are driving the adoption of electric buses. Lithium-ion batteries, in particular, have become more energy-dense, affordable, and reliable, enabling electric buses to achieve longer ranges and faster charging times. Moreover, improvements in electric motor efficiency and vehicle design are enhancing the performance and reliability of electric buses, making them increasingly competitive with conventional diesel buses in terms of range, power, and operational capabilities.

Market Challenges

- Charging Infrastructure: Unlike traditional fossil fuel-powered buses that can be refueled quickly at existing gas stations, electric buses require charging infrastructure at bus depots and along routes to ensure continuous operation. The deployment of charging infrastructure involves significant upfront investment and logistical considerations, including the need for standardized charging protocols, grid integration, and urban planning.

- Cost Considerations: While electric buses offer long-term cost savings in terms of reduced fuel and maintenance expenses, they often have higher upfront costs compared to diesel or natural gas-powered buses. The higher cost of electric buses can be attributed to the expense of battery technology, electric drivetrains, and charging infrastructure. Transit agencies and municipalities face financial challenges in procuring electric buses and retrofitting or expanding existing infrastructure to support electrification efforts.

Market Trends

- Fleet Electrification: A growing trend among transit agencies and municipalities is the electrification of entire bus fleets. Many cities are setting ambitious targets to transition their public transportation systems to zero-emission vehicles, including electric buses. Fleet electrification initiatives involve strategic planning, phased implementation, and collaboration between government agencies, transit operators, and stakeholders to overcome technical, financial, and operational barriers. As battery technology continues to improve and charging infrastructure expands, the electrification of bus fleets is expected to accelerate in the coming years.

- Integration with Renewable Energy: Another emerging trend in the electric bus sector is the integration of renewable energy sources to power charging infrastructure. Solar panels, wind turbines, and other renewable energy systems can generate clean electricity to charge electric buses, reducing reliance on grid electricity and further lowering the carbon footprint of public transportation. Innovative projects that combine electric buses with renewable energy generation and energy storage technologies are gaining traction as cities seek to achieve carbon neutrality and energy independence in their transit systems.

Battery Electric Vehicles (BEVs) have emerged as the dominant force in the electric bus industry, propelled by their remarkable combination of zero-emission capabilities, lower operating costs, and continuous advancements in battery technology. Unlike other types of electric buses, such as hydrogen fuel cell or hybrid electric buses, which rely on alternative power sources or complex propulsion systems, BEVs harness the simplicity and efficiency of electric propulsion powered solely by rechargeable batteries. At the heart of the BEV revolution lies its ability to deliver zero-emission transportation solutions, addressing the urgent need to reduce greenhouse gas emissions and combat air pollution in urban areas.

By eliminating tailpipe emissions associated with traditional fossil fuel-powered buses, BEVs significantly improve air quality and public health, making them a compelling choice for cities grappling with environmental challenges. The transition to BEVs aligns with global efforts to mitigate climate change and achieve sustainable development goals, driving governments, transit agencies, and stakeholders to prioritize electrification in their public transportation systems. Moreover, BEVs offer compelling economic advantages over their diesel and gasoline-powered counterparts, contributing to their widespread adoption and market dominance.

While BEVs may have higher upfront costs due to the expense of battery technology and charging infrastructure, they offer lower operating costs over their lifetime, resulting in substantial savings for transit agencies and municipalities. Electric propulsion systems are inherently more energy-efficient and require less maintenance than internal combustion engines, leading to reduced fuel and maintenance expenses for BEV fleets. Additionally, advancements in battery technology have enabled BEVs to achieve longer ranges and faster charging times, further enhancing their competitiveness and viability as a sustainable transportation solution.

The continuous evolution of battery technology is a key driver behind the leadership of BEVs in the electric bus industry. Lithium-ion batteries, the primary energy storage technology used in BEVs, have undergone significant improvements in energy density, durability, and cost-effectiveness in recent years. As battery prices continue to decline and energy density increases, BEVs are becoming more cost-competitive with conventional diesel buses, narrowing the financial gap and accelerating their adoption in public transit fleets. Furthermore, ongoing research and development efforts are focused on advancing next-generation battery chemistries, such as solid-state batteries and lithium-sulfur batteries, which promise even greater energy density, safety, and longevity, paving the way for further advancements in BEV technology.

Intracity routes are leading in the electric bus industry due to their suitability for battery electric vehicles (BEVs) and their alignment with urban sustainability goals.

Intracity routes have emerged as the leading segment in the electric bus industry, driven by their inherent suitability for battery electric vehicles (BEVs) and their alignment with urban sustainability goals. Unlike intercity or long-distance routes, which may require larger buses with extended range capabilities and complex charging infrastructure, intracity routes typically involve shorter distances and frequent stops, making them ideal environments for the deployment of BEVs. The compact nature of intracity routes allows BEVs to operate within their range limitations while taking advantage of regenerative braking and frequent charging opportunities, maximizing energy efficiency and minimizing downtime.

As cities worldwide strive to reduce carbon emissions, improve air quality, and enhance the livability of urban environments, the electrification of intracity bus fleets offers a practical and effective solution to address these pressing challenges. One of the key advantages of intracity routes for electric buses is the suitability of BEVs to meet the operational requirements of short-distance, stop-and-go transit services. BEVs excel in urban environments characterized by dense populations, congested traffic conditions, and high demand for public transportation.

Their zero-emission capabilities and quiet operation make them well-suited for navigating city streets, reducing noise pollution, and improving the overall quality of life for urban residents. Moreover, the shorter distances and frequent stops typical of intracity routes allow BEVs to leverage regenerative braking technology, which captures kinetic energy during deceleration and converts it back into electrical energy, extending battery range and enhancing energy efficiency. This inherent synergy between BEVs and intracity routes makes electric buses a natural fit for urban transit systems seeking to reduce emissions, enhance sustainability, and promote multimodal mobility options.

Furthermore, the electrification of intracity bus fleets aligns with broader urban sustainability goals and initiatives aimed at reducing reliance on fossil fuels and transitioning to cleaner, more sustainable transportation solutions. By replacing conventional diesel and gasoline-powered buses with electric alternatives, cities can significantly reduce greenhouse gas emissions, improve air quality, and mitigate the adverse impacts of transportation-related pollution on public health and the environment. The adoption of electric buses on intracity routes sends a powerful signal of commitment to sustainable development and climate action, demonstrating leadership in the transition to a low-carbon, resilient, and inclusive urban future.

The leadership of intracity routes in the electric bus industry is further reinforced by the availability of supportive policies, incentives, and funding mechanisms aimed at accelerating the adoption of zero-emission vehicles in urban transit fleets. Governments at the local, regional, and national levels are implementing regulatory measures, financial incentives, and procurement targets to promote the electrification of public transportation and reduce barriers to entry for electric bus operators. Additionally, partnerships between public agencies, transit operators, industry stakeholders, and community organizations are driving collaboration and knowledge sharing to overcome technical, financial, and institutional challenges associated with the deployment of electric buses on intracity routes.

Public end use is leading in the electric bus industry due to the significant environmental and economic benefits offered by zero-emission public transportation.

Public end use has emerged as the driving force in the electric bus industry, propelled by the substantial environmental and economic benefits of zero-emission public transportation. As cities worldwide confront the dual challenges of urbanization and climate change, the electrification of public transit fleets offers a practical and effective solution to reduce greenhouse gas emissions, improve air quality, and enhance the sustainability of urban transportation systems. The transition to electric buses aligns with broader societal goals of reducing dependence on fossil fuels, mitigating the impacts of transportation-related pollution, and creating healthier, more livable communities for current and future generations.

One of the primary reasons for the leadership of public end use in the electric bus industry is the significant environmental benefits offered by zero-emission public transportation. Traditional diesel and gasoline-powered buses are major contributors to air pollution in urban areas, emitting harmful pollutants such as nitrogen oxides (NOx), particulate matter (PM), and greenhouse gases (GHGs). By replacing these polluting vehicles with electric buses powered by clean energy sources, cities can dramatically reduce their carbon footprint and improve local air quality, leading to tangible benefits for public health and the environment.

Electric buses produce zero tailpipe emissions, eliminating harmful pollutants and reducing the overall environmental impact of public transportation operations, particularly in densely populated urban areas where air quality is a major concern. Moreover, the transition to electric buses offers compelling economic advantages for public transit agencies and municipalities, further driving the adoption of zero-emission public transportation. While electric buses may have higher upfront costs compared to conventional diesel or natural gas-powered buses, they offer lower operating costs over their lifetime, resulting in significant savings for transit operators and taxpayers.

Electric propulsion systems are inherently more energy-efficient and require less maintenance than internal combustion engines, leading to reduced fuel and maintenance expenses for electric bus fleets. Additionally, advancements in battery technology and charging infrastructure are driving down costs and improving the performance and reliability of electric buses, making them increasingly competitive with conventional buses in terms of range, power, and operational capabilities. Furthermore, the leadership of public end use in the electric bus industry is reinforced by supportive policies, incentives, and funding mechanisms aimed at accelerating the adoption of zero-emission vehicles in public transit fleets.

Governments at the local, regional, and national levels are implementing regulatory measures, financial incentives, and procurement targets to promote the electrification of public transportation and reduce barriers to entry for electric bus operators. Additionally, partnerships between public agencies, transit operators, industry stakeholders, and community organizations are driving collaboration and knowledge sharing to overcome technical, financial, and institutional challenges associated with the deployment of electric buses in public transit systems.

The Asia-Pacific region is leading in the electric bus industry due to strong government support, robust manufacturing capabilities, and a rapidly growing market for urban mobility solutions.

The Asia-Pacific region has emerged as the frontrunner in the electric bus industry, propelled by a combination of strong government support, robust manufacturing capabilities, and a rapidly growing market for urban mobility solutions. As countries across Asia-Pacific confront the challenges of urbanization, congestion, and air pollution, the electrification of public transportation offers a strategic pathway to address these pressing issues while driving economic growth and technological innovation. The region's leadership in the electric bus industry reflects a comprehensive approach to sustainable development, with governments, industry stakeholders, and communities working together to promote clean and efficient transportation solutions.

Many countries in the region have implemented ambitious targets and regulatory measures to promote the electrification of public transportation, including subsidies, tax incentives, and procurement mandates for electric buses. Governments are also investing in charging infrastructure, research and development, and pilot projects to demonstrate the feasibility and benefits of electric buses in urban transit systems. For example, China, the world's largest market for electric buses, has implemented aggressive policies to promote EV adoption, including subsidies for manufacturers and operators, deployment targets for electric buses, and incentives for charging infrastructure development.

Additionally, the Asia-Pacific region benefits from robust manufacturing capabilities and a well-established supply chain ecosystem for electric vehicles, making it a global hub for electric bus production and innovation. Countries such as China, South Korea, and Japan are home to leading electric bus manufacturers, leveraging their expertise in automotive manufacturing, battery technology, and electric drivetrains to produce high-quality and cost-effective electric buses for domestic and international markets.

The presence of a competitive manufacturing ecosystem, coupled with economies of scale and government support, has enabled Asia-Pacific manufacturers to drive down costs, improve performance, and accelerate the pace of innovation in the electric bus industry. Moreover, the Asia-Pacific region offers a rapidly growing market for urban mobility solutions, driven by rapid urbanization, population growth, and increasing demand for sustainable transportation options.

Cities in Asia-Pacific are experiencing unprecedented levels of congestion and air pollution, prompting governments and transit authorities to invest in cleaner and more efficient public transportation systems. Electric buses offer a viable solution to these challenges, providing zero-emission mobility options that reduce reliance on fossil fuels and improve the overall quality of life for urban residents. As cities across the region modernize their public transit fleets and invest in sustainable infrastructure, the demand for electric buses is expected to surge, driving further growth and innovation in the industry.

Recent Developments

- In January 2023, Daimler received an order to supply 45 buses to VLP Transport for intercity transport.

- In January 2022, the Valley Transportation Authority (VTA) in Santa Clara City, US, will install an innovative clean energy microgrid and EV fleet charging system with Proterra and Scale Microgrid Solutions. This project will showcase how clean energy paired with fleet-scale EV charging can enable the adoption of fully electric vehicle fleets. Expected to come online in late 2023, it will help VTA further reduce greenhouse gas emissions.

- In September 2022, the Urbino 18 model is equipped with a modern hydrogen fuel cell, which aids long-distance commuting as it can cover 350 km in a single refill with a passenger capacity of 138 seats.

- In June 2022, Ashok Leyland's EV arm unveils the electric bus platform EiV12; the buses would be available in two variants EiV 12 low floor and EiV 12 standard buses that would offer the best in reliability, range, and comfort.

- In April 2022, Proterra introduced the new ZX5 electric bus with 738 kilowatt hours of energy.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Electric Bus market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Vehicle

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

By Application

- Intercity

- Intra-city

By End-Use

- Private

- Public

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. After this, the analyst started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once the analyst had primary data, they started verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Electric Bus industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BYD Company Limited

- AB Volvo

- Ankai Automobile

- Mercedes-Benz Group AG

- Ashok Leyland Limited

- JBM Auto Ltd

- Volkswagen AG

- Hyundai Motor Company

- Tata Motors Limited

- Olectra Greentech Limited

- Proterra Inc

- Zhengzhou Yutong Group Co., Ltd.

- Solaris Bus & Coach

- NFI Group Inc

- VDL Groep

- Ebusco Holding N.V.

- Blue Bird Corporation

- Wrightbus

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 59.27 Billion |

| Forecasted Market Value ( USD | $ 110 Billion |

| Compound Annual Growth Rate | 11.1% |

| Regions Covered | Global |