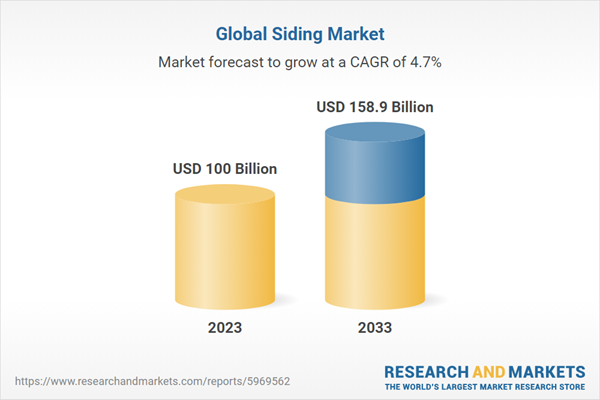

The global siding market reached a value of nearly $100 billion in 2023, having grown at a compound annual growth rate (CAGR) of 3.22% since 2018. The market is expected to grow from $100 billion in 2023 to $123.9 billion in 2028 at a rate of 4.39%. The market is then expected to grow at a CAGR of 5.10% from 2028 and reach $158.9 billion in 2033.

Growth in the historic period resulted from strong economic growth in emerging markets, rise in construction of green building and increasing demand for siding installations. Factors that negatively affected growth in the historic period were supply shortages and high demand.

Going forward, increasing population density and urbanization, increasing construction and building activities, increase in incidences of natural disasters such as hurricanes, tornadoes and wildfires and rapid growth in renovation activities will drive the growth. Factor that could hinder the growth of the siding market in the future include competition from alternative materials.

The siding market is segmented by material into fiber cement, vinyl, stucco, brick, wood and other materials. The vinyl market was the largest segment of the siding market segmented by material, accounting for 34.7% or $34.6 billion of the total in 2023. Going forward, the fiber cement segment is expected to be the fastest growing segment in the siding market segmented by material, at a CAGR of 5.34% during 2023-2028.

The siding market is segmented by application into new construction and repair and maintenance. The new construction market was the largest segment of the siding market segmented by application, accounting for 63.8% or $63.8 billion of the total in 2023. Going forward, the repair and maintenance segment is expected to be the fastest growing segment in the siding market segmented by application, at a CAGR of 5.12% during 2023-2028.

The siding market is segmented by end-user into residential and non-residential. The residential market was the largest segment of the siding market segmented by end-user, accounting for 64.7% or $64.7 billion of the total in 2023. Going forward, the non-residential segment is expected to be the fastest growing segment in siding market segmented by end-user, at a CAGR of 4.52% during 2023-2028.

North America was the largest region in the siding market, accounting for 35.7% or $35.7 billion of the total in 2023. It was followed by Asia-Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the siding market will be Asia-Pacific and Western Europe where growth will be at CAGRs of 5.10% and 4.5% respectively. These will be followed by North America and Eastern Europe where the markets are expected to grow at CAGRs of 4.25% and 3.95% respectively.

The global siding market is fairly fragmented, with a large number of small players in the market. The top ten competitors in the market made up 23.08% of the total market in 2022. Alumasc Group PLC. was the largest competitor with a 15.52% share of the market, followed by Compagnie de Saint-Gobain S.A. with 1.72%, Louisiana-Pacific Corporation with 1.52%, Rockwool International A/S with 1.40%, Etex Group SA with 0.84%, Nichiha Corporation with 0.53%, Ply Gem Industries Inc. with 0.50%, SHERA Public Company Limited with 0.43%, Knauf Gips KG with 0.35% and Westlake Chemical Corporation with 0.30%.

The top opportunities in the siding market segmented by material will arise in the vinyl segment, which will gain $8.5 billion of global annual sales by 2028. The top opportunities in the siding market segmented by application will arise in the new construction segment, which will gain $13.7 billion of global annual sales by 2028. The top opportunities in the siding market segmented by end-user will arise in the residential segment, which will gain $15.2 billion of global annual sales by 2028. The siding market size will gain the most in the USA at $6.8 billion.

Market-trend-based strategies for the siding market include use of microscopic light-disruptive paint technology to offer flexibility, integration of poly-ash material in siding to offer stability, strategic partnerships and acquisitions among market players to drive innovation and introduction of architectural collection to elevating exterior design standards.

Player-adopted strategies in the siding market include focus on expanding operational capabilities through strategic acquisitions, focus on enhancing business capabilities through the launch of new products and focus on enhancing business operations through strategic collaborations and partnerships.

To take advantage of the opportunities, the analyst recommends the siding companies to focus on microscopic light-disruptive paint technology integration, focus on poly-ash material integration, focus on innovative product launches, focus on fiber cement and vinyl segments, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships and acquisitions, provide competitively priced offerings, continue to use B2B promotions and focus on non-residential end-users.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Siding Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global siding market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for siding? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The siding market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider siding market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by material, segment by application and by end-user market.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario - The report provides an analysis of the impact of the Russia-Ukraine war, impact of the COVID-19 pandemic and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the siding market.

- Global Market Size and Growth - Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional and Country Analysis - Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by material, segment by application and by end-user in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth - Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard - Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions - Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Market Opportunities and Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations for siding providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Scope

Markets Covered:

1) by Material: Fiber Cement; Vinyl; Stucco; Brick; Wood; Other Materials.2) by Application: New Construction; Repair; Maintenance .

3) by End-User: Residential; Non-Residential.

Key Companies Mentioned: Alumasc Group PLC; Compagnie de Saint-Gobain S.A.; Louisiana-Pacific Corporation; Rockwool International a/S; Etex Group SA

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Brazil; Canada; France; Germany; UK; Italy; Spain; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; siding indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Alumasc Group PLC

- Compagnie de Saint-Gobain S.A.

- Louisiana-Pacific Corporation

- Rockwool International A/S

- Etex Group SA

- Nichiha Corporation Real Madrid C.F

- Ply Gem Industries Inc.

- SHERA Public Company Limited

- Knauf Gips KG

- Westlake Chemical Corporation

- Novofab

- AKLING ENTERPRISES

- Indorama India Private Limited

- Tata Metaliks Ltd

- Naresh Kumar & Co Pvt Ltd

- Ramco Cements Ltd

- Hangzhou Sunland Plastics Co., Ltd

- Zhangjiagang Xinguang Import and Export Co., Ltd

- Ningbo Yihe Green Board Co. Ltd

- Bnbm(Suzhou) Co

- Ningbo Yihe Green Board Co.,Ltd

- Eternit France

- Terreal

- James Hardie Industries

- Trespa International

- Grupo Aluman

- Grupo Tancón

- Grupo Belloch

- Byggmax Group

- AB Gustaf Kähr

- Södra Wood

- Eternit Schweiz AG

- swisspor AG

- Swisspearl

- Marazzi Group

- Rondine Group

- Casalgrande Padana

- James Hardie Building Products

- Eurocell

- Marley Ltd

- TechnoNICOL Corporation

- ALCOR

- Teraplast Group

- TeraPlast SA

- Ro Group

- Drutex S.A

- WISNIOWSKI

- Waleriana Lukasinskiego

- ETERNIT CR

- SWISS KRONO

- Baumit

- Euroformat Group

- Kronospan

- NBM Group

- Royal Building Products

- Kaycan Ltd

- Gentek Building Products

- Maibec Inc

- CanExel

- Cedar Valley Manufacturing Inc

- Durabuilt Products Inc

- KWP Products

- Grupo Lamosa

- Cemex S.A.B

- Grupo Kalos

- Alpek S.A.B. de C.V

- Prefabricados y Extruidos de Concreto

- Grupo Cementos Chihuahua (GCC)

- Grupo Acosta Verde

- Paneles de Mexico (PAMESA)

- Ply Gem Holdings, Inc

- CertainTeed Corporation

- LP Building Solutions

- Georgia-Pacific Corporation

- ABTCO

- Alsco Metals Corporation

- Mastic Home Exteriors

- Norandex Building Materials Distribution, Inc.

- Itagres

- Portobello Shop Florianópolis

- Revest House Import

- Blocke Mendoza

- Revestimiento Sba

- Alberdi Maderasare

- AK Cladding LLC

- Al Mustaqbal Bldg Cont Co LLC

- Al Nubla General Cont Co

- Bait Al Muhandiseen Technical Services Co LLC

- Biston Construction Company LLC

- Bin Asheer Transport and General Contracting Est

- Klick Engineering Consultants

- Build it

- Builders Express

- Cashbuild

- Mica

- Buco Hardware

- Buildware

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | May 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 100 Billion |

| Forecasted Market Value ( USD | $ 158.9 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 97 |