Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Process Optimization and Efficiency

In recent years, the global Intelligent Flow Meter market has witnessed a significant surge in demand driven by the growing emphasis on process optimization and efficiency across various industries. As businesses strive to enhance their operational performance, there is a rising need for advanced measurement and control systems. Intelligent Flow Meters, with their ability to provide real-time data and insights into fluid dynamics, play a pivotal role in optimizing processes, reducing waste, and improving overall efficiency.Industries such as oil and gas, chemicals, water and wastewater, and manufacturing are increasingly adopting Intelligent Flow Meters to gain better control over their operations. The ability of these meters to offer precise measurements, coupled with advanced features like automatic calibration and self-diagnosis, positions them as indispensable tools for organizations seeking to streamline their processes and maximize productivity.

Stringent Regulatory Standards and Environmental Compliance

The global push for environmental sustainability and adherence to stringent regulatory standards has become a key driver for the Intelligent Flow Meter market. Governments and regulatory bodies worldwide are implementing stricter norms regarding the monitoring and control of fluid flow in industries to minimize environmental impact. Intelligent Flow Meters, equipped with advanced sensors and communication capabilities, enable companies to meet these compliance requirements effectively.Industries such as water treatment, where environmental regulations are particularly stringent, are increasingly turning to Intelligent Flow Meters to ensure accurate measurement and reporting of fluid flow. The meters not only assist in meeting regulatory standards but also contribute to sustainable practices by minimizing resource wastage and reducing the carbon footprint associated with inefficient processes.

Integration of Industrial Internet of Things (IIoT) and Industry 4.0 Technologies

The ongoing wave of digital transformation, marked by the integration of Industrial Internet of Things (IIoT) and Industry 4.0 technologies, is a major driver for the Intelligent Flow Meter market. Modern industries are seeking connected solutions that provide real-time data for better decision-making and operational control. Intelligent Flow Meters, equipped with sensors and communication interfaces, seamlessly integrate into smart industrial ecosystems.Through IIoT connectivity, these meters enable remote monitoring and control, predictive maintenance, and data analytics. This connectivity not only enhances operational efficiency but also contributes to the evolution of smart factories where seamless communication and automation are paramount. As industries continue to embrace the Fourth Industrial Revolution, the demand for Intelligent Flow Meters as integral components of interconnected systems is expected to rise significantly.

Expansion of End-use Industries in Emerging Markets

The global expansion of end-use industries, particularly in emerging markets, is driving the demand for Intelligent Flow Meters. As economies grow and industrialization accelerates, there is an increasing need for accurate and reliable flow measurement solutions. Industries such as power generation, pharmaceuticals, and food and beverage in emerging markets are recognizing the importance of Intelligent Flow Meters in ensuring operational efficiency and product quality.In these regions, where infrastructure development is a priority, the demand for Intelligent Flow Meters is on the rise to support the establishment of modern and efficient processes. The versatility of these meters in catering to a wide range of industries positions them as essential tools for the sustained growth of emerging economies.

Focus on Water and Wastewater Management

With growing concerns about water scarcity and the need for efficient water management, there is a heightened focus on the use of Intelligent Flow Meters in the water and wastewater industry. Governments and municipalities worldwide are investing in advanced technologies to monitor and control water distribution and treatment processes more effectively. Intelligent Flow Meters, with their ability to provide accurate and real-time data on water flow, play a crucial role in optimizing water management systems.To accurate measurement, Intelligent Flow Meters contribute to water conservation efforts by minimizing leaks and losses in distribution networks. The integration of smart water management solutions, leveraging the capabilities of these meters, is becoming a priority for regions facing water challenges, further propelling the growth of the Intelligent Flow Meter market.

Increasing Awareness of Energy Efficiency

The global emphasis on energy efficiency and the need to reduce energy consumption in industrial processes are significant drivers for the Intelligent Flow Meter market. Industries are increasingly adopting measures to enhance energy efficiency and reduce operational costs. Intelligent Flow Meters, by providing accurate measurements and insights into fluid dynamics, contribute to the optimization of energy-intensive processes.The ability of these meters to monitor and control the flow of fluids in real-time enables industries to identify areas of energy wastage and implement corrective measures. As sustainability becomes a key focus for businesses, Intelligent Flow Meters are being recognized as essential tools in achieving energy-efficient operations, further driving their adoption across various industrial sectors.

Government Policies are Likely to Propel the Market

Regulatory Framework for Environmental Compliance

Governments worldwide are increasingly recognizing the importance of implementing robust regulatory frameworks to ensure environmental compliance within industries, and the Intelligent Flow Meter market is no exception. Environmental concerns related to fluid flow measurement and control have prompted authorities to establish policies that mandate the use of advanced technologies, such as Intelligent Flow Meters, to monitor and manage industrial processes more efficiently.In many regions, governments have set specific emission standards and guidelines for industries, particularly in sectors such as oil and gas, chemicals, and manufacturing. These standards often include requirements for accurate measurement and reporting of fluid flow to control emissions and minimize environmental impact. Intelligent Flow Meters, equipped with precise sensors and communication capabilities, are positioned as essential tools for industries to adhere to these regulations effectively.

By enforcing policies that promote the adoption of Intelligent Flow Meters for environmental compliance, governments aim to strike a balance between industrial growth and environmental sustainability. These policies not only contribute to cleaner and more responsible industrial practices but also drive the growth of the Intelligent Flow Meter market as businesses seek compliant solutions.

Incentives for Industry 4.0 Adoption

In the era of Industry 4.0, governments are playing a pivotal role in promoting the adoption of advanced technologies, including Intelligent Flow Meters, to enhance industrial processes and competitiveness. Policies aimed at providing incentives for the implementation of Industry 4.0 technologies are becoming increasingly common to stimulate economic growth and innovation.Governments may offer tax incentives, subsidies, or grants to industries that invest in smart technologies, encouraging the integration of Intelligent Flow Meters into their operations. These policies aim to accelerate the transition towards more connected, automated, and data-driven industrial ecosystems. By fostering a supportive environment for the adoption of Intelligent Flow Meters, governments contribute to the overall modernization and efficiency of industries, positioning their economies for sustained growth in the global market.

Water Management and Conservation Initiatives

Given the global challenges related to water scarcity and the need for efficient water management, governments are formulating policies to promote the use of Intelligent Flow Meters in the water and wastewater sector. These policies often focus on encouraging municipalities, water utilities, and industries to adopt advanced flow measurement technologies to optimize water distribution, reduce losses, and enhance overall water efficiency.In regions where water resources are under stress, governments may introduce regulations that mandate the installation of Intelligent Flow Meters in water infrastructure. These policies aim to address water wastage, leaks, and inefficiencies in distribution networks. By prioritizing water management and conservation, governments contribute to the sustainable use of water resources and support the growth of the Intelligent Flow Meter market in applications related to water monitoring and control.

Standards for Energy Efficiency in Industries

Governments worldwide are increasingly recognizing the role of energy efficiency in sustainable industrial development. In response, they are implementing policies that set standards and guidelines for energy-efficient practices within industries, including those related to fluid flow measurement. Intelligent Flow Meters, with their capability to optimize processes and reduce energy consumption, align with the objectives of these policies.Policies promoting energy efficiency may include requirements for industries to adopt technologies that monitor and control fluid flow in real-time. Intelligent Flow Meters, by providing accurate measurements and facilitating better control over industrial processes, contribute to the overall reduction of energy wastage. Governments, through these policies, aim to create a more sustainable industrial landscape while supporting the growth of the Intelligent Flow Meter market.

Research and Development Funding for Innovation

To encourage innovation and technological advancement in the field of flow measurement, governments are instituting policies that allocate funds for research and development (R&D) activities. These policies aim to stimulate collaboration between government agencies, research institutions, and private enterprises to drive advancements in Intelligent Flow Meter technologies.By providing financial support for R&D initiatives, governments create an environment conducive to innovation in flow measurement solutions. This can lead to the development of more accurate, reliable, and cost-effective Intelligent Flow Meters. As a result, these policies not only foster technological progress but also contribute to the global competitiveness of the Intelligent Flow Meter market.

International Standards and Certification

Recognizing the global nature of the Intelligent Flow Meter market, governments are increasingly involved in the development and adoption of international standards and certification processes. Policies aimed at aligning national regulations with international standards ensure consistency in the performance, safety, and interoperability of Intelligent Flow Meters across borders.These policies may involve collaboration with international standardization bodies to establish guidelines for the design, manufacturing, and performance of Intelligent Flow Meters. By adhering to international standards, governments facilitate the smooth functioning of the global market, promote fair competition, and enhance the acceptance of Intelligent Flow Meters in diverse industries worldwide. This approach contributes to the harmonization of regulations, streamlining market access for manufacturers, and fostering a globally integrated Intelligent Flow Meter market.

Key Market Trends

Adoption of Wireless and IoT-enabled Intelligent Flow Meters

In recent years, the Global Intelligent Flow Meter Market has witnessed a significant trend towards the adoption of wireless and IoT-enabled intelligent flow meters. This trend is driven by the growing demand for enhanced efficiency, accuracy, and remote monitoring capabilities across various industries such as oil and gas, water and wastewater management, chemicals, and others.One key aspect of this trend is the integration of wireless communication technologies such as Wi-Fi, Bluetooth, and cellular connectivity into intelligent flow meters. These wireless-enabled meters offer several advantages over traditional wired meters, including easier installation, reduced maintenance costs, and greater flexibility in deployment. By eliminating the need for physical wiring, wireless intelligent flow meters can be installed in remote or hard-to-reach locations, providing real-time data without the constraints of traditional infrastructure.

Furthermore, the integration of IoT (Internet of Things) technology has enabled intelligent flow meters to become part of interconnected systems, allowing for seamless data exchange and analysis. IoT-enabled flow meters can communicate with other devices and systems, such as SCADA (Supervisory Control and Data Acquisition) systems and cloud platforms, to provide comprehensive insights into flow dynamics, optimize processes, and facilitate predictive maintenance.

The adoption of wireless and IoT-enabled intelligent flow meters is driven by the need for improved operational efficiency and cost savings. These advanced meters offer real-time monitoring and data analytics capabilities, enabling businesses to optimize their processes, reduce downtime, and make informed decisions. Moreover, the scalability and flexibility of wireless and IoT-enabled meters make them well-suited for a wide range of applications, from small-scale operations to large industrial facilities.

As the demand for real-time data and predictive analytics continues to grow, the adoption of wireless and IoT-enabled intelligent flow meters is expected to accelerate further. Manufacturers are focusing on developing innovative solutions that offer advanced connectivity, interoperability, and analytics capabilities to meet the evolving needs of the market. Overall, the trend towards wireless and IoT-enabled intelligent flow meters represents a significant opportunity for businesses to enhance their operational efficiency and stay competitive in an increasingly connected world.

Key Market Challenges

Interoperability and Integration Complexities in Diverse Industries

One significant challenge facing the global Intelligent Flow Meter market is the complexity associated with interoperability and integration across diverse industries. Intelligent Flow Meters are utilized in a wide array of sectors, including oil and gas, chemicals, water and wastewater, pharmaceuticals, and manufacturing. Each industry has its unique set of requirements, processes, and communication protocols, making it challenging to create standardized solutions that seamlessly integrate with existing systems.Incompatibility issues often arise when attempting to implement Intelligent Flow Meters in an industrial setting, particularly when these meters need to communicate with other devices, control systems, or enterprise resource planning (ERP) systems. The lack of a universal communication standard for Intelligent Flow Meters can hinder the smooth integration of these devices into existing infrastructure, leading to increased implementation costs, longer deployment times, and potential disruptions in operations.

Industries with legacy systems may face difficulties in retrofitting Intelligent Flow Meters into their outdated infrastructure. This challenge is further compounded by the need for these meters to interface with emerging technologies such as the Industrial Internet of Things (IIoT) and Industry 4.0. As a result, stakeholders in the Intelligent Flow Meter market must address the interoperability challenge by developing solutions that are adaptable to diverse industrial ecosystems and capable of seamless integration with both legacy and cutting-edge technologies.

To overcome this challenge, collaborative efforts between Intelligent Flow Meter manufacturers, industry stakeholders, and standardization bodies are crucial. Establishing industry-wide communication standards and protocols can facilitate interoperability, making it easier for end-users to integrate Intelligent Flow Meters into their existing systems. Additionally, manufacturers should prioritize the development of modular and flexible solutions that can adapt to the diverse requirements of different industries, reducing the complexities associated with integration.

Security Concerns and Cybersecurity Risks

As the global Intelligent Flow Meter market becomes more interconnected with the rise of smart industrial ecosystems, the challenge of addressing security concerns and mitigating cybersecurity risks emerges as a critical issue. Intelligent Flow Meters, like many other IoT devices, are vulnerable to cyber threats that can compromise the integrity, confidentiality, and availability of sensitive data. The integration of these meters into networked systems introduces potential entry points for cyberattacks, posing a significant risk to industrial processes and critical infrastructure.One primary concern is the unauthorized access to Intelligent Flow Meters, which could lead to the manipulation of flow data, inaccurate measurements, or disruptions in fluid control systems. Additionally, the compromised security of these meters could allow attackers to gain entry into broader industrial networks, posing a threat to the overall cybersecurity posture of organizations.

Addressing cybersecurity risks requires a multifaceted approach involving manufacturers, end-users, and regulatory bodies. Manufacturers of Intelligent Flow Meters must prioritize the implementation of robust security features, including encryption protocols, secure authentication mechanisms, and regular software updates to patch vulnerabilities. Furthermore, industry standards and guidelines for cybersecurity in the context of Intelligent Flow Meters need to be developed and adhered to across the supply chain.

End-users play a crucial role in mitigating cybersecurity risks by implementing best practices, such as network segmentation, intrusion detection systems, and employee training on cybersecurity awareness. Regular cybersecurity audits and assessments should be conducted to identify and rectify potential vulnerabilities in the implementation and usage of Intelligent Flow Meters within industrial facilities.

Government and regulatory bodies can contribute by establishing clear guidelines and regulations regarding the cybersecurity requirements for Intelligent Flow Meters. Compliance with these standards can be enforced through audits and certifications, fostering a culture of cybersecurity awareness and responsibility throughout the Intelligent Flow Meter market.

While the integration of Intelligent Flow Meters offers numerous benefits in terms of efficiency and data-driven decision-making, addressing interoperability challenges and cybersecurity risks is imperative for the sustained growth and reliability of the global Intelligent Flow Meter market. Collaborative efforts, technological innovations, and regulatory measures are essential components of overcoming these challenges and ensuring the seamless and secure deployment of Intelligent Flow Meters across diverse industries.

Segmental Insights

Communication Protocol Insights

The Profibus segment held the largest Market share in 2023. Profibus has gained prominence as an industry-standard communication protocol, especially in the field of process automation. Its widespread adoption across various industries, including manufacturing, chemicals, and oil and gas, has contributed to its dominance in the market.Profibus is known for its compatibility with a wide range of devices and equipment. Its open standard nature promotes interoperability between devices from different manufacturers, providing users with flexibility when selecting and integrating Intelligent Flow Meters into their systems.

Profibus offers high-speed data transmission, making it suitable for applications that require real-time communication and fast response times. In the context of Intelligent Flow Meters, where timely and accurate data is crucial for process control, the high-speed capabilities of Profibus can be advantageous.

Profibus supports both process automation (Profibus PA) and factory automation (Profibus DP), making it a versatile protocol that can be applied across various industrial settings. This flexibility has contributed to its widespread use in different types of process control applications, including those involving Intelligent Flow Meters.

Profibus has been established as a widely adopted and recognized standard in the automation industry. Many manufacturers of industrial devices, including Intelligent Flow Meters, offer products with Profibus communication capabilities, making it a natural choice for users looking for compatibility and a broad ecosystem of supported devices.

Profibus has undergone continuous development and enhancements over the years, ensuring that it remains relevant and capable of meeting the evolving needs of the industry. Ongoing support and updates contribute to its longevity and popularity in the market.

Regional Insights

North America

North America stands out as the largest market share holder in the Global Intelligent Flow Meter Market in 2023 due to a combination of factors ranging from technological advancements to robust industrial infrastructure and stringent regulatory requirements. One distinctive aspect contributing to North America's dominance in this market is the region's emphasis on innovation and adoption of cutting-edge technologies across various industries.North America's leadership in technological innovation and adoption plays a pivotal role in driving the demand for intelligent flow meters. The region is home to numerous prominent technology companies, research institutions, and engineering firms that continuously develop and implement advanced measurement and control solutions. This culture of innovation fosters the development and adoption of intelligent flow meters equipped with state-of-the-art features such as wireless connectivity, real-time data analytics, and predictive maintenance capabilities.

North America's diverse industrial landscape, spanning sectors such as oil and gas, chemicals, water and wastewater management, pharmaceuticals, and food and beverage, creates a substantial market for intelligent flow meters. These industries rely heavily on accurate flow measurement and control for various processes, including production, refining, distribution, and monitoring of critical assets. Intelligent flow meters offer significant advantages over traditional flow measurement technologies by providing enhanced accuracy, reliability, and efficiency, thereby addressing the evolving needs of North America's industrial sector.

North America's stringent regulatory environment pertaining to environmental protection, safety standards, and product quality mandates the use of advanced flow measurement technologies to ensure compliance and mitigate risks. Intelligent flow meters enable industries to monitor and manage flow parameters in real time, thereby facilitating proactive decision-making and regulatory compliance. The need to adhere to regulatory requirements drives the adoption of intelligent flow meters across a wide range of applications, including emissions monitoring, leak detection, and process optimization.

North America's extensive investment in infrastructure modernization and renewal projects, particularly in sectors such as water and wastewater management, fuels the demand for intelligent flow meters. These meters play a crucial role in optimizing resource utilization, minimizing energy consumption, and improving operational efficiency within water distribution networks, treatment plants, and industrial facilities. As governments and utilities in North America prioritize investments in infrastructure upgrades and sustainability initiatives, the adoption of intelligent flow meters is expected to further accelerate.

The presence of a well-established network of industry players, including manufacturers, distributors, system integrators, and service providers, contributes to North America's dominance in the global intelligent flow meter market. These stakeholders collaborate closely to develop customized solutions, provide technical support, and offer comprehensive services to end-users, thereby driving market growth and penetration.

Report Scope:

In this report, the Global Intelligent Flow Meter Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Intelligent Flow Meter Market, By Type:

- Coriolis

- Magnetic

- Ultrasonic

- Multiphase

- Vortex

- Variable Area

- Differential Pressure

- Thermal

- Turbine

Intelligent Flow Meter Market, By Communication Protocol:

- Profibus

- Modbus

- Hart

Intelligent Flow Meter Market, By End User:

- Oil and Gas

- Pharmaceuticals

- Water and Wastewater

- Paper and Pulp

- Power Generation

- Food and Beverages

Intelligent Flow Meter Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Intelligent Flow Meter Market.Available Customizations:

Global Intelligent Flow Meter Market report with the given Market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Honeywell International Inc.

- Emerson Electric Co.

- Siemens AG

- ABB Ltd

- Endress+Hauser Group Services AG

- Yokogawa Electric Corporation

- Schneider Electric SE

- Genergy Electric Company

- KROHNE Group

- Rockwell Automation Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2024 |

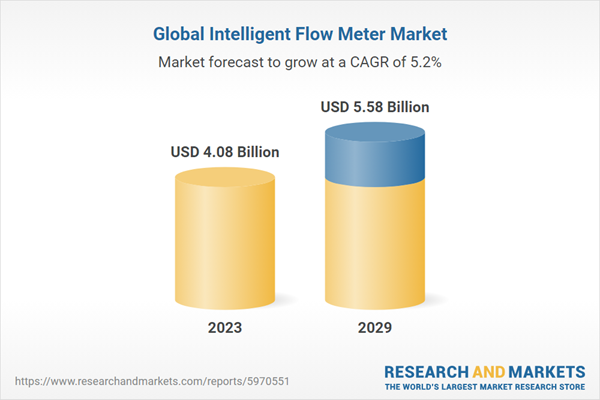

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 4.08 Billion |

| Forecasted Market Value ( USD | $ 5.58 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |