Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

New Initiatives by the Government: In 2022, new protections have been introduced to prevent surprise medical bills. If an individual has private health insurance, these new protections ban the most common surprise bills. The No Surprises Act protects people covered under group and individual health plans from receiving surprise medical bills when they receive most emergency services, non-emergency services from out-of-network providers at in-network facilities, and services from out-of-network air emergency medical service providers. It also establishes an independent dispute resolution process for payment disputes between plans and providers. It provides new dispute resolution opportunities for uninsured and self-pay individuals when they receive a medical bill substantially greater than the good faith estimate from a provider.Rising Adoption of Telemedicine: Telemedicine platforms facilitate remote consultations with physicians during emergencies by enabling real-time audio, video, or chat communication between healthcare providers and patients. Patients can swiftly connect with a physician in urgent situations, describe their symptoms, and receive immediate guidance. Physicians, in turn, can assess the situation, offer preliminary diagnoses, recommend necessary actions, or even prescribe medications remotely. This rapid response can prove crucial in emergencies, potentially averting complications or unnecessary hospital transfers. The advantages of telemedicine in Emergency Medical Services (EMS) are noteworthy. It helps reduce unnecessary hospital transfers by allowing healthcare professionals to evaluate and manage patients on-site or within a more suitable healthcare facility. This optimization of resource utilization ensures that patients receive tailored care, ultimately enhancing overall outcomes.

U.S. EMERGENCY MEDICAL SERVICES MARKET INSIGHTS

- In 2023, the public provider segment dominated, occupying over 54% of the U.S. emergency medical services market share. The segmental growth is primarily driven by increased government support for providing the best EMS services across the U.S.

- The advanced life support service segment showcases significant growth, with the fastest-growing CAGR of 10.82% in the U.S. emergency medical services market. The increase in demand for advanced life support services in the U.S. is attributed to the aging population, which is more prone to health disorders and requires advanced life support services while transferring patients.

- The mass casualty incident segment is growing significantly, with the highest CAGR during the forecast period. The significant growth in the mass casualty segment is attributed to increased natural disasters, which can cause large-scale catastrophic incidents, such as epidemics, air or rail crashes, infrastructure/utility outages, and extreme weather.

- The adult patient group segment dominated the U.S. emergency medical services market share in 2023. The segmental growth is attributed to a significant increase in the percentage of the elderly population. The population of individuals over 65 in the U.S. is expected to double over the next 25 years to 84 million people. By 2030, older adults will comprise roughly one-fifth of the U.S. population.

- The air and water transportation segment by patient group is expected to have the highest growth rate in the U.S. emergency medical services market. Air transport allows emergency medical service providers to quickly reach remote areas where ground services cannot reach on time, thus helping the segment grow.

- In 2022, there were approximately 58 million people aged 65 and above in the U.S., projected to become about 82 million by 2050. As the elderly are more prone to diseases, the need for emergency medical services due to illnesses and accidental falls is expected to rise during the forecast period.

VENDOR LANDSCAPE

The U.S. emergency medical services market report contains exclusive data on 44 vendors. The emergency medical services (EMS) market in the U.S. is fragmented due to the presence of approximately 2,000 providers. This fragmentation entails a diverse landscape comprising large-scale companies and numerous small-scale regional competitors. These entities often secure long-term contracts with medical care organizations and actively seek strategic alliances and collaborations with businesses in various countries to expand their market footprint. Furthermore, emergency medical service providers are expanding their service offerings by integrating mobile healthcare, patient advocacy, primary care extenders, and medical education into their portfolios.SEGMENTATION & FORECAST

- By Provider

- Public

- Private

- Hybrid

- By Service

- Advanced Life Support

- Basic Life Support

- By Incident

- Single Casualty Incidents

- Mass Casualty Incidents

- By Patient Group

- Adults

- Pediatrics

- By Transport

- Ground Transport

- Air & Water Transport

VENDORS LIST

- Acadian Ambulance Service

- Air Medical

- Ambulnz

- Apollo MedFlight

- BSA Health System

- Central EMS

- City Ambulance Service

- Falck

- Global Medical Response

- HEMSI

- LifeLine EMS

- Lifestar EMS

- Lynch EMS

- Medstar

- MMT

- Redlands Community Hospital

- SeniorCare Emergency Medical Services

- American Medical Response (AMR)

- U.C. Health

- Union Emergency Medical Services

- Air Ambulance Worldwide

- Air Methods

- AirEvac International

- American Air Ambulance

- Chatham Emergency Services

- Eagle County Paramedic Services

- Emergency Ambulance Service

- Greenwich Emergency Medical Service

- Guardian Flight

- Leon County EMS

- Life Flight Network

- Livingston County EMS

- Mckeesport Ambulance Rescue Service

- Metro West Ambulance

- Mohawk Ambulance Service

- National EMS

- New Castle County EMS

- NorthStar EMS

- Okaloosa County Emergency Medical Services

- PHI Air Medical

- Puckett EMS

- Regional Paramedical Services

- RIT Ambulance

- Rural/Metro Corp

KEY QUESTIONS ANSWERED

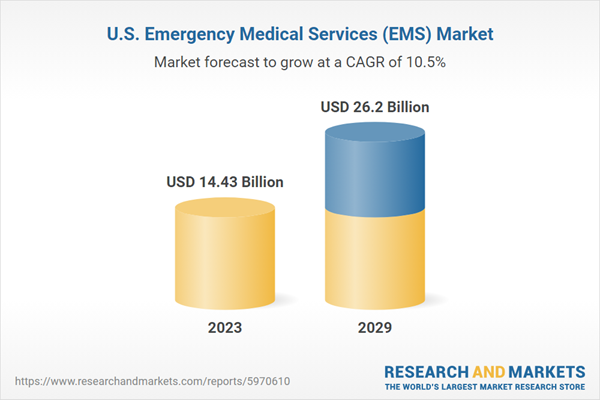

1. How big is the U.S. emergency medical services market?2. What is the growth rate of the U.S. emergency medical services market?

3. What are the key U.S. emergency medical services market trends?

4. What are the restraints in the U.S. emergency medical services market?

Table of Contents

Companies Mentioned

- Acadian Ambulance Service

- Air Medical

- Ambulnz

- Apollo MedFlight

- BSA Health System

- Central EMS

- City Ambulance Service

- Falck

- Global Medical Response

- HEMSI

- LifeLine EMS

- Lifestar EMS

- Lynch EMS

- Medstar

- MMT

- Redlands Community Hospital

- SeniorCare Emergency Medical Services

- American Medical Response (AMR)

- U.C. Health

- Union Emergency Medical Services

- Air Ambulance Worldwide

- Air Methods

- AirEvac International

- American Air Ambulance

- Chatham Emergency Services

- Eagle County Paramedic Services

- Emergency Ambulance Service

- Greenwich Emergency Medical Service

- Guardian Flight

- Leon County EMS

- Life Flight Network

- Livingston County EMS

- Mckeesport Ambulance Rescue Service

- Metro West Ambulance

- Mohawk Ambulance Service

- National EMS

- New Castle County EMS

- NorthStar EMS

- Okaloosa County Emergency Medical Services

- PHI Air Medical

- Puckett EMS

- Regional Paramedical Services

- RIT Ambulance

- Rural/Metro Corp

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | May 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 14.43 Billion |

| Forecasted Market Value ( USD | $ 26.2 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 44 |