Increasing Demand for Data Center and Cloud Computing Fuels the Middle East & Africa Power and Control Cable Market

The growth of data centers and technology-driven industries propelled the need for power and control cables to ensure uninterrupted power supply and data transmission. The cables are crucial to maintain the functioning of critical infrastructure. As the demand for data storage and processing continues to rise, more data centers are being built. These facilities require extensive power and control cable systems to distribute electricity and manage various systems and equipment. Modern data centers are designed to accommodate high-power-density servers and equipment. This generates a huge scope for power cable systems capable of handling larger electrical loads safely and efficiently. Lately, several data centers have been installed. In 2023, Egypt's Ministry of Communications and Information Technology and the UAE Ministry of Investment signed an MOU to invest in Egypt's digital infrastructure through 1GW of data center projects. Also, Edgnex Data Centers have signed a new collaboration deal to construct a data center and Cinturion, a cable landing station (CLS) in Saudi Arabia. Also, in 2022, to expand its presence on the African continent, Equinix, Inc. announced plans to join the South African market with a US$ 160 million data center investment in Johannesburg. Therefore, the growing data center industry relies heavily on power and control cables to ensure reliable, efficient, and safe operations. As data centers evolve and expand, the demand for these cables is expected to increase significantly in the coming years.Middle East & Africa Power and Control Cable Market Overview

The infrastructure sector in the MEA is growing significantly. Several Middle Eastern countries seek diversification of their country's income source and focus on developing infrastructure in different sectors. The energy sector is one of the most promising sectors in the region. For instance, the UAE government plans to revisit its energy strategy to attract more investments in solar energy and green hydrogen projects. It has set a target to propel its renewables capacity at an annual average rate of 16.7% from 2021 to 2030 to meet the 11.3% of the power mix target by 2030.Saudi Arabia is one the largest spenders on infrastructure in the Middle East and is witnessing an unprecedented rise in the number of construction and urban mega projects. Approximately 200 small, medium, and large infrastructure projects are at different stages of completion or implementation under the country's public-private partnership (PPP) model. A few of the prime examples of infrastructure development projects include the 400 MW capacity Dumat Al-Jundal wind farm and the 2.65GW Ras Al-Khair power and water plant. The government also plans to set up projects to generate 10 GW of renewable energy and ~50% of its power requirements from renewable sources by 2030. The NEOM Green Hydrogen plant being constructed for US$ 8.4 billion is the world's largest green hydrogen plant that will produce green ammonia on a large scale. The plant is expected to utilize up to 4GW of wind and solar energy for producing approximately 600 metric ton/day of carbon-free hydrogen by the end of 2026.

Similarly, as part of Bahrain's 2021 Economic Recovery Plan, the government announced over 22 strategic infrastructure projects worth more than US$ 30 billion, including the construction of five artificial islands in the PPP model. Such emphasis on infrastructure development is aligned with the Kingdom's Vision 2030 economic development strategy. The approach seeks to improve infrastructure, industry, housing, and connectivity and thus requires a more diverse economic base, with broader industrialization, training, and education of the national workforce. All such factors are driving the Middle East & Africa power and control cable market in the region.

Demand for energy consumption in Africa is anticipated to grow rapidly in the coming years. Africa presently has the world's lowest per capita use of modern energy. The African utilities sector is characterized by its large geography, limited interconnection, improving electrification, and existing system adequacy issues. As Africa's agriculture, commerce, and industry expand, the need for productive energy utilization also surges. IEA anticipates electricity demand in industry, freight, and agriculture to grow by ~40% by 2030, compared to 2021. African nations are focusing on increasing the production of appliances, cement, clean energy technologies, fertilizer, steel, and vehicles to reduce dependency on imports. Thus, rapid industrialization is anticipated to boost the use of power and control cables in the region during 2022-2030.

Middle East & Africa Power and Control Cable Market Segmentation

The Middle East & Africa power and control cable market is segmented based on type, voltage, application, and country.Based on type, the Middle East & Africa power and control cable market is bifurcated into power cable and control cable. The power cable segment held a larger share in 2022.

By voltage, the Middle East & Africa power and control cable market is segmented into high voltage, medium voltage, and low voltage. The low voltage segment held the largest share in 2022.

By application, the Middle East & Africa power and control cable market is segmented into utilities and industrial. The utilities segment held a larger share in 2022.

Based on country, the Middle East & Africa power and control cable market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa power and control cable market in 2022.

Belden Inc; Furukawa Electric Co Ltd; HENGTONG GROUP CO., LTD.; LEONI AG, Nexans SA; Prysmian SpA; Riyadh Cables Group Co; and Sumitomo Electric Industries Ltd are some of the leading companies operating in the Middle East & Africa power and control cable market.

Table of Contents

Companies Mentioned

- Belden Inc

- Furukawa Electric Co Ltd

- HENGTONG GROUP CO., LTD.

- LEONI AG

- Nexans SA

- Prysmian SpA

- Riyadh Cables Group Co

- Sumitomo Electric Industries Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | February 2024 |

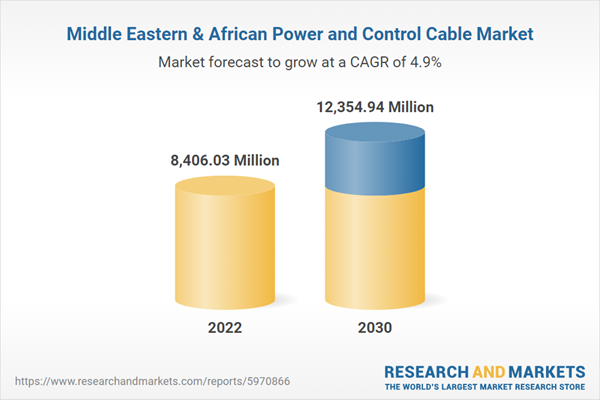

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 8406.03 Million |

| Forecasted Market Value by 2030 | 12354.94 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 8 |