Advent of Industry 4.0 Fuels the Asia Pacific Real Time Production Monitoring Market

The advent of Industry 4.0 is driving the real-time production monitoring market. The fundamental idea behind Industry 4.0 is to switch old business practices to digital ones to streamline production processes for higher utilization and quicker turnaround times by monitoring production. Industry 4.0 supports completing the field's digital transition and brings real-time decision-making, increased productivity, flexibility, and agility. All industrial organizations, including those engaged in discrete and process manufacturing, as well as oil & gas, mining, and other industrial sectors, benefit from implementing Industry 4.0 concepts and technology. Thus, several enterprises are deploying Industry 4.0 technology. The research done by Nokia in April 2023 unveiled the industry 4.0 maturity index for industrial campuses. Industrial and manufacturing sectors are dominated by companies that make electronics and appliances. Overall, with maturity scores of 73.1 and 79.5 out of 100, respectively, electronics and appliance manufacturers are setting the bar for Industry 4.0 technology investments and use case implementations. Further, several organizations are supporting the deployment of Industry 4.0. The United Nations Industrial Development Organization (UNIDO) assists those in utilizing the brand-new possibilities of Industry 4.0 to promote change through inclusive and sustainable industrial development. Thus, the growing adoption of Industry 4.0 focuses on technological advancements using the internet and tracking worker efficiency by collecting volumes of real-time data generated through these new capabilities. The adoption of Industry 4.0 provides a fully digitalized manufacturing ecosystem with the introduction of various digital technologies such as enterprise software, computers, machine learning, IIoT, and big data analytics by monitoring the floor activities. These technologies have immensely pushed manufacturing methodologies toward being more data-driven. Real- time production monitoring is becoming the fundamental component of data collection. This data is further used for real time insight into the production process. Such advancements in connectivity and the industrial digital landscape are driving the demand for real-time production monitoring.Asia Pacific Real Time Production Monitoring Market Overview

Asia Pacific (APAC) is a diverse region with a large population and growing digital economy, contributing to high data generation. APAC has been at the forefront of data computing adoption due to the proliferation of IoT devices, smart manufacturing initiatives, and the need for real-time data processing. APAC reported a significant increase in internet penetration rates, leading to a surge in data consumption and need for localized data processing.APAC has long been a strong manufacturing base, and the sector continues to be a strong adopter of the IoT. IoT is widely adopted across verticals across the region leading to the adoption of digital solutions. The region has strong potential for the strength of its manufacturing sector. In March 2023, Rockwell Automation Inc. announced the outcome from the 8th annual"State of Smart Manufacturing Report". According to a survey from 1,350 manufacturers across countries such as Australia, India, China, Republic of Korea, and Japan, around 44% manufacturers in APAC plan to adopt smart manufacturing within the next year, where around 80% of manufacturers in China, 60% in Australia, and 59% in India have been already using some components of smart manufacturing. Thus, the growing adoption of smart manufacturing and existing smart manufacturing facilities represent a strong the Asia Pacific real time production monitoring market share in APAC as this solution helps smart facilities manage the production workflow efficiently in real time.

According to The World Bank Group, railways is considered as one of the efficient ways to transport passenger and freights. The World Bank Group supports the development of the rail industry to make it efficient. It supports the country governments in reforming the railway infrastructure and incorporating advanced technologies. In addition, the governments of developing countries are investing to boost their railway industry. According to India Brand Equity Foundation, the country will invest around US$ 715.41 billion in rail infrastructure and development by 2030. Such investments propel the adoption of advanced solutions in the rail industry. With the emergence of manufacturing in Industry 4.0, adoption of automation for mass customizations plays a crucial role in producing large production volumes in a shorter time. In September 2019, Zyfra and Indian Railways launched a joint project where Zyfra provided its MDCplus real-time machine monitoring and manufacturing data collection system to the different manufacturing facilities operated by Indian Railways. The project increased production efficiency by 20%. Thus, government investments and adoption of software solutions in the rail industry drive the APAC real-time production monitoring market growth.

Asia Pacific Real Time Production Monitoring Market Segmentation

The Asia Pacific real time production monitoring market is segmented based on component, deployment, enterprise size, industry, and country.Based on component, the Asia Pacific real time production monitoring market is bifurcated into solution and services. The solution segment held a larger share in 2022.

By deployment, the Asia Pacific real time production monitoring market is bifurcated into on-premise and cloud. The on-premise segment held a larger share in 2022.

By enterprise size, the Asia Pacific real time production monitoring market is bifurcated into large enterprise and SMEs. The large enterprise segment held a larger share in 2022.

By industry, the Asia Pacific real time production monitoring market is bifurcated into process manufacturing and discrete manufacturing. The process manufacturing segment held a larger share in 2022.

Based on country, the Asia Pacific real time production monitoring market is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific real time production monitoring market in 2022.

Aspen Technology Inc, Capgemini SE, Dassault Systemes SE, General Electric Co, Hitachi Ltd, Infosys Ltd, Oracle Corp, Rockwell Automation Inc, and Siemens AG are some of the leading companies operating in the Asia Pacific real time production monitoring market.

Table of Contents

Companies Mentioned

- Aspen Technology Inc

- Capgemini SE

- Dassault Systemes SE

- General Electric Co

- Hitachi Ltd

- Infosys Ltd

- Oracle Corp

- Rockwell Automation Inc

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 98 |

| Published | February 2024 |

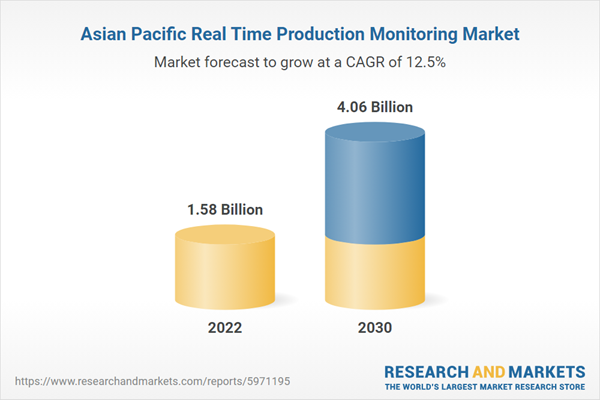

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 1.58 Billion |

| Forecasted Market Value by 2030 | 4.06 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |