By incorporating rubber by-products, adhesives gain improved flexibility, impact resistance, and adhesion to diverse substrates, making them suitable for a wide range of applications across industries such as automotive, construction, packaging, and electronics. These by-products, derived from the rubber manufacturing process, are often transformed into additives or modifiers that enhance the adhesive's properties. Therefore, the Canada region used 25.8 Kilo Tonnes of rubber by product in the market in 2023.

The US market dominated the North America Hot Melt Adhesives Market by Country in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $2,078.5 Million by 2031. The Canada market is experiencing a CAGR of 6.5% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 5.6% during (2024 - 2031).

Hot melt adhesives are utilized in the footwear and textile industries for bonding shoe components, fabric lamination, seam sealing, and decorative applications. They offer durable bonds while maintaining flexibility and comfort in finished products. Hot melt adhesives are employed in electronics manufacturing for bonding components, sealing enclosures, and potting electronic assemblies. They provide reliable protection against moisture, dust, and other environmental factors, enhancing the longevity and performance of electronic devices.

Moreover, there is a growing demand for hot melt adhesives with enhanced performance characteristics, such as higher temperature resistance, improved bonding strength, and greater flexibility. Manufacturers are investing in research and development to develop innovative formulations that meet the stringent requirements of various industries, including automotive, aerospace, and electronics. Sustainability is a major driving force in the hot melt adhesives market. Manufacturers increasingly focus on developing eco-friendly formulations that reduce environmental impact and meet regulatory requirements. This includes using renewable raw materials, bio-based polymers, and solvent-free formulations to minimize emissions and waste.

In November 2023, Canadian manufacturing sales increased by 1.2% to $71.7 billion, as reported by Statistics Canada. The robust growth of manufacturing industries in Canada, including automotive, packaging, construction, woodworking, and textiles, fuels the demand for hot melt adhesives. Hot melt adhesives offer fast curing times, high bond strength, and efficient application methods, supporting productivity and efficiency gains in manufacturing processes in Canada. Canadian manufacturers seek adhesive solutions that improve production throughput, reduce assembly time, and enhance product quality, driving demand for hot melt adhesives. The construction sector in Canada utilizes hot melt adhesives for various applications such as insulation, flooring, roofing, and panel bonding.

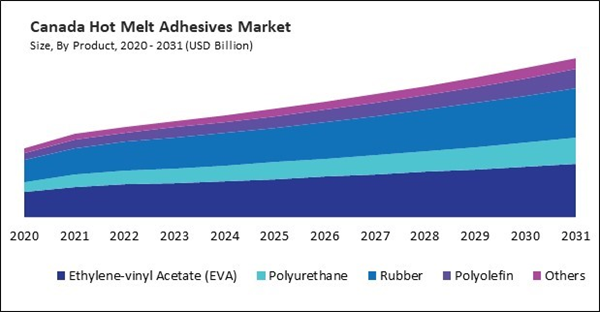

Based on Product, the market is segmented into Ethylene-vinyl Acetate (EVA), Polyurethane, Rubber, Polyolefin and Others. Based on Application, the market is segmented into Packaging, Assembly, Woodworking, Automotive, Nonwovens and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Henkel AG & Company, KGaA

- H.B. Fuller Company

- The Dow Chemical Company

- Sika AG

- Arkema S.A.

- Ashland Inc.

- Avery Dennison Corporation

- Jowat SE

- Evonik Industries AG (RAG-Stiftung)

- 3M Company

Market Report Segmentation

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)- Ethylene-vinyl Acetate (EVA)

- Polyurethane

- Rubber

- Polyolefin

- Others

- Packaging

- Assembly

- Woodworking

- Automotive

- Nonwovens

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Henkel AG & Company, KGaA

- H.B. Fuller Company

- The Dow Chemical Company

- Sika AG

- Arkema S.A.

- Ashland Inc.

- Avery Dennison Corporation

- Jowat SE

- Evonik Industries AG (RAG-Stiftung)

- 3M Company