Earth observation satellites use remote sensing instruments to measure various physical properties of the Earth’s surface, atmosphere, and oceans. These instruments include spectrometers, radiometers, and altimeters, which rely on space electronics for data acquisition, processing, and transmission. Therefore, the Earth observation segment would generate approximately 15.9% revenue share of the market by 2031. Space electronics enable real-time monitoring and analysis of environmental parameters such as vegetation health, land use, and climate patterns.

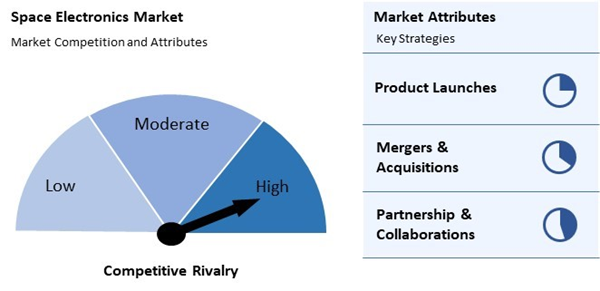

The major strategies followed by the market participants are partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September 2023, Honeywell entered into collaboration with Asia Pacific Aircraft Component Services (“APACS”), a subsidiary of SIA Engineering Company Limited. Through this collaboration, the company aims to offer quality component parts and repair services. And in June 2023, STMicroelectronics signed an agreement with Airbus, a global pioneer in the aerospace industry. With this agreement, the company would focus on the development of SiC and GaN devices, packages, and modules tailored for integration into Airbus' aerospace applications.

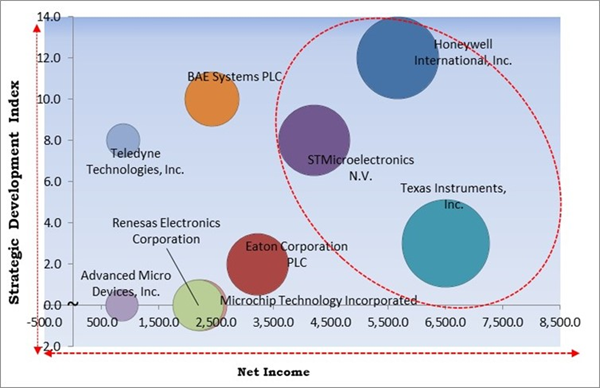

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Texas Instruments, Inc., Honeywell International, Inc., STMicroelectronics N.V. are the forerunners in the Space Electronics Market. In September, 2023, Honeywell joined hands with Aegiq, a quantum networking and computing company to explore creating a comprehensive solution to enable more precise and cost-effective design and deployment of space payloads and related ground assets. And Companies such as Eaton Corporation PLC, BAE Systems PLC, Microchip Technology Incorporated are some of the key innovators in Space Electronics Market.Market Growth Factors

Space exploration missions, whether robotic or crewed, require sophisticated spacecraft systems that rely heavily on advanced electronics. These systems encompass propulsion, navigation, communication, power management, thermal control, and scientific instrumentation. As space agencies and private companies embark on ambitious missions to explore the Moon, Mars, asteroids, and beyond, there’s a growing demand for high-performance space electronics to support these endeavors. Therefore, the market is expanding significantly due to the increased space exploration activities.Space debris monitoring relies on sophisticated sensors and tracking systems to detect, track, and catalog objects in Earth’s orbit. These sensors include ground-based radars, optical telescopes, and space-based sensors that require advanced electronics for data acquisition, signal processing, and data transmission. The demand for high-performance space electronics is essential to support SSA initiatives to improve space traffic management and collision avoidance. Thus, because of the space debris monitoring and mitigation, the market is anticipated to increase significantly.

Market Restraining Factors

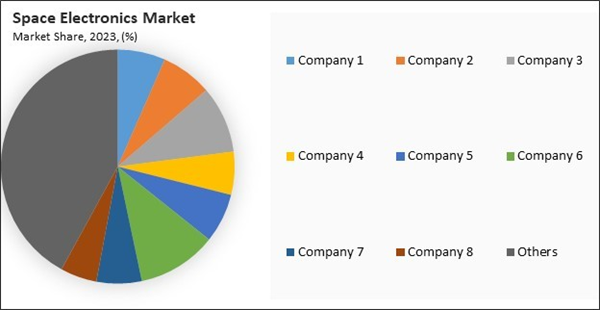

The high development costs associated with space electronics can act as a barrier to entry for new companies and startups, particularly those with limited resources or funding. The substantial investment required for research, development, testing, and certification of space-grade electronics can deter potential entrants from entering the market, limiting competition and innovation. Thus, high development costs can slow down the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations and Agreements.

Type Outlook

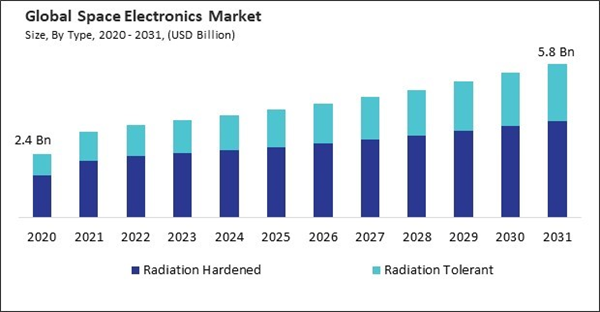

On the basis of type, the market is bifurcated into radiation hardened and radiation tolerant. The radiation tolerant segment garnered a 33.7% revenue share in the market in 2023. Radiation-tolerant electronics offer improved reliability in space missions by minimizing the risk of radiation-induced failures. These components are designed to operate in radiation-rich environments encountered in space, such as cosmic rays and solar radiation, ensuring the functionality of critical systems onboard spacecraft and satellites.Platform Outlook

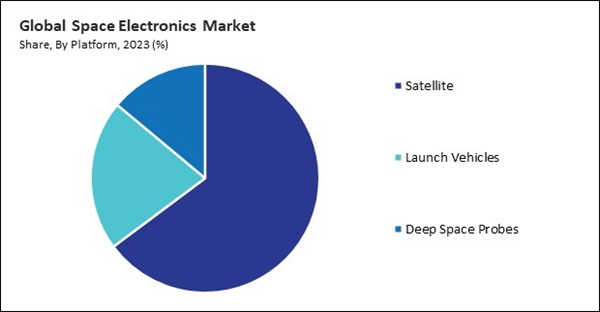

By platform, the market is categorized into satellite, launch vehicles, and deep space probes. In 2023, the satellite segment held the 64.8% revenue share in the market. The satellite segment is experiencing a surge in launches driven by the growing demand for communication, Earth observation, navigation, and remote sensing applications. Each satellite requires a wide array of electronics systems, including communication payloads, power management systems, attitude control systems, and onboard computers, driving the demand for space electronics.Component Outlook

By component, the market is divided into microprocessors & controllers, sensors, application specific integrated circuits (ASIC), memory chips, power source & cables, discrete semiconductors, and others. The memory chips segment recorded a 10.7% revenue share in the market in 2023. Memory chips are essential for storing and retrieving data onboard spacecraft and satellites. They store critical mission data, telemetry, commands, and software, enabling spacecraft systems to operate autonomously and perform mission-critical functions such as navigation, communication, and scientific observation.Application Outlook

Based on application, the market is classified into communication, earth observation, navigation, global positioning system (GPS) & surveillance, technology development & education, and others. In 2023, the communication segment witnessed a 48.14% revenue share in the market. Satellite communication enables mobile services such as voice, data, and messaging for maritime, aviation, and land-mobile applications. Mobile satellite terminals, antennas, modems, and handheld devices rely on space electronics to communicate with satellite networks, ensuring reliable connectivity in remote and mobile environments.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region acquired a 23% revenue share in the market. The Asia Pacific region has a growing demand for satellite communication and broadcasting services, driven by increasing internet penetration, digitalization, and demand for high-speed connectivity in remote and underserved areas. The Asia Pacific region is prone to natural disasters such as earthquakes, typhoons, and floods, creating a need for robust Earth observation and remote sensing capabilities for disaster management, environmental monitoring, and agricultural planning.Market Competition and Attributes

The space electronics market is fiercely competitive, driven by a combination of technological innovation, cost efficiency, and reliability. Key players, including established aerospace giants and agile startups, continually vie for contracts in satellite manufacturing, propulsion systems, communication equipment, and onboard electronics. With the increasing privatization of space exploration and the emergence of new spacefaring nations, the competition has intensified. Companies differentiate themselves through advancements in miniaturization, radiation-hardened components, and novel materials, while also focusing on stringent quality control measures to meet the demanding requirements of space missions. This dynamic landscape fosters innovation and pushes the boundaries of what's possible in space technology.

Recent Strategies Deployed in the Market

- Feb-2024: BAE Systems acquired Ball Aerospace from Ball Corporation. The acquisition would add market-leading space, science, and defense capabilities to the company’s portfolio of products and services through a new business called Space & Mission Systems.

- Sep-2023: Honeywell joined hands with Aegiq, a quantum networking and computing company to explore creating a comprehensive solution to enable more precise and cost-effective design and deployment of space payloads and related ground assets. The collaboration aimed at combining Honeywell’s atmospheric sensing technology and Aegiq’s emulation toolkit for link performance of optical communication technologies used by small satellites.

- Sep-2023: Honeywell entered into collaboration with Asia Pacific Aircraft Component Services (“APACS”), a subsidiary of SIA Engineering Company Limited. Through this collaboration, the company aims to offer quality component parts and repair services.

- Jun-2023: STMicroelectronics signed an agreement with Airbus, a global pioneer in the aerospace industry. With this agreement, the company would focus on the development of SiC and GaN devices, packages, and modules tailored for integration into Airbus' aerospace applications. Comprehensive research and testing of these components will be conducted by the companies, focusing on advanced demonstrators such as e-motor control units, high and low voltage power converters, and wireless power transfer systems.

- Feb-2023: BAE Systems entered into agreement with NewSpace Research and Technologies, a Bangalore-based technology group. Together, the companies would leverage their collective expertise in aerospace development and systems engineering to identify opportunities in both the defense and commercial markets.

List of Key Companies Profiled

- STMicroelectronics N.V.

- Texas Instruments, Inc.

- Honeywell International, Inc.

- Eaton Corporation PLC

- Teledyne Technologies, Inc.

- BAE Systems PLC

- Advanced Micro Devices, Inc.

- Microchip Technology Incorporated

- TT Electronics PLC

- Renesas Electronics Corporation

Market Report Segmentation

By Type- Radiation Hardened

- Radiation Tolerant

- Satellite

- Launch Vehicles

- Deep Space Probes

- Microprocessors & Controllers

- Discrete Semiconductors

- Power Source & Cables

- Sensors

- Application Specific Integrated Circuits (ASIC)

- Memory Chips

- Others

- Communication

- Navigation, Global Positioning System (GPS) & Surveillance

- Earth Observation

- Technology Development & Education

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- STMicroelectronics N.V.

- Texas Instruments, Inc.

- Honeywell International, Inc.

- Eaton Corporation PLC

- Teledyne Technologies, Inc.

- BAE Systems PLC

- Advanced Micro Devices, Inc.

- Microchip Technology Incorporated

- TT Electronics PLC

- Renesas Electronics Corporation